Markets Reversed Course in February Amid Hawkish Fed

|

| By Jordan Chussler |

After a strong start to the year, the major indices ended February with an about-face.

Despite positive macroeconomic indicators like ongoing decreases in jobless claims, it is lingering inflation that continues to maintain the Federal Reserve’s focus, with the central bank’s higher-for-longer rate hike policy unlikely to waiver in the near future.

This, in turn, is fueling market volatility as analysts and investors try to interpret the Fed’s plan.

After a January that saw the Dow Jones Industrial Average gain 2.87%, the S&P 500 gain 6.6% and the Nasdaq Composite gain 13.76%, the major indices all slid in February:

• The S&P 500 shed 3.62%.

• The Dow Industrials dropped 4.21%.

• And the Nasdaq lost 6.11%.

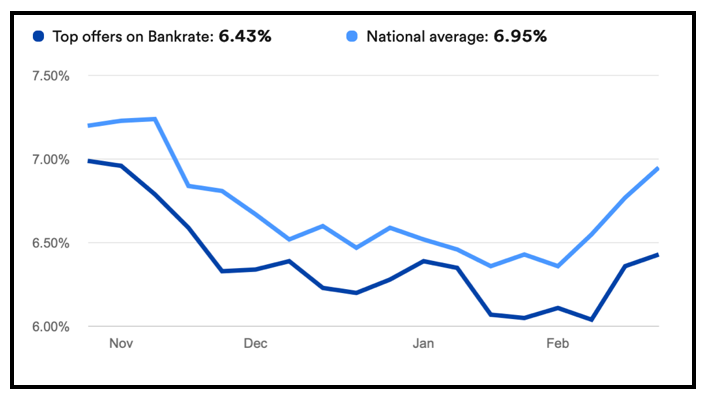

The Fed’s inflation-fighting policy also continues to weigh on interest-rate sensitive sectors like the housing market.

Mortgage demand is now 44% lower than it was a year ago, and the rate for a 30-year fixed mortgage is once again on the uptick, standing at 6.95% at the time of writing.

Click here to see full-sized image.

However, there are still resilient corners of the market if investors know where to look. To learn how to find them — and capitalize on their strength — here are this week’s top stories from your team of Weiss Ratings experts.

What to Buy When the Fed Acts Crazy

Senior Analyst Sean Brodrick suggests this conservative investing tactic to profit from the Fed’s unyielding rate-hike policy.

VIDEO: Market Minute with Kenny Polcari

Financial News Anchor Kenny Polcari dives into the latest macroeconomic data, including the Federal Housing Finance Agency House Price Index, in this week’s Market Minute.

Pulitzer Prize winner Jon Markman discusses how regulation is playing a critical role in supporting Big Tech — and its shares — and how that will shape AI going forward.

The U.S. Debt Crisis Goes Beyond Government Spending

Senior Editor Tony Sagami reports on America’s — and Americans’ — record-setting debt, and how it can be addressed at the individual level.

Private Tech Shares Are Flooding the Market

Startup Investing Specialist Chris Graebe discusses how the mass layoffs impacting the tech sector are resulting in a deluge of private shares hitting the market.

How to Adopt a Foolproof Exit Strategy

Analyst Kenny Polcari talks about supercore inflation, how it differs from inflation and core inflation and how investors can plan for the Fed’s ongoing inflation fight.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily