It's a time of uncertainty and market turbulence, but there's no shortage of opportunities to profit as an investor.

In fact, it's precisely the kind of atmosphere that Investment Analyst Nilus Mattive prefers over anything else — including a "pie-in-the-sky bull market," as he told me. In this segment, he outlines different ways that volatility can work in your favor, and with safety as a priority.

We discuss an exchange-traded fund that rises when the market declines; selling options for income; and fractional investing in alternative asset classes like non-fungible tokens, on a platform that doesn't require using crypto.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): With all the economic uncertainty and sizable market drops, here's the big question top of mind.

JB: Is it possible, Nilus, to make money right now?

Nilus Mattive: Yes, definitely. It's actually possible to make pretty good returns with absolutely no risk at all.

I'm putting tons of my own money into some of these investments that are ultraconservative.

JB (narration): Investment Analyst Nilus Mattive is associate editor of Safe Money Report, offering winning strategies that are tailored to a turbulent market.

NM: One example is a type of government savings bond currently paying 9.62% annual interest — so that's almost 10% annual yield — and it has absolutely zero downside risk whatsoever. You cannot lose a dollar of principal when you buy this investment.

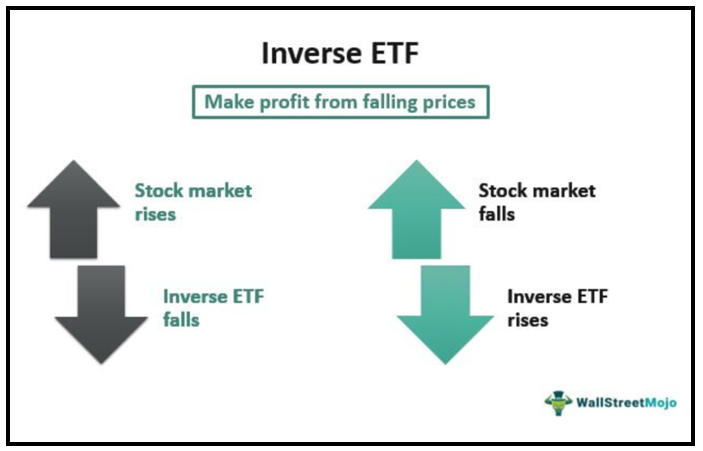

In addition, we also recommend in the Safe Money Report a type of exchange-traded fund that will profit when the stock market goes down.

JB (narration): One of those inverse ETFs is the ProShares Short Russell2000 (RWM).

Click here to view full-sized image.

NM: There's really no shortage of opportunities in this type of market. In fact, I would much rather be in this type of a market than a skyrocketing, pie-in-the-sky bull market.

JB (narration): Nilus is also the associate editor of Weekend Windfalls, which targets up to $1,000 in income every Friday for members.

The mechanism? Selling options.

NM: Another prime example of how you make money in these markets is to put the volatility to work for you, and one of the ways that you can do that is by selling options on stocks or ETFs that you would like to own anyway.

You collect up-front premiums, so that's immediate income to you. And in the worst-case scenario, you wind up getting the investment you wanted at a good price.

Interestingly, because options serve as insurance, if the market collapses, when volatility spikes, the actual premiums you collect for selling options also go up.

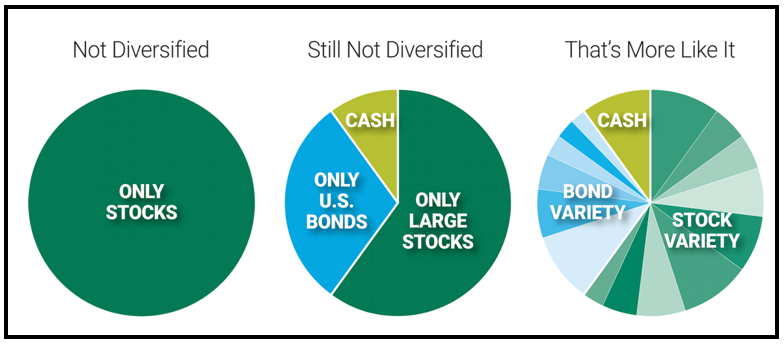

JB (narration): Nilus is a big proponent of diversification.

He's the coeditor of Weiss Crypto Investor.

NM: People will say, "You work on Safe Money Report and you work on Weiss Crypto Investor, and these things seem like they're on the total opposite ends of the spectrum. How can you do both?"

And the answer is, you do both because 95% of your money can be totally conservative. The highest degree of safety is investing across a broad spectrum of things, not just doing one thing.

Click here to view full-sized image.

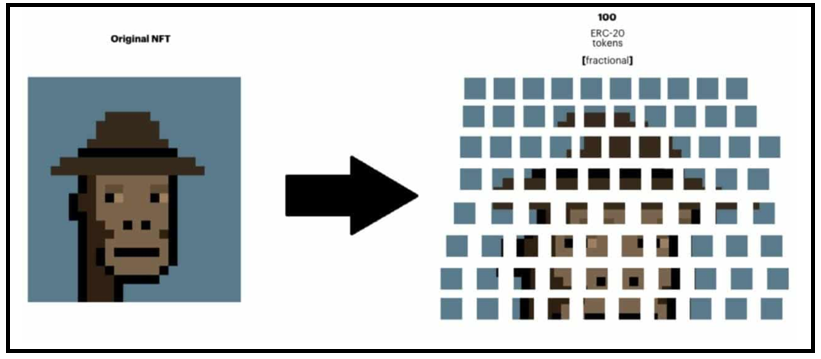

JB: You've been writing a lot about fractional investing and how that can be a great avenue for people because it's a way for people to get into spaces they might otherwise not get into.

NM: It's a way for someone — a regular person — to get a partial interest, a partial investment, in something they might not otherwise be able to afford.

If you can't afford to buy a $300,000 or $400,000 car, you can put $4,000 into it, and own 100th of that investment.

JB (narration): How it works is these fractional investing companies can use a special Securities and Exchange Commission rule to convert collectibles into individual securities.

NM: The basic idea is companies are able to take assets like a painting, or a non-fungible token for a crypto investor, and turn it into a company, much like a security. The asset becomes its own company, and then you sell shares in that company to investors.

JB (narration): The platform Rally has expanded to include blue-chip NFTs, like this one, from the Bored Ape collection.

Click here to view full-sized image.

NM: Some of these things are worth several hundred thousand dollars. At the height of the market, they were in the millions.

You may want to dip your toe in the water and get involved, but how are you going to do that in the price points that these things trade for? The answer is through fractional investing.

JB (narration): You can invest $5, $10, $15 in these NFTs and not even use crypto. You buy it with dollars.

NM: Making volatility work for you can be as simple as buying things when the prices go down.

I don't want to buy things when prices are high. The argument for the NFT space is the same. These things were a million dollars and now they're $250,000. Could they go to zero? They could.

But history argues in almost every case that a lot of these markets rebound, and they rebound as strongly or more strongly.

Combine the discounted prices with the fact that you don't have to put a lot of money into these things, and my argument is it's a great time to speculate.

JB (narration): And across a variety of alternative asset classes that he'll explore in upcoming issues.

JB: Investment Analyst Nilus Mattive, it's always great speaking with you. Thank you so much for your time and insights today.

NM: Thanks.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings