|

| By Jim Nelson |

The Nvidia killer is still nowhere in sight. Though, several are still gunning to take down the AI giant.

AMD revealed a new AI chip that will compete with Nvidia’s Blackwell for use in data centers.

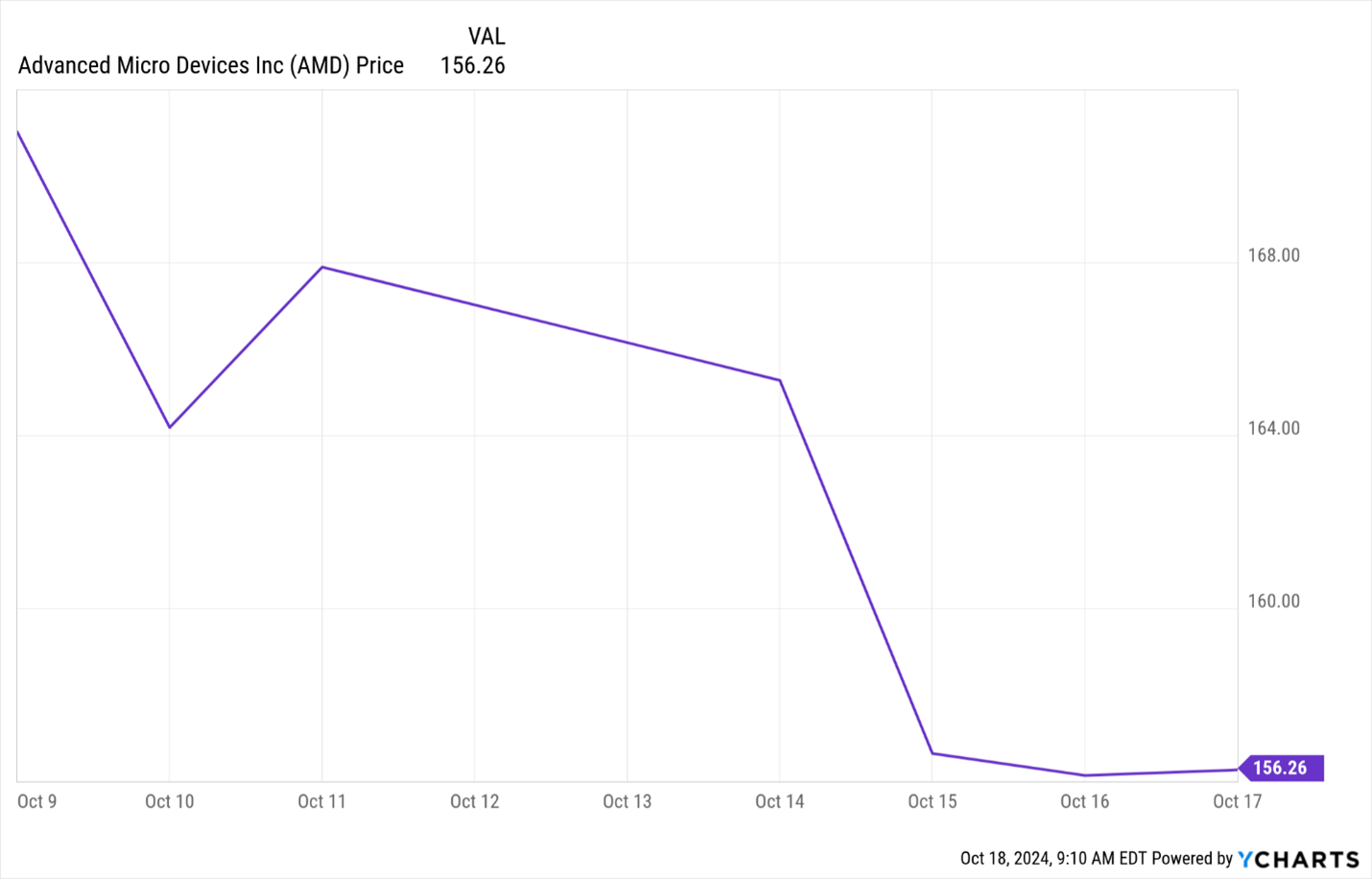

While the announcement received plenty of fanfare, investors are less enthused about the perpetual No. 2 chipmaker’s new product:

The rollout of AMD’s Instinct MI325X chip won’t begin in earnest until the end of this year.

That might already be too late for the big players …

Companies like Meta, Google and Microsoft have already locked in orders for Nvidia’s Blackwell chips, which will begin shipping early next year.

AMD — the runner-up chipmaker to Intel for decades — looks to continue playing its No. 2 roll behind Nvidia for the foreseeable future.

But what about more nimble startups with new chip designs?

Well, just this week, Reuters reported that Cerebras Systems will postpone its IPO. Cerebras claims its current chip is faster and more efficient than Nvidia’s GPUs.

This was supposed to be David taking down Goliath. But this particular David has some serious issues.

Nearly nine-tenths of its revenue comes from just one company in Abu Dhabi. That triggered a review by the Committee on Foreign Investment in the U.S., or CFIUS.

And the timing couldn’t be worse for such a review …

Just this week, the White House is supposedly considering whether to put limits on AI chip exports by Nvidia and AMD to certain countries — including the UAE, where Cerebras’ main customer operates.

This will undoubtedly slow down — or even completely stop — Cerebras’ expected $8 billion IPO.

So, despite several worthy challengers, Nvidia remains at the top of the AI pyramid … for now.

Of course, our own startup specialist Chris Graebe would have been able to tell you about Cerebras’ red flags long before news of the delayed IPO even hit the newswire.

Just yesterday, Chris told us his three steps to find the next superstar startup. I urge you to read that here.

And when you’re done, I suggest you check out something else …

You see, Chris found a startup opportunity even bigger than a potential Nvidia takedown. This opportunity could spark a $1.8 trillion revolution.

Check it out here. But hurry. We have to take down this video soon.

Now, here’s what the rest of your editors are looking at right now:

Gavin Magor is the person you want to have your back when it comes to finding safety and reliability — whether you’re talking about investing, picking a bank or finding an insurance policy. This week, he lays out how to find two of the three.

A Warren Buffett Secret You Need to Know About

It’s never a bad idea to follow along with what Warren Buffett is doing with his Berkshire Hathaway. Nilus Mattive digs into why he’s going back to his roots with his oldest secret and newest investment.

Of course, the Oracle of Omaha has many old secrets. Nilus ferreted out another … one that Buffett used to make billions just before the Financial Crisis in 2008.

A New Force to Send Gold Surging

Gold is up more than 27% to over $2,600 per ounce this year. But that’s nothing. Sean Brodrick found a new force that will send it even higher.

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily