|

| By Jim Nelson |

Fed-watching has always been Wall Street’s favorite sport.

Especially now that the president watches Jerome Powell’s every move just as closely as they do.

In fact, one individual bet $2.4 billion on this week’s interest-rate decision.

The whole market can hinge on even the smallest of changes to rates … and even no change, like we saw this week, can still move markets.

This sport gets even more interesting because every second meeting (so, four times a year), the Fed will post something called the Summary of Economic Projections.

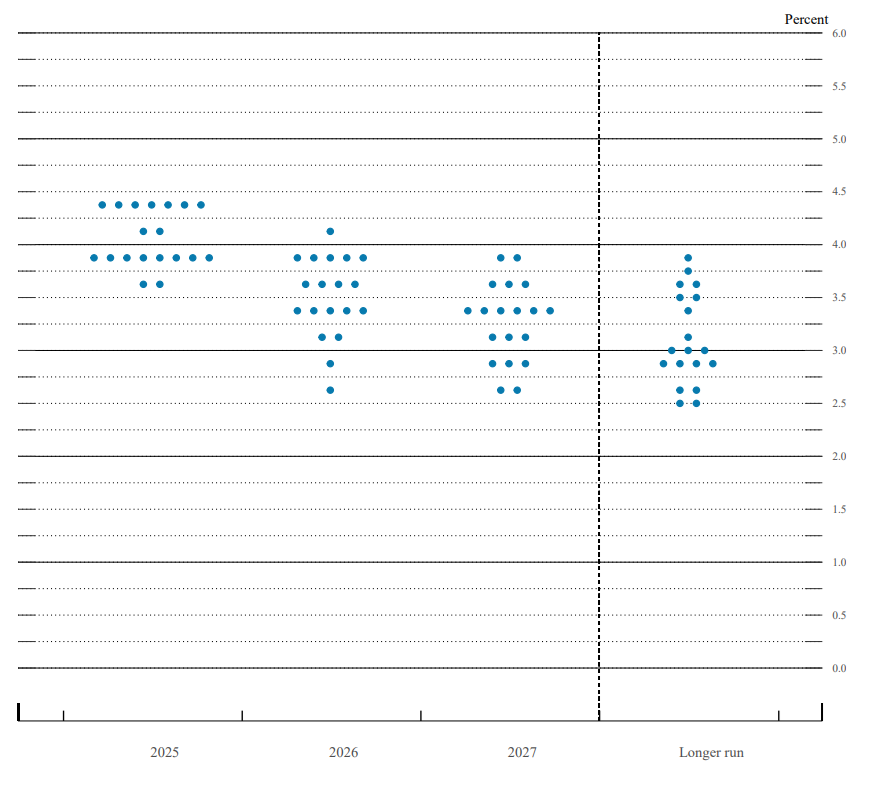

One graph in this report features the now-famous “dot-plot.”

This is the one for this week.

What it shows is how many FOMC participants expect what rates will be over the following three years.

Here, we have seven members expecting no rate change.

Two predict one quarter-point cut.

Seven are looking toward two cuts.

And the final two members see at least three cuts before the end of 2025.

Everyone expects rates to be lower by the end of 2026 than they are right now.

Why does this matter?

These are the people who make the decisions on monetary policy in this country.

It also shows that they don’t even know what they’ll do.

The Wall Street Journal pointed out this week that these dot-plots are essentially useless.

“Consider: At the Fed’s June 2024 meeting, the median interest-rate projection for the year moved to a single, quarter-point cut, down from three in March 2024.

“The Fed subsequently proceeded to deliver 1 percentage point in rate cuts beginning in September, with a half-point rate cut at that meeting.”

It went from three cuts, to one, to the equivalent of four!

That’s just over the course of a few months. The dot-plot extends to the end of 2027 and even the “longer run.”

Fortunately, your editors don’t recommend you place a $2.4 billion bet trying to read these tea leaves.

They have actionable ideas based on reality.

Here’s what they are looking at …

A Little-Known Tax Shelter for Crypto, Gold & Real Estate

Here’s how to join the 5% for a wide range of investment options and tax benefits — including on real estate, gold and even crypto.

These Gold-Leveraged Plays Offer Larger Gains

There are three types of gold stocks that are leveraged for even higher gains than the metal itself.

While the U.S. power grid braces for the surge in demand from AI data centers, one group of companies is set to rally.

Digital Dividends Are Almost Here

A recent decision by the SEC is potentially ushering in a new era for crypto. It’s a “Have your cake and eat it, too” moment.

Secret AI Sauce Brings Life Back to This Mag 7 ‘Hold’

Even the world’s largest companies need a few tricks up their sleeves to stay ahead. Now, you can see how one Mag 7 darling could gain its advantage from its secret AI sauce.

Have a great weekend!

Jim Nelson

Managing Editor,Weiss Ratings Daily