|

| By Jordan Chussler |

The first week of 2023 is in the books, and the market remains rangebound just as it has since mid-December.

This has been a disappointing development for bulls and bears alike, as January often serves as an indicator of the broad market’s performance for the remainder of the year.

The January Barometer, as it’s called, is believed by some to predict the likely direction of the market for the rest of the year based on the S&P 500’s performance in the first month.

Proponents of the January Barometer cite data that shows how, between 1950–2021, there were only 11 years out of 71 in which the yearly performance of the market did not reflect its January performance. That’s good for an 84.5% success rate. Not too bad for a market indicator.

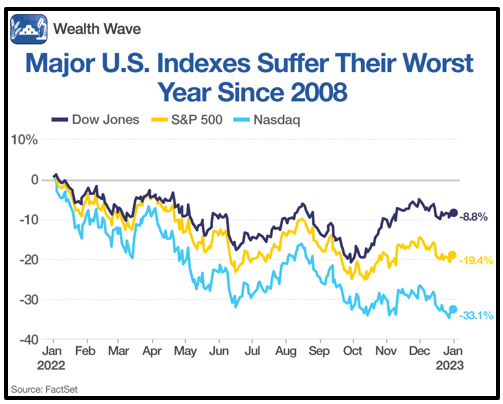

And after 2022, when the major indices logged their worst year since 2008, investors are looking for clarity and direction.

Click here to view full-sized image.

Of course, a rangebound S&P isn’t helping provide that clarity or direction.

However, our team of editors and analysts can. Here are this week’s top stories from your favorite Weiss Ratings experts.

Key to 2023 Success: Avoiding Investing Potholes

Last year had its fair share of investing potholes. But this year, investors can navigate the markets on the way to solid returns with Financial News Anchor & Analyst Kenny Polcari’s strategies for preserving — and growing — your wealth.

3 Reasons Gold Could Go Higher

As the U.S. dollar continues to deflate, Senior Analyst Sean Brodrick, an expert on natural resources and cycles, discusses three reasons why gold — and the stocks of companies that mine the precious metal — is poised to continue its ascent.

Investing Trends for the New Year

Pulitzer Prize winner and Senior Analyst Jon D. Markman dives into evident trends for the new year, which will help investors identify burgeoning opportunities in spaces like ad-supported streaming services, fast food, deglobalization and Big Pharma.

Why You Should Invest in Shipping Containers

It’s not uncommon for investors’ portfolios to be replete with the makers of goods. But often, the takers — or companies that transport those goods around the globe — are overlooked. Senior Editor Tony Sagami reports on the cargo industry and how investors can position themselves to potentially profit from three prominent companies in the space.

A New Year’s Dive into the Ratings

Which sectors are set to outperform in 2023? Which stocks in the Weiss Ratings universe have recently been upgraded to “Buy?” Financial News Anchor & Analyst Kenny Polcari breaks it down with this year’s first dive into the Weiss Ratings.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily