|

| By Sean Brodrick |

Federal Reserve Chair Jerome Powell rained on the bulls’ parade on Friday after warning that the economy would feel “some pain” from his quest to reduce inflation.

The market dropped like a stone when investors’ hopes for a Fed pivot were dashed, but another less talked about form of economic tightening will accelerate this week.

I’m referring to balance sheet reduction, the Fed’s current program of rolling off a maximum of $47.5 billion per month in Treasurys and mortgage-backed securities.

On Thursday, the rate will double to $95 billion per month, sapping market liquidity at the fastest pace ever recorded.

I mentioned last month how this process is the opposite of quantitative easing, where the Fed injects new money into the money supply by buying securities.

Without the Fed as a driving force of demand, markets face greater challenges.

Brian Quigley, Vanguard’s head of MBS, agencies and volatility, claims, "The Fed stepping away as a buyer of the market will prompt a period of adjustment that will ripple across financial markets as valuations will have to cheapen to attract more price-sensitive buyers.”

Powell’s relentless commitment to lowering inflation is a harsh reality for financial markets now forced to price in possible +4% interest rates and less liquidity.

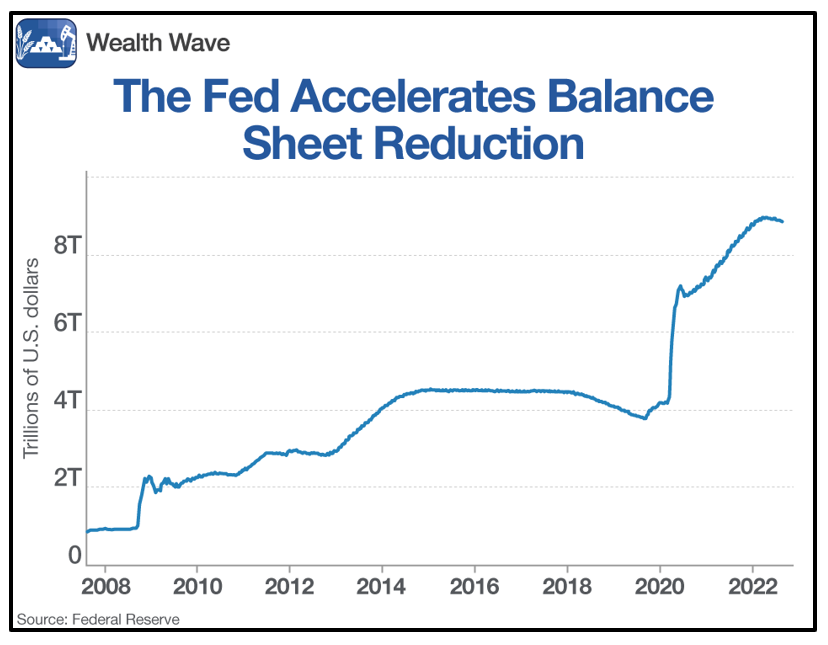

The Fed’s balance sheet soared to nearly $9 trillion from unprecedented quantitative easing during the pandemic, and it currently sits at $8.85 trillion after about three months of trimming.

That’s still over double its pre-pandemic level of $4.2 trillion and nearly 300% higher than its peak of 2.25 trillion in 2008! The chart below shows its progression since the beginning of 2008:

Quantitative easing can balloon the balance sheet quickly, but shrinking it is a more gradual process. Even at the fastest tightening pace in history, it’ll take over four years to cut the balance sheet down to pre-pandemic levels.

Globally, we should see more of the same. The G4 central banks of the U.S. Federal Reserve, Bank of Japan, Bank of England and European Central Bank are expected to cut assets by $4 trillion by the end of 2023.

Last week, I talked about how value stocks are one of the safer bets during periods of economic uncertainty.

Among that group of fundamentally sound investments, strong dividend payers have an extended history of outperformance.

Dividends account for 40% of historical market returns, but they’re even better while inflation is high. During inflationary periods, such as the 1940s and 1970s, they made up over two-thirds of market returns!

Where to Look for Potential Profits

One exchange-traded fund to consider is the Vanguard High Dividend Yield Index Fund (VYM). VYM only holds companies characterized by high dividend yields while tracking the FTSE High Dividend Yield Index.

The fund’s dividend pays 3%, which is nearly double the S&P 500’s current yield of 1.6% and 50 times greater than its expense ratio of 0.06%!

VYM’s average daily volume tops 2 million shares while it manages about $59 billion in net assets.

The fund’s top three holdings are:

1. Johnson & Johnson (JNJ)

2. Exxon Mobil (XOM)

3. JPMorgan Chase (JPM)

Those three companies account for nearly 9% of its total assets.

VYM’s chart shows that despite the market-wide dip, the fund’s recent uptrend remains intact as its testing the 200-day moving average:

VYM should capitalize on broader rallies, but if the market sells off further, dividend stocks offer added cushioning with their quarterly payouts.

Always do your own research before taking a position, but as conditions get tighter, funds usually flow to the companies with proven track records.

All the best,

Sean

P.S. If you’d like my tailored, recession-resistant picks that pay big dividends, sign up for my service, Wealth Megatrends. Members are currently sitting on several positions with double-digit open gains. Click here to join them before my next trade alert is issued.