|

| By Kelly Green |

Earnings season is wrapping up. And I’m just going to say it: There were a lot of things that just did not make sense.

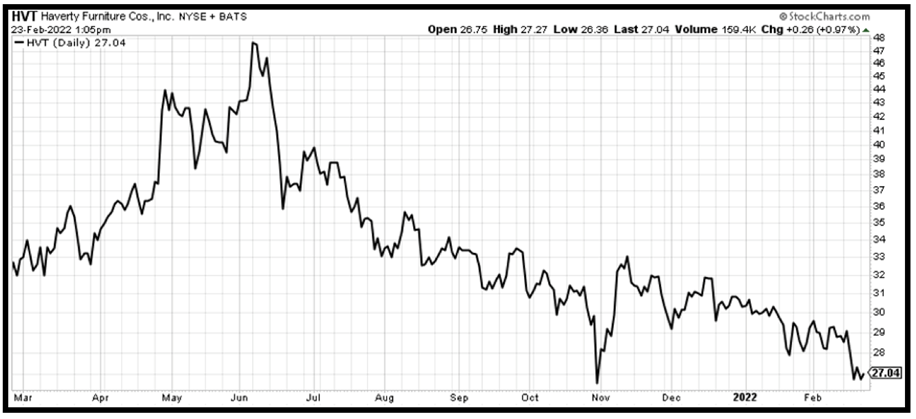

Look no further than one of my favorite dividend stocks of 2021, Haverty Furniture (HVT). The company just made sense following the hot housing market.

People had new homes and the desire to fill them with new furniture. The company also had a habit of paying a special dividend, and I suspected that it would do that again. It did.

Haverty continued to build on momentum. And for Q4, it reported another record-breaking quarter in sales. Despite orders still taking 10 weeks for deliveries, their backlog is continuing to grow.

But for whatever reason, investors didn’t seem to care.

Even now, shares continue to ride straight down.

A recent CNN article headline sums up the whole season concisely: Solid earnings season wasn’t enough to calm investors.

Fear-Fueled Selling

Investors have made the transition from greed to fear.

When greed rules investors’ minds, we see them latch onto the positives in an earnings release. They then run with it in the form of share prices.

- However, when fear rules investors’ minds, we see that same attachment to any piece of negativity.

It could be something small like a company’s management changing the way it reports guidance. And then that small piece of information negates all the positive things that have happened during the quarter.

And that very fear is manifesting in the markets right now, as negative investor sentiment is fueling declines.

This fear mentality is rooted in the uncertainty surrounding the Ukraine-Russia conflict, a 40-year high in inflation and ongoing supply chain issues. And I suspect that we will be stuck with it until the next round of earnings releases.

- But remember: It’s all how you look at it.

If a company is solid, a dip in share prices can mean the opportunity to buy at a discount. That’s where the Weiss Ratings come in. I can quickly see all the information I need to make an investment decision.

