|

| By Jim Nelson |

We kicked off 2024 with the same worries, hopes and confusion that we had when 2023 ended. The one thing that seems to have changed is how Wall Street is trading these things.

Consumer staples, utilities, healthcare and energy stocks are up this first week of the year. While tech, consumer discretionary and industrials are lagging.

It certainly doesn’t feel like the dropping of the ball last weekend should have changed much. But investors certainly seem to think it did.

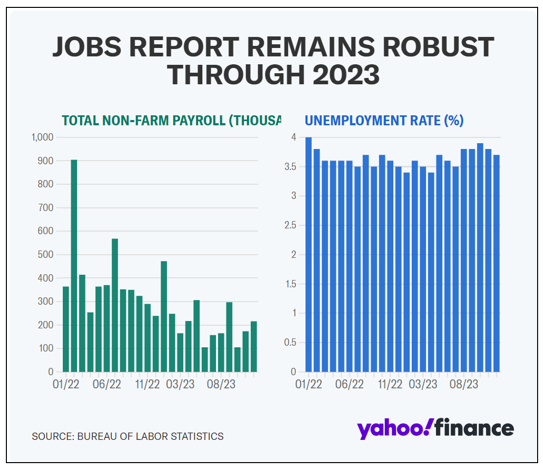

To compound this, those pesky jobs numbers continue to defy the odds. This week we got a glimpse at the final tallies of 2023.

Labor markets added 216,000 jobs last month, way up from the expected 175,000. That brings unemployment down to 3.7% from the estimated 3.8% to start 2024.

This immediately flipped market expectations for the first rate cut of the year.

Prior to this jobs release, the CME FedWatch Tool showed an 88% chance of a cut during the March FOMC meeting. Now, it’s down to just a 56% chance of one.

Of course, there’s a lot more trading to do before then. There are also many more economic reports to stymie investors before March.

For now, we sit back and let our own experts inform our thinking on what to expect. Here’s what they have to say in this first week of 2024 …

Kick off 2024 with a Look at 2023’s 'Buy'-Rated Winners

2023 was certainly a good year for most equity investors. Our chief ratings guru, Gavin Magor, wrote on New Year’s Day about how much better it could have been if you had used Weiss Ratings to help you pick which stocks to buy. Don’t worry, however. He also reminds us that it’s free to use and is ready to help you find winners this year too!

How to Pump Up Your Oil Profits in 2024

Despite the U.S. being the world’s No. 1 producer of crude right now, this surge is happening against a backdrop of an oil-price roller coaster. Sean Brodrick shows you how to play it.

The Unlikeliest AI Alliance Presents Under-the-Radar Opportunity

Last month, an unholy alliance of public companies, universities and brain trusts declared AI to be open to all. This alliance flies in the face of the current leaders in AI development. Tech expert Jon Markman separates the wheat from the chaff to find the biggest winner in the bunch.

How to Win at Monopoly & Stock Investing

Nilus Mattive offers five tips to help you win at Monopoly. These tips can help with more than just a board game. He also shares five common investing mistakes to avoid, which can help you compound your real-life cash.

That’s it for this week. Have a great weekend!

Jim Nelson

Managing Editor

Weiss Ratings Daily