|

| By Jordan Chussler |

In Q1, General Motors (GM) overtook Ford Motors (F) as the second-best seller of electric vehicles in the U.S.

Both companies remain tremendously behind Tesla (TSLA); however, competitive inroads are being made, with the two legacy carmakers combining for 31,536 EVs sold in the first quarter.

For comparison, Tesla manufactured 440,000 EVs in Q1 with 422,000 deliveries.

Click here to see full-sized image.

But despite the lopsided competition, the shift to electrification is rapidly growing.

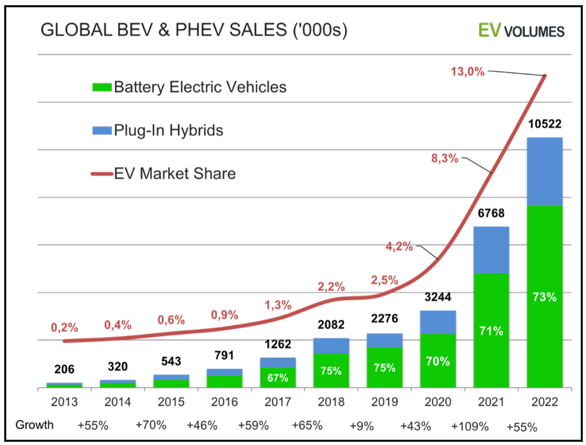

According to a study conducted by EV Volumes, a total of 10.5 million EVs were delivered in 2022, representing a 55% increase over 2021. Furthermore:

“Rapid EV adoption in weak auto markets has boosted EV shares further … EV sales were resilient to weak auto markets: They overperformed by 21 % in Europe, by 87 % in China, by 55 % in Northern America and by 78 % in the Non-Triad markets … China is, by far the largest EV market, with 59 % of global EV sales in 2022. Their role as the largest EV production base is even stronger, with 6,7 million units, 64 % of global volume, made in China.”

The overall trend is undeniable: EVs are the future of transportation, and there are innumerable investment opportunities for those who know where to look.

But those opportunities aren’t just in the companies who manufacture vehicles, as Jon Markman points out in his column this week …

This Company Will Even the EV Race

As EVs continue to drive the digitization of vehicles, car companies are killing tethered operating systems in favor of built-in Androids. Pulitzer Prize Winner Jon Markman suggests that this semiconductor and software company will be the big winner.

VIDEO: Market Minute with Kenny Polcari

In his weekly look ahead, Financial News Anchor Kenny Polcari scrutinizes how macroeconomic data will impact the markets, including the S&P Global Manufacturing Purchasing Managers’ Index and the S&P Services Global PMI, a key data point to watch since 70% of the U.S. economy is service-based.

Why Sky-High Gas Prices Are Likely This Summer

Senior Analyst Sean Brodrick breaks down why we’re heading for $5/gallon gas, what’s driving a resurgent bull market for oil and how investors can use one ETF in particular to profit from prices at the pump.

Power Your Portfolio with Renewable Energy

In 2022, renewable energy’s electric power production exceeded that of nuclear and coal for the first time ever. Senior Editor Tony Sagami reports on numerous ways to profit from the shift to green energy.

Billions Pour Into this Industry as Storms Flood Farmlands

An investment in water can be lucrative, considering that money is constantly flowing into the technology and infrastructure behind proper management. Senior Investment Writer Karen Riccio explains.

Here’s What Happens to Options When Stocks Freeze

Income Analyst Nilus Mattive discusses what happens to options when stocks freeze, as was the case last month with then-publicly traded companies, SVB Financial Group and Signature Bank of New York.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily