|

| By Nilus Mattive |

I spend a lot of time thinking about big-picture forces and how they relate to all the major asset classes.

And when I consider all the different things happening right now — and all the possible future scenarios that could play out from here — I come away with the feeling that gold remains the very best risk-reward setup in global markets today.

Especially if (non-gold-related) stocks are my other choice.

Last week, I reiterated my bold (some would say insane) forecast that the S&P 500 could drop all the way back down to 4,000.

Without rehashing all the reasons why, it basically boils down to today’s absurdly high valuations.

I actually think it’s really funny to hear the same people cheer on stocks like Nvidia (NVDA) and Palantir (PLTR) while saying gold’s run just has to end at some point soon.

If anything, history suggests the exact opposite.

First off, more than a century of U.S. market data says today’s stock prices are completely unsustainable …

Especially if we’re talking about tech companies trading at huge multiples of sales and earnings.

Meanwhile, as I showed you back in October, based on its last major bull market … gold could easily hit $6,000 … $10,000 … or even $15,000 an ounce this time around.

And in this follow-up piece I did about gold’s big run in the 1970s, you’ll see that a similar move this time around would actually take the yellow metal above $48,000 an ounce.

I’m not saying any of that will definitely happen.

What I AM saying is that gold going to $48,000 is actually MORE likely based on data and market history than the U.S. stock market even being able to stay as high as it is already.

Sure, the major stock indexes can go even higher still — especially if the Federal Reserve continues lowering rates further.

But if the Fed keeps lowering rates, that is also good for gold.

And if the Fed somehow resists mounting pressure and either pauses or — gasp! — starts hiking rates …

That is bad for the economy, stocks and other risk-on assets …

Yet probably still good for gold, which typically acts as a safe haven when everything else goes to pot.

Oh, and our ever-rising pile of government debt?

Good for gold.

All the geopolitical problems present and (almost certainly) future?

Good for gold.

All the fissures in the global monetary system as foreign countries look to further hedge their reserves and circumvent U.S. dollar dominance?

Good for gold.

I don’t really see too many scenarios where gold doesn’t continue to shine.

So, if you’re asking me to consider risk versus reward, I’m going with gold (and gold-related stocks) right now.

Speaking of which, just three weeks ago I told you the name of a gold stock that currently accounts for almost my entire Roth IRA.

Since then, it’s risen about 23%.

I don’t think the gains are over.

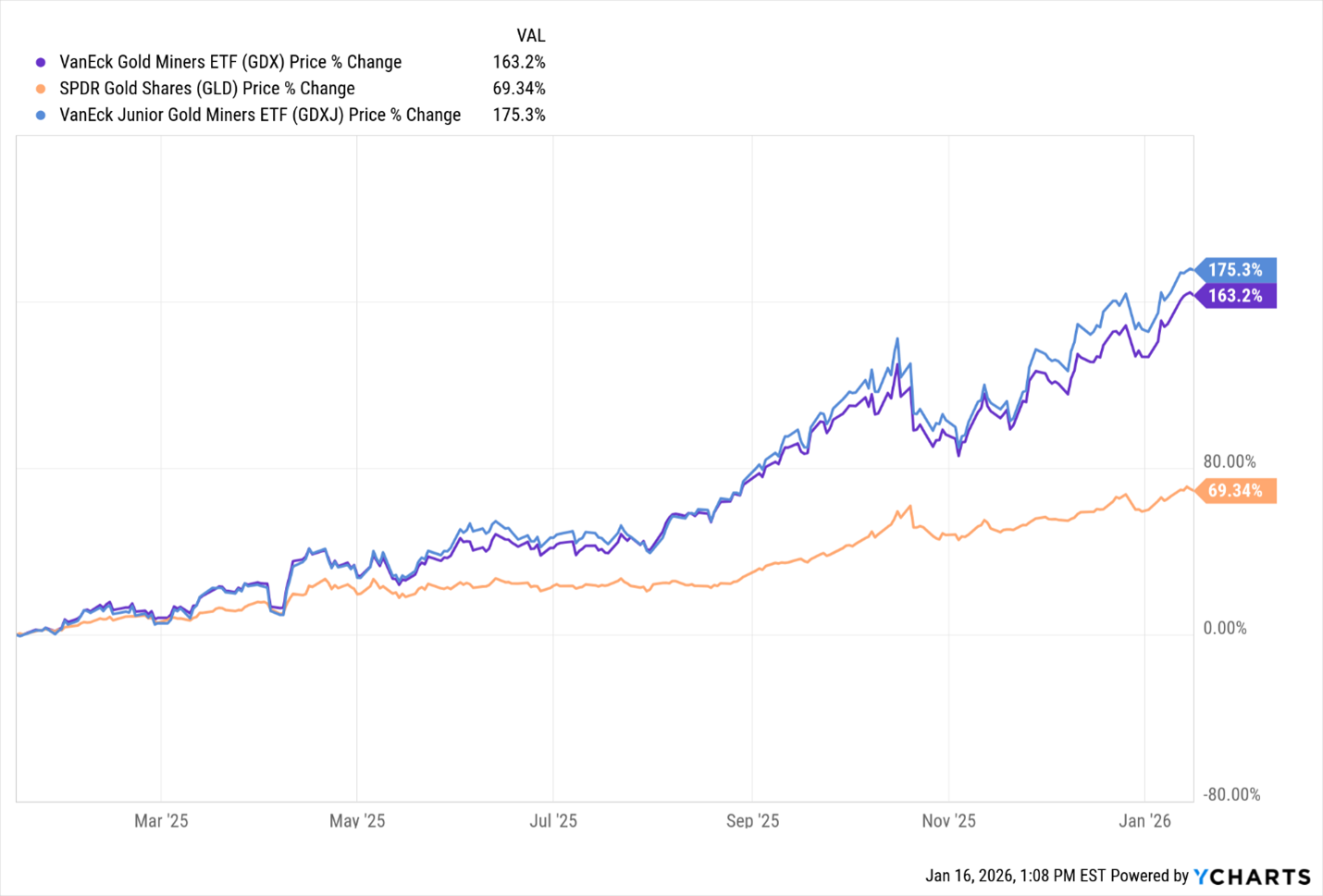

If anything, gold mining stocks have yet to provide as much leverage to metals prices as we usually see.

I think this is because most investors don’t believe today’s prices are here to stay.

Which means there is still a lot of room for upside even if gold merely maintains its current level.

And if we DO see more gains from gold as I just argued we will?

Then there is still a lot more upside from gold mining stocks … especially junior miners, which should already be jumping way ahead of senior miners but haven’t really done so.

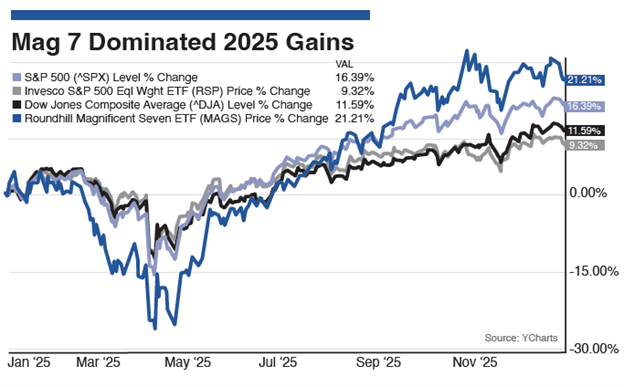

Meanwhile, if I look at the broad stock market indexes, a handful of names continue to drive the majority of the gains.

Here are the final 2025 gains for:

- The Mag 7 stocks,

- The S&P 500,

- The Dow Jones Industrial Average and

- A different version of the S&P 500 where every single constituent counts for the same percentage of the index (rather than its market-weighted methodology).

The Mag 7 stocks did roughly twice as well as an equal-weight version of the S&P 500.

And although I didn’t add it in my chart, the Nasdaq performed pretty closely to the Mag 7 … rising 20.16%.

Any future reversal of the trend is going to spell disaster for millions of people … including those invested in “diversified” index funds.

Take a look at the February through April section of my chart to see how quickly it can happen — with the Mag 7 dropping roughly twice as much as the Dow or equal-weight S&P 500.

This demonstrates that a current advantage can become tomorrow’s liability.

So, if you’re heavily weighted to U.S. indexes or aggressive tech companies right now, keep all this in mind.

And if you don’t have an allocation to gold or gold stocks, now’s a good time to consider re-evaluating that as well.

My colleague Sean Brodrick can help you with that. He just put together a series of reports targeting other companies like the one I showed you three weeks ago.

Best wishes,

Nilus Mattive