|

| By Sean Brodrick |

Today, I’m going to talk about the opportunity that Wall Street analysts have trouble seeing.

While they’re blind to the obvious, you don’t have to be and you can pick up potentially big gains.

You know how Wall Street keeps pushing formerly high-flying tech stocks — now that they’ve sold off — as bargains?

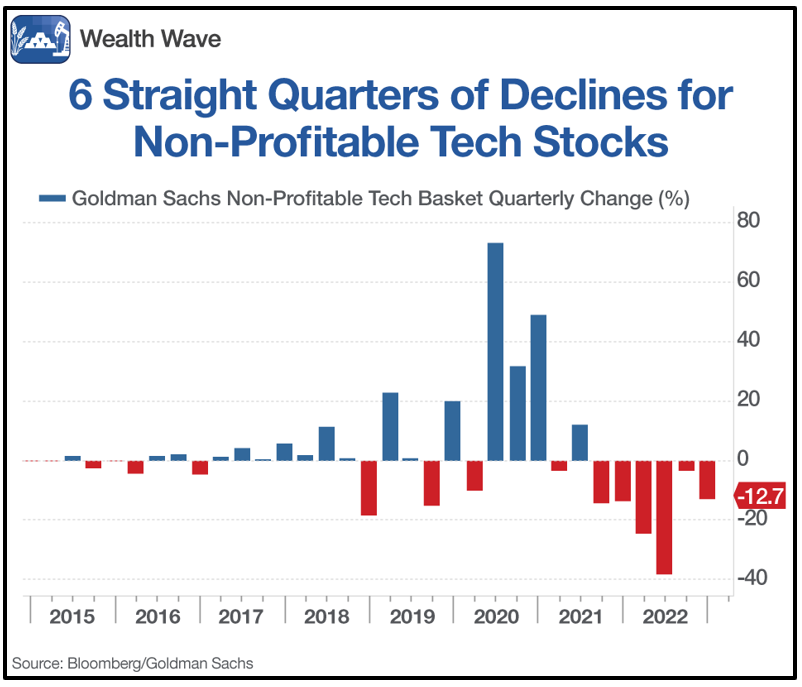

Well, they have some heavy lifting ahead of them. Goldman Sachs (GS) tracks a basket of nonprofitable tech stocks also known as “growth stocks.” Man, those stocks are on a losing streak and have been for six quarters in a row:

Click here to view full-sized image.

Now, if you’ve been a Wealth Wave reader for a while, this is no big surprise to you. Back in January 2022, I told you we’d see money stampede out of growth stocks (stocks without earnings) and move into value stocks (stocks with earnings and often dividends).

I kept pounding the table about this all last year. The trend is obvious to anyone who uses their eyes.

Well, Wall Street analysts — the same guys who want you to buy those nonprofitable tech stocks — might tell you that this trend will end as all do. And sure, all trends end.

The thing is, growth outperformed value for more than a decade. So, I’d say value has a lot of catching up to do … and it could take a while.

What explains this shift from growth to value? Basically, it’s the end of “free money.” Wall Street got hooked on the ultra-low interest rates the Federal Reserve pushed for over a decade. In fact, borrowing free money and not paying it back is basically the business model of nonprofitable tech stocks.

Now, the Fed keeps hiking rates. It has hiked its benchmark rate to the highest level in 15 years, to a targeted range between 4.25%–4.5%. The Fed may hike rates even higher and plans no reductions until 2024.

Man, that’s the kind of news that will make the CEO of a nonprofitable tech stock really break out in a sweat.

When I told you about this trend in January 2022, I recommended the Energy Select Sector SPDR Fund (XLE) as the way to play this. If you’d taken my advice, you could have been up as much as 57% in October, and you’d still be up 48% now.

The performance of the S&P 500 over the same time period? Down 15.9%. How about growth stocks? Down a whopping 24%. Ouch!

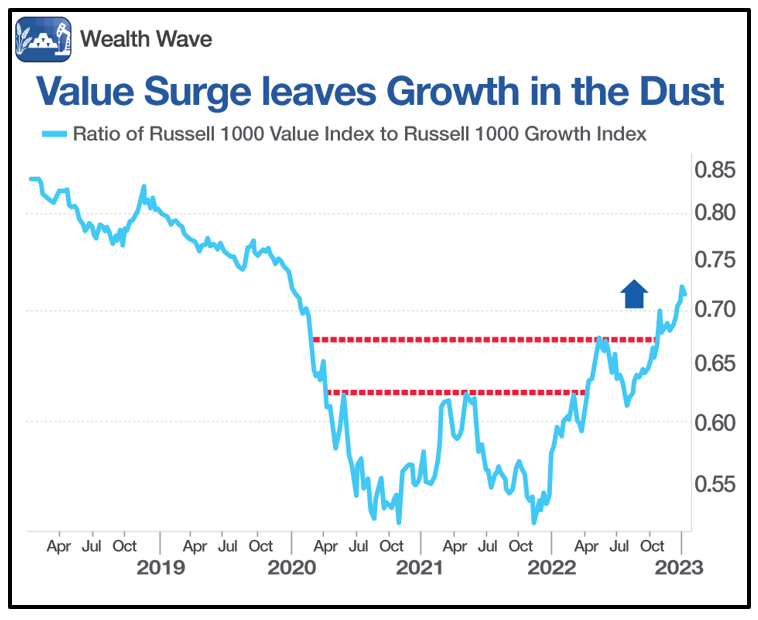

In fact, value is shifting into higher gear and leaving growth in the dust. Here’s an update of the chart I showed you last January, tracking the ratio of the Russell 1000 Value Index divided by the Russell 1000 Growth Index:

Click here to view full-sized image.

Look at that blast off! Value has pushed through two overhead levels of resistance and keeps on trucking.

So, what do I think is better? I’ll tell you …

What’s Worth Buying Now

Oil stocks got ahead of themselves, but now they look decent after a recent pullback. I also believe oil will have a strong 2023. But for right now, I’d recommend buying value stocks as a group. I’m talking about the iShares Russell 1000 Value ETF (IWD).

Click here to view full-sized image.

Looking at the chart, you can see that the IWD bottomed back in October and recently broke a downtrend. Now it will likely test overhead resistance. I’m already expecting the IWD to rally to $207. But it could go a lot higher.

You could also drill down into the IWD and buy individual stocks, balancing more risk against potentially more reward. Just make sure you’re ready for value’s next leg higher.

As always, remember to conduct your own due diligence.

All the best,

Sean

P.S. If you’d like my individual value stock picks, consider joining my trading service, Wealth Megatrends. Members are currently sitting on seven positions with double-digit gains, including over 50%, 33% and 21%. Click here to find out more.