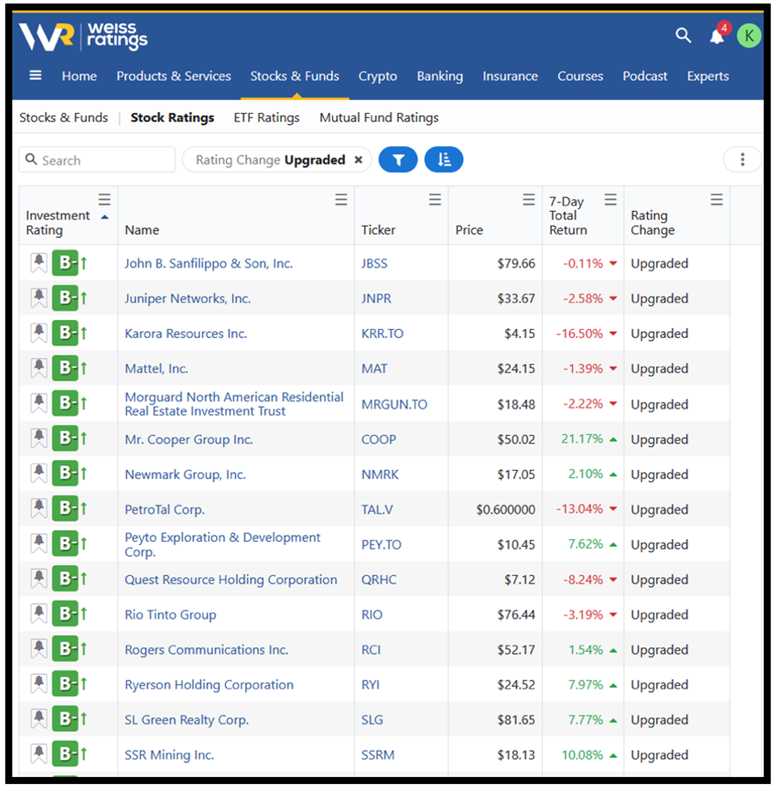

Today, I did a very general screen but ended up looking for something very specific.

Initially, I cleared everything out and entered one single filter. I simply wanted to know the stocks that had seen a ratings upgrade.

From there, I clicked on the top of the Investment Rating column to sort.

As I went through the list, I became interested in the companies that were rated “B-.”

Why? Because …

- If a company was recently upgraded to a “B-” … something changed to move it from a “Hold” to a “Buy.”

This would indicate an investment opportunity, especially if the company can continue in that direction.

Here are a few that stood out:

1. John B. Sanfilippo & Son (JBSS) is a company that processes and distributes tree nuts and peanuts in the United States. The company, based in Illinois, was founded in 1922 and is the force behind Fisher Nuts, Orchard Valley Harvest, Squirrel Brand and Southern Style Nuts.

Prior to 2016, the company was a solid “Buy.”

Since then, it has bounced back and forth between “Buy” and “Hold.”

It was most recently upgraded to a B- on Feb. 16. This is not the first time in the past year it’s climbed back to “Buy” territory. But, it’s worth watching to see if this time, it will be able to hold it for more than 90 days.

Shares are down since the last earnings announcement. This is most likely due to the decrease in earnings per share (EPS) and earnings before interest and taxes (EBIT).

This chart is even more interesting since the shares declined and that price seemed to stick into a tight sideways pattern. But I’m definitely adding this one to my watchlist.

If it can hold onto that “Buy” rating, the discounted shares could mean a nice profit.

2. USA Truck (USAK) is one of the nation’s largest over-the-road carriers. The company was established in 1983 as Crawford Produce with fewer than 10 tractors and now has more than 2,000 driving team members.

Although the stock was a solid buy before March 2016, it has spent its time in the “Hold” and “Sell” ranges since. Until just recently.

At the end of December, it popped up to a “B-” … only to be downgraded again in January. Now here we are in February, wondering if it will be able to hold onto that momentum this time.

Shares have recently seen a correction.

This could be a buying opportunity if this play interests you. Shares are still up 29% over the past month and up 71% over the past year. And inflation in transportation costs — currently at 21.4% — are the fourth highest of any sector.

One honorable mention from today’s screen would be Tower Semiconductor (TSEM).

Just two days before the company announced its earnings (and it was upgraded), it revealed that it would be acquired by Intel (INTC) for $5.4 billion. Intel noticed that the company had something here.

The price has already been set, so there’s no more money to be made on this one. But it was a reminder that I haven’t looked at the state of the semiconductor industry in quite a few weeks. (I’ll circle back to that the next time I write to you.)

One thing that I’d rather not wait to circle back on is Dr. Martin Weiss’ Weekend Windfalls service. He’s providing subscribers savvy strategies to generate weekly, consistent income. If you’d like more information, click here now.

Remember, the stocks I talked about today were just a few of the companies that moved up to a “B-” recently.

I could have chosen to look at those that had moved from a “B-” to a “B” or even into the “A-” range.

We are now seeing more companies in that “Buy” range.

And by using WeissRatings.com, you can quickly see historical ratings and price history with just a few clicks.

Best,

Kelly Green