|

| By Jim Nelson |

The new all-time highs keep coming. We got a new one in the S&P 500 three of the five trading days this week. What does this mean for equities going forward?

Well, that’s a matter of debate … even in our office building here at Weiss Ratings.

You can certainly see both sides of this issue …

According to Nilus Mattive, our Safe Money expert, the market remains completely overvalued compared to historical averages. He sums that up in his article down below.

On the other hand, the expected Federal Reserve interest rate cuts — which, to the shock of no one, did not begin this week — could add even more fuel to the tech bonfire.

Tech companies are historically linked to interest rates more than most other industries. Often, it takes piles of money — and debt — to get new technologies and innovations off the ground.

To add to the confusion of whether we should expect a continued bull market or see a turnaround is the economic picture.

The U.S. Department of Labor reported 353,000 new jobs last month, crushing economists’ expectation of 185,000. Wages also grew.

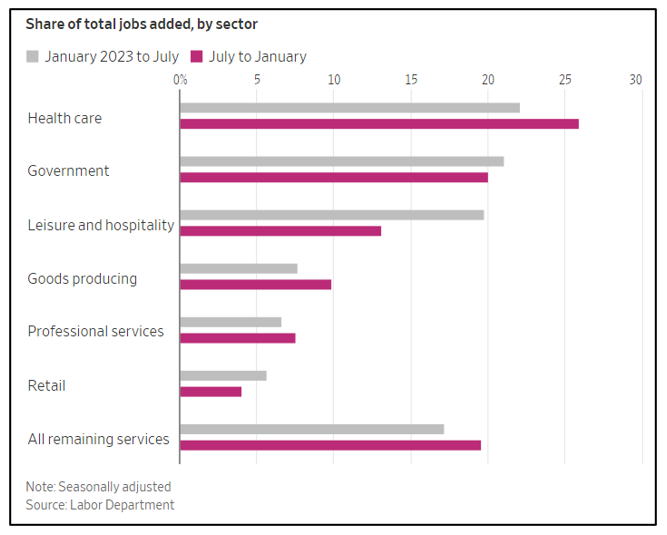

Though, if you dig just a little deeper, there are still concerns with all these new jobs. They appear to be shifting toward more essential sectors, leaving discretionary ones behind. Take a look at this Wall Street Journal chart:

As you can see, the number of healthcare jobs jumped more in the past six months than the previous six. Meanwhile, new leisure and hospitality positions have slowed. New retail jobs have pulled back a bit, too.

If that indicates anything about how people are spending their money, maybe the picture doesn’t look quite as great as our recent all-time highs would have us believe.

As noted, your Weiss experts have plenty more on these topics. Here’s what they are covering right now …

4 New ‘A’-Rated Weiss Stocks to Put on Your Radar

New economic data has pushed stocks up to all-time highs. So, it’s more important than ever to use our Weiss ratings to find breakthrough ideas for your portfolio. Weiss Director of Research & Ratings Gavin Magor has just the place to start, featuring four hot “A”-rated stocks.

The 4 Big Forces That Will Shape 2024 and Beyond

Safe Money expert Nilus Mative brings a less bullish outlook for 2024. He identifies four huge trends that are shaping how this year will turn out for equities. But that doesn’t mean there’s no money to be made. And he shows you how to do just that.

Gold to Jump Thanks to the Fed

Everything is lining up for a gold bull run this month. Our Resources Guru Sean Brodrick points to a few problems the Fed faces, which could force the price of gold much higher. He also shares a great way to play this expected rally.

Here’s the Winner of Intel’s Bad Day

The semi industry is changing. The question surrounding “fab” versus “fabless” chipmaking is being answered. Intel’s recent terrible day proves it. Tech specialist Jon Markman has the full scoop. He also has the perfect way to take advantage of all these changes.

5 Forecasts to Profit from Startups This Year

The start of 2024 has been wild even for companies not listed on a major exchange. In fact, startup expert Chris Graebe expects the whole year to present new challenges and opportunities for startups. He gives us his five biggest predictions on how to profit in the space for 2024.

That’s it for this week. Have a great weekend!

Jim Nelson

Managing Editor

Weiss Ratings Daily