It's a market priced for perfection heading into a less-than-perfect period. That's how Analyst Nilus Mattive views the investing climate right now, and why he's focused on a broad range of profitable Safe Money strategies.

In this segment, we discuss high-interest bonds, tax-loss harvesting, retailers on the rise and the FTX collapse and its ripple effect.

You can watch the video here or continue reading for the full transcript.

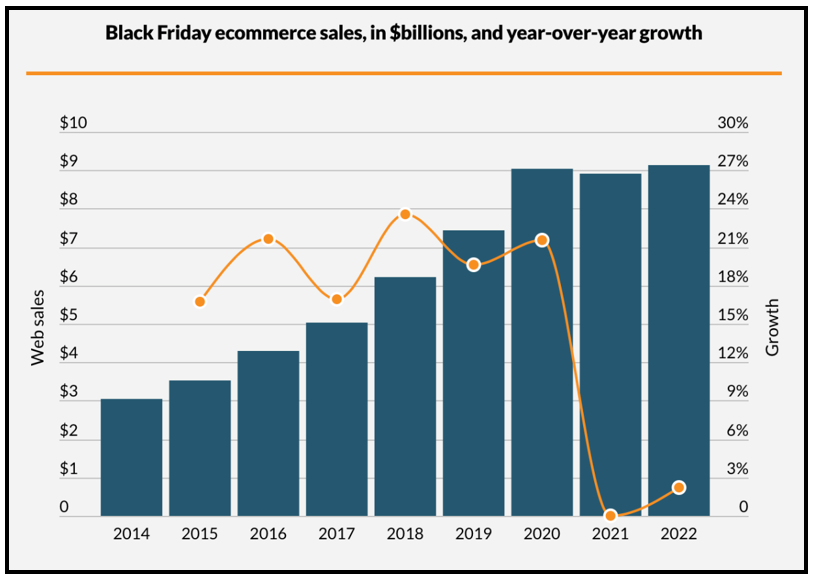

Jessica Borg (narration): Holiday shopping is in full swing.

Online sales alone, on Black Friday reached a record-setting $9.12 billion.

JB: Nilus, weigh in on Black Friday sales. What do you think the implications are for the U.S. economy and the markets at large?

Click here to view full-sized image.

Nilus Mattive: Good question. I think people are still in this kind of post-COVID, celebratory, "We only live once and we're going to go big" kind of mentality.

And I think it still speaks to this inflation issue, as well, relating to whether prices for things come down. I think people are still in the mindset of let's spend and have a great time.

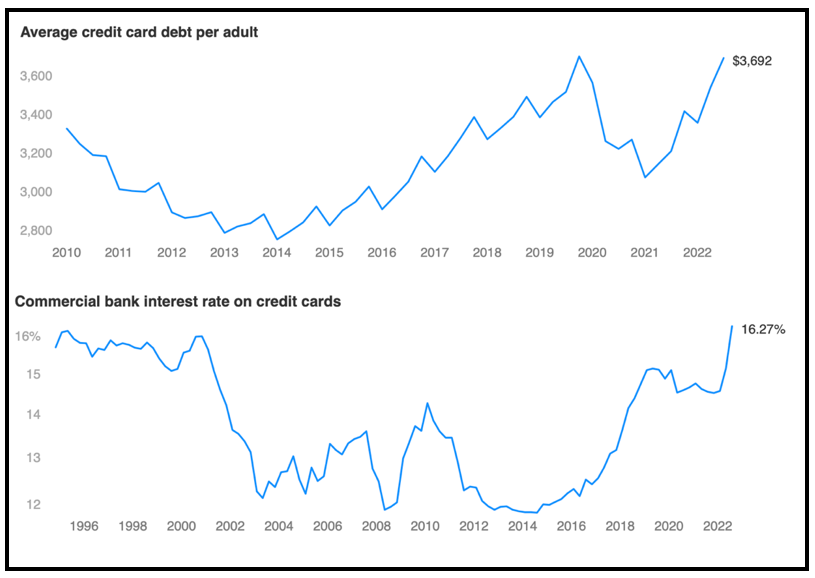

I do think that credit card debt will go up. You're going to start to see more and more money put on credit cards. The question is whether they actually have the money that they're spending like they did when they were receiving stimulus checks, and the answer to that might be "no."

