|

| By Nilus Mattive |

As the resident Safe Money Analyst, my job is to find safety in all kinds of markets.

With the recent whipsawing in stocks — and the ludicrous valuations I keep harping on about — it’s time for me to discuss one of my favorite ways to profit while defending against stock volatility.

Last year, I gave you two nontraditional, off-Wall Street ideas that I hope you were able to lock in.

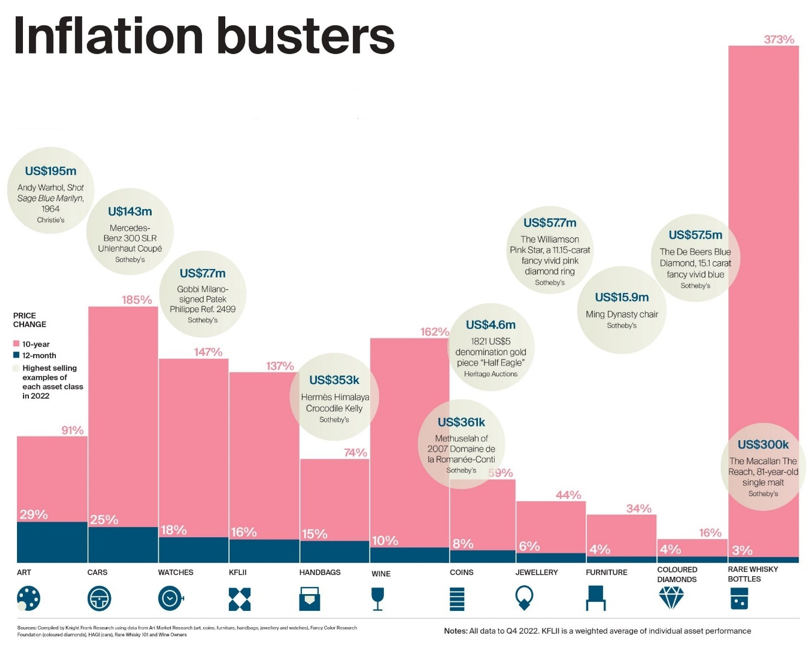

First, I laid out why being a “car nut” can be quite profitable.

Investing in luxury cars, through a fractional investment platform like Rally, is a great way to profit — AND beat inflation — while avoiding overpriced stocks.

Then, a month later, I recommended you look into contemporary, “blue-chip” artworks. In other words, invest like the Medici family.

Again, I recommend this to people with all different sizes of portfolios. Art is also available for fractional investment on the Masterworks platform.

Today, I’m going to introduce you to a new opportunity in one of the hottest categories right now: sports memorabilia.

I’ll even show you a deal I shared with readers and how it worked. It is closed now, but I’ll share where you can find many other similar sports memorabilia deals to consider.

Why Sports Memorabilia?

Investor interest continues to grow for all types of items like bats, gloves, balls and jerseys.

Indeed, as a Kiplinger article explained last year …

“The market for sports collectibles has begun to show signs of increasing orderliness. We see a tiered list of players that includes legends, potential future legends and stars.

“The top names, true legends of their sport, such as baseball Hall of Famers Babe Ruth and Mickey Mantle, are blue chips. Those players’ memorabilia, owing to their vintage and exclusivity, are likely going to rise in value over time.

“Memorabilia of current sports stars with proven records, like NBA players LeBron James or Steph Curry, fall a level below that of Ruth and Mantle. These players’ careers are in full bloom, and prices have been pushed up high as a result. Because of the long-term nature of their performances, however, their legacies are assured, and they almost certainly will become blue chips one day.”

From my perspective, that second tier is the most exciting one … because you’re buying stuff associated with a proven name. Yet, there’s still a lot of future nostalgia-related value that could be unlocked.

Which is why I rushed my readers a first-movers’ deal to buy shares of a collection of 10 game-worn LeBron James jerseys.

As the quote above notes, James is already one of the biggest names in basketball history. Arguably, he’s up there in rarefied air with just a handful of other names like Jordan and Bryant.

That was enough to make Rally’s offering an attractive one.

But there are other factors that put it over the top.

Here are some of them straight from Rally …

Authenticity and provenance: The ownership record of this collection is ironclad, with individual pieces having been originally sourced directly from the league and the Lakers organization.

In addition, the entire collection has been certified and acquired directly from MeiGray, the leader in the photo-matching space and the name behind the authentication of some of the most expensive game-worn pieces ever sold.

Based on data provided by Altan Insights in 2023, authenticated photo-matched items at auction provided a 92% premium to authenticated items that were not photo-matched.

