|

| By Nilus Mattive |

Last week, I talked about two ways to hedge a stock portfolio — short selling and inverse exchange-traded funds.

Today, I’m going to give you a third strategy that I sometimes use myself: Buying put options.

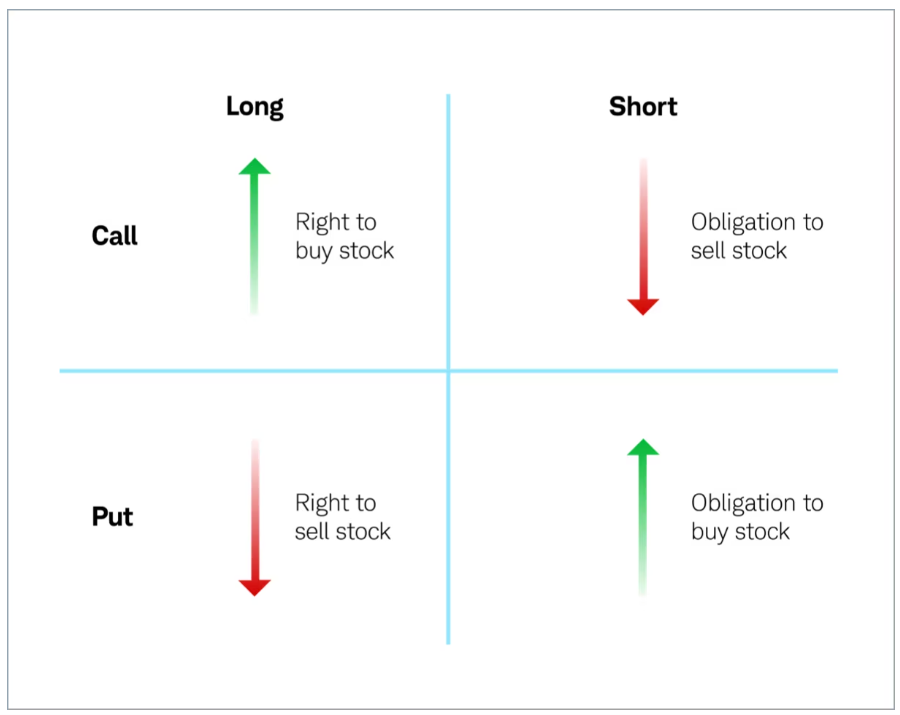

In case you aren’t familiar with how they work, options give investors the right — but not the obligation — to buy or sell a set number of shares of an underlying investment at a set price over a fixed amount of time.

Call options give the right to buy. Put options convey the right to sell.

Here are the quick and dirty details:

- The standard options contract covers 100 shares of an underlying investment.

- The price you can buy or sell the underlying investment at is called the strike price.

- The day the contract expires is called the expiration date, and in the United States it almost always happens at the close of trading on Fridays unless there’s a holiday or some other unique situation.

- You can find options on most stocks and ETFs, including index funds, covering a wide range of time frames.

I can’t possibly get into every detail about options trading today.

But what I can tell you is that I normally recommend SELLING options to other investors as a way to generate investment income and lower a portfolio’s overall risk.

In fact, my premium service — Weekend Windfalls — is completely dedicated to that strategy. And we are approaching three and a half years of continuous, uninterrupted closed profits.

However, I also personally BUY options from time to time as a more powerful way of profiting from big moves or getting outsized protection for parts of my portfolio.

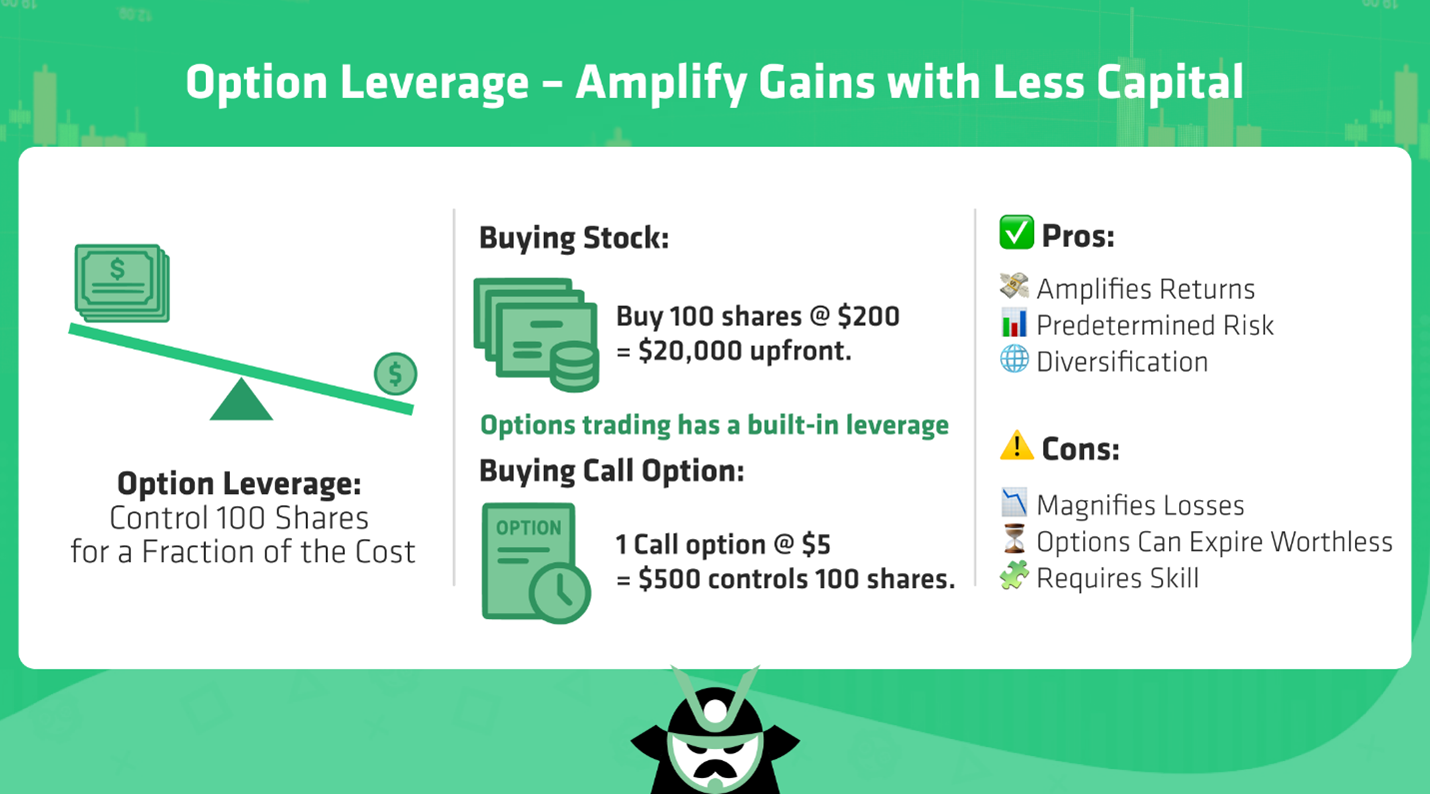

Why? Because options typically allow you to control a large amount of an investment with a relatively small amount of money.

In the case of BUYING put options, it means you can reap a very substantial gain in a relatively short period of time if the underlying investment drops before your put contract expires.

Meanwhile, the potential loss for getting the trade wrong is limited to the amount of money you spent on that put contract (as well as any commissions).

So, you get more leverage than inverse ETFs with more defined downside risk than with short selling.

There are still a few other big things to think about though …

First and foremost, timing is critically important.

All options have expiration dates. And as the adage reminds us, “markets can stay irrational longer than you can stay solvent.”

This is why I typically buy longer-dated put options — usually anywhere from six months to a year out.

You get a little less leverage but have a much longer time horizon to have the trade work out.

You also need a strong stomach because option prices can swing quite violently.

In one recent case, I watched a batch of my put options on the Nasdaq-100 Index lose more than 75% of their value as tech stocks continued rising.

Then, during the big downdraft this past spring, they skyrocketed in value, and I ended up walking away with a very sizeable gain.

And frankly, it’s very easy to lose everything you spent buying the options.

A lot of people lose a lot of money buying options.

This is precisely why I typically recommend taking the other side of those trades.

I’ve certainly watched a few batches of my put options go to zero as this stock rally continues, in fact.

But that’s okay with me. It’s part of the game.

I’m buying insurance … making calculated bets … and I’m not risking more than I can afford to lose.

I treat these positions the same way I treat my other “intelligent speculations” — the term I use for my portfolio of riskier bets on unknown stocks, private companies, alternative assets and other similar investments.

I’m not trying to win all the time.

I’m not even trying to win the majority of the time.

I’m simply trying to win big on a couple of trades … which is enough to keep my overall results positive.

Am I saying you should do the same? No.

Only you can decide if this type of strategy fits into your personal goals and investing style.

Still, I thought now was a good time to revisit a strategy that I’m using personally and give you some food for thought on how to employ it yourself.

Because, in my opinion, the current market frenzy can’t be sustained indefinitely.

Best wishes,

Nilus Mattive

P.S. One of the “intelligent speculations” I gave readers nearly three years ago was Bitcoin … when it traded at less than $22,000.

See, timing is just as important in the crypto market as it is when buying options. That’s why I’m excited for tomorrow.

You see, my friend and colleague, Juan Villaverde, is the master of crypto timing. And at 2 p.m. tomorrow, he is going to unveil his much anticipated Crypto Timing Model 2.0.

It is signaling something very important — for both crypto and the traditional finance markets — is coming soon. Attend this VIP event free as a Weiss Ratings subscriber to hear all about it.