Click here to view full-sized image.

JB (narration): Certain big-box retailers are soaking up consumer spending.

NM: I do think people are shifting toward warehouse stores and places where they still want to spend, but their budgets are still a little constrained.

I know Macy's (M) had really good numbers. They're kind of bucking the trend, and the stock has been doing well these last couple of days.

So, I think people are looking for value, but they still want to open their pocketbooks as much as they can.

JB (narration): BJ's Wholesale Club Holdings (BJ) is a company that shouldn't be overlooked.

It has a Weiss safety rating of "B" and ranks "Excellent" on our Growth Index, Efficiency Index and Total Return Index.

Even though consumer spending is high, Nilus, coeditor of Safe Money Report, warns against market exuberance.

JB: How should investors approach this last month of the year and 2023?

NM: Cautiously. The economy will look good in the short term because of all this spending, but I still question whether it's going to be blue skies from here. I don't personally think that.

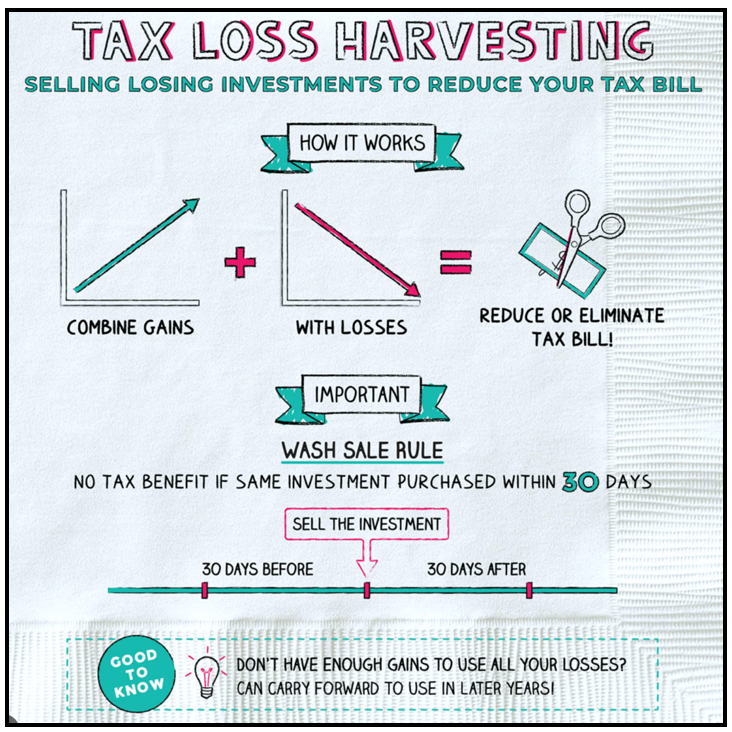

The first thing I would tell people, and something that I'm going to write about pretty extensively for the next month, is the idea of wash-sale rules and tax-loss harvesting.

Click here to view full-sized image.

Even if you have taken some hits in your portfolio, you have opportunities to get a good tax benefit between now and the end of the year, by selling your losers — locking in those losses — and then using those to offset taxes going forward, including on stocks and other investments that you have gains on.

Wash-sale rules means if you sell a stock, you can't buy the same stock back within 30 days and harvest the tax loss.

So, for example, if I sold International Business Machines (IBM) at a loss and I buy it back five days from now, that doesn't count for taxes. That's just a wash.