Rarity: Data suggests that just over 1,250 game-worn LeBron James jerseys exist in total. Only 117 photo-matched examples have come to market publicly. This collection represents 19.6% of all game-worn LeBron Lakers jerseys and 27% of all conclusively photo-matched LeBron Lakers jerseys that have publicly sold.

Flexibility: Rally says this investment vehicle will give them the option to add more jerseys over time, which means investors could also have the option to add to their positions in the future as well.

Liquidity: Rally would also have the ability to sell jerseys either individually or in varying quantities at any time with the approval of investors. That could create some very nice exit opportunities, especially because of …

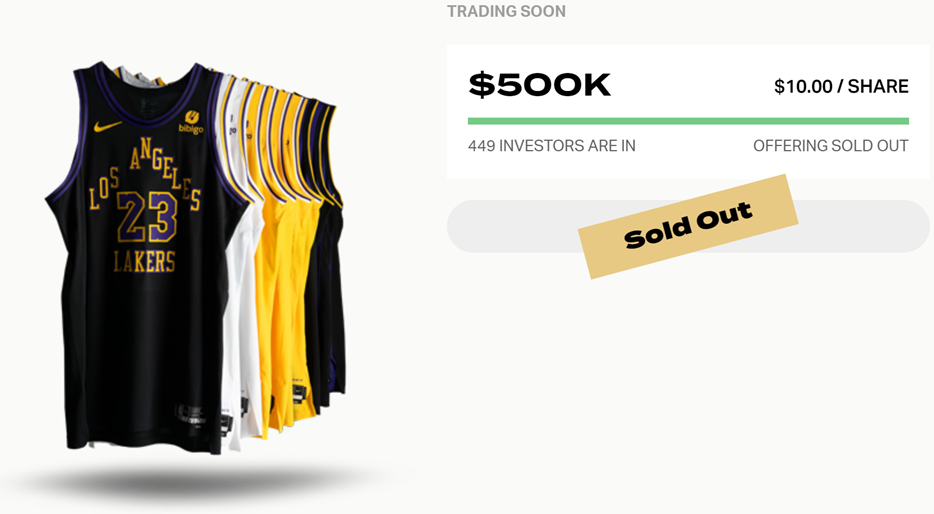

An attractive valuation: The first release of “The King Collection,” containing the first 10 jerseys, is priced at $500,000, or $10 per share.

But Rally noted that the $50,000 average price-per-jersey represents a 46.1% discount to the $92,000 average sale price of a game-worn photo-matched LeBron James Lakers jersey.

Bottom line: Rally should be able to manage this collection for maximum profit potential over time.

And speaking of time, it’s worth noting two more things I told readers about at the time:

“First, LeBron continues to build on his already impressive records and achievements, but he is also the oldest active player in the NBA. That means we could be rapidly approaching his retirement, a possible catalyst for the collection and other James-associated memorabilia.

“Second, when I talked to Rally about getting first-mover access on this collection, they told me it was already seeing huge interest from insiders and other VIP investors. I expect it will be fully sold out very quickly once it hits the full public on Friday.”

That’s exactly what happened.

You can see here that the deal is already filled up:

While this deal might no longer be active, you aren’t out of luck. Rally also offers a secondary market for certain assets. That’s what the “Trading Soon” means above.

Even if you can’t currently buy a piece of “The King Collection,” I urge you to take a few minutes and consider other assets open to investment or coming soon.

As noted, I’ve bought on both the Rally and Masterworks platforms. I’ve been pleased with both.

It’s important for me to tell you that neither I nor anyone else at Weiss Ratings has received any type of compensation for bringing deals like this to readers.

We simply believe in collectible assets as a way to diversify a portfolio and that Rally is a great way to open up these types of opportunities to you.

As a corollary to that, it’s totally up to you whether this type of investment is right for you.

And should you decide to participate, the amount you decide to put in is totally up to you as well.

Also keep in mind some of the points I’ve made in the past, including the fact that these types of investments could typically be held for years before full exits take place.

At the end of the day, I consider the investments I’ve made on the Rally platform to be very long term in nature. I would recommend you do the same.

I also suggest building a diversified portfolio of alternative assets over time and not putting a substantial amount of your total investable money into any single offering.

That’s what I’ve recommended my Safe Money Report readers do. I’ve shared these platforms with them and consider these alternative investments a core asset class in my own portfolio.

Of course, I have plenty of other ideas to keep my money safe … because I see what’s coming. In fact, Dr. Martin Weiss recently put together this presentation on what we’re seeing on the horizon. I urge you to check it out.

Best wishes,

Nilus Mattive