|

| By Sean Brodrick |

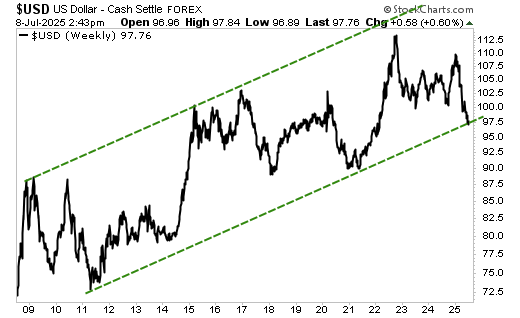

In the first half of 2025, the U.S. Dollar Index plunged about 10.8%.

That’s the worst half-year performance in over 50 years.

This also marks King Dollar’s steepest six-month fall since 1973, the year the U.S. officially abandoned the gold standard.

And now, on an absolute level, the dollar has reached its lowest mark since March 2022.

No wonder why some 31% of institutional investors are underweight the greenback right now.

Why is the dollar down in the dumps?

It’s at the eye of a perfect … and still-swirling … storm.

These bearish conditions are caused by the Trump tariffs … soaring national debt from mega-spending bills … shifts in foreign asset allocations … and relentless pressure on the Fed to cut interest rates.

And with no immediate resolution on the radar for any of these conditions, should you prepare for …

An Earthquake on Wall Street?

With everyone so negative on the greenback, it’s easier for the dollar to go up than down.

However, it’s getting major support from a major trend …

The U.S. dollar has been in a significant uptrend for over a decade.

Now, it is testing the bottom of that trend. The dollar could bounce from here.

Which brings me to the question: What if it doesn’t bounce?

That, my friends, would send an earthquake down Wall Street.

You Can Play It Either Way

As an investor, you can play this either way. Here’s what I suggest.

If the dollar bounces, that means I get another chance to buy more gold, silver and miners on the cheap.

That’s because gold and the dollar sit on opposite ends of what I call “The Seesaw of Pain.” When one gets hurt, the other usually goes up.

On the other hand, if the dollar can’t find its footing and breaks that support in a hurry, then my existing gold and silver positions are likely to take off, hitting my targets for them much earlier than I thought.

You know I firmly believe that gold is in a multi-year bull market.

My target for gold is over $6,900 an ounce in the longer term.

And I believe the yellow metal should top $4,100 an ounce next year.

However, if King Dollar breaks down, we could reach that target much faster.

Mind you, there are still sources of dollar strength.

The U.S. dollar remains the dominant global currency in trade.

It is still the world’s reserve currency.

But fiscal irresponsibility and trade wars with the world do tend to tarnish the dollar’s brand.

Easy Way to Play This

To me, there are easy ways to play this. The only question is should you buy them now or wait and see if the dollar bounces … and buy them on a pullback.

I’m talking about gold and miners.

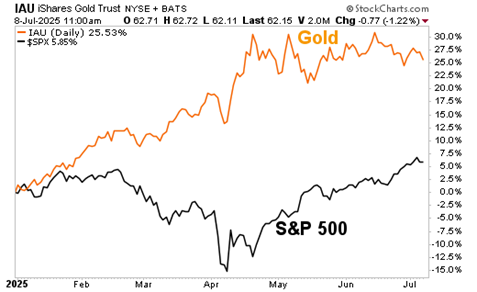

In an article on May 28, I told you that my Resource Trader readers bought the iShares Gold Trust (IAU) on Feb. 3.

They recently had a nice 17.5% open gain, far outperforming the S&P 500 over the same time frame.

And that’s no surprise because the IAU has soared above the S&P 500 all year.

Gold and the IAU have spent the past two months going sideways, but that won’t last too much longer.

While gold should pull back if the greenback bounces, there are multiple forces lining up to push gold higher, even as the dollar runs afoul of forces dragging it down.

Some bullish forces for gold include:

- Central bank buying, who have loaded up on gold for 10 years in a row, and were recently discovered to be buying even more gold than they let on. The World Gold Council reports Q1 2025 central bank purchases exceeded 290 metric tonnes, the second highest Q1 total ever.

- Purchases by affluent investors, who Kitco News reports doubled their gold holdings in the past year and are looking to buy a lot more.

- A record U.S. deficit of $2 trillion, which should send total U.S. debt to $37.1 trillion by the end of this year. Uncle Sam can print money to pay debts. But the government can’t print gold!

Beyond these top three, there are multiple other bullish drivers for gold.

And that brings me back to my point: Will the dollar bounce and give me a chance to load up on more gold, silver and miners?

Or will the dollar crack sooner rather than later and light a fire under my existing positions?

Whatever happens to the dollar, I sleep better knowing my gold holdings protect me.

I recommend you protect yourself and get some leverage for the coming gold boom and dollar doom.

I can show you exactly how to do that, too!

Just watch my interview with Chris Hurt here. Stay to the end to find out how to 1,000x your gold profits without buying another ounce.

All the best,

Sean