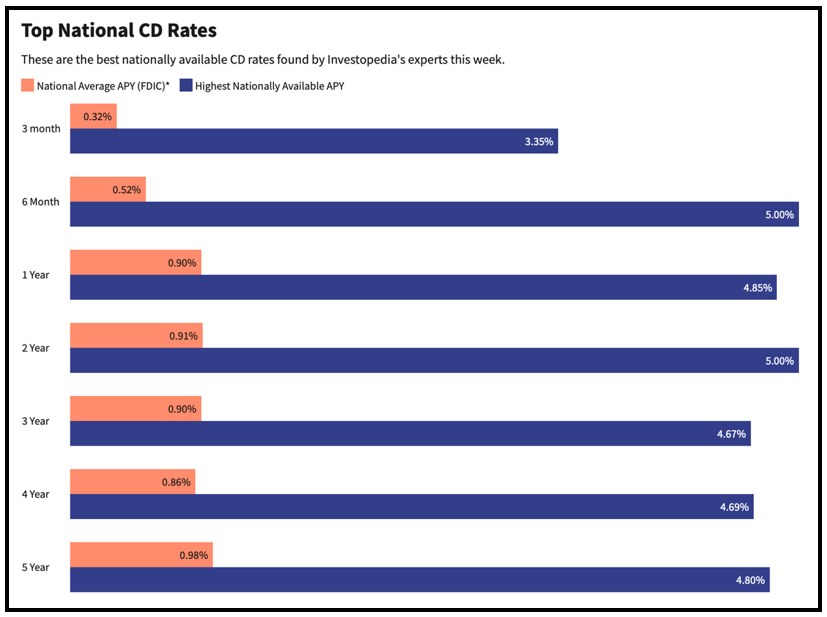

JB (narration): He says not to shy away from bonds right now.

NM: The bonds market looks really interesting. I'm buying a lot of bonds for myself and my family … even certificates of deposit and other ultra-conservative investments right now. If you look at interest rates, you can finally earn 4% or 5% a year on a one-year CD.

Click here to view full-sized image.

JB (narration): Nilus is also coeditor of Weiss Crypto Investor.

NM: The major issue we just talked about was how to get your assets to be self-custody assets, rather than keeping them on centralized platforms. That's a really timely topic for people who are worried about another FTX type of situation.

Going forward, we will talk about how to use any crypto losses you have for a good tax benefit.

Things like crypto are not subject to the wash-sale rule because it's treated like commodities.

JB (narration): The bankruptcy of FTX — the world's second-largest exchange — has cast a wide net.

NM: It shouldn't have happened. It was certainly fraud and, in my mind, probably criminal in some ways. I'm talking about what was done with the funds — commingling funds with their asset management, relative to the brokerage platform.

But the reason I say it wasn't a black swan event is because it's another shock wave that really began with things like the Luna collapse.

There have been a series of rolling repercussions, and I guess the question now is, "Are there more coming because of this one?" I think the answer to that question is "Yes."

JB (narration): Overall, this climate has created a window for people to reposition their portfolios in interesting ways. Keep in mind, a market bottom may be on the horizon, but it isn't here yet.

NM: After you've been around for 10, 15, 20, 25 years doing this, and you've seen several real panics and real collapses, I don't sense that yet.

The fact that everybody keeps asking the questions, "Are they going to pivot right now, is this the pivot?" It doesn't feel like that when you're really at a bottom.

Bullishness is still baked into all aspects of the financial markets, and the Fed has to sense that.

If they pivot right now with interest rates, it's straight back to the problems they are trying to solve with inflation, so I think they have to see it through a little longer.

The stock market itself is still priced at the level when it represented some of the biggest top-market tops in prior cycles.

It is priced for perfection, but I have an idea that we're going to go into a less-than-perfect situation.

JB (narration): So, stay cautious and wait for upcoming issues on how to keep money in your pocket.

JB: Investment Analyst Nilus Mattive, it's always a pleasure to speak with you. Thank you so much for your time and insights today.

NM: No problem. Thank you.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings