|

| By Nilus Mattive |

I spent a couple days last week visiting my mom and other relatives in Pennsylvania.

I went to several favorite childhood pizza joints … a favorite childhood BBQ restaurant (in business since 1926!) … plus, a big Italian festival where I ate even more pizza and two different porchetta sandwiches.

So basically, I broke every one of my normal dietary rules all in one weekend.

I also violated another cardinal rule of mine: I bought a lottery ticket.

I didn’t want to.

But my mom and aunt both insisted I do it on their behalf because they consider me to be lucky, and the Powerball jackpot was already north of a billion.

Well, spoiler alert: I’m not THAT lucky.

I lost my $6, which would have been far better used to buy a couple more cuts of pizza.

And here’s the truth: Even if you happen to be the one lucky person who wins a billion dollars from the Powerball, the government wins a heck of a lot more.

Think about it …

Every single person who buys a lottery ticket is effectively paying a voluntary tax.

Then, if they manage to win against all odds — about 292 million to 1 — they owe MORE taxes on the proceeds!

Isn’t it enough that the states involved collected way more in total revenues than they paid out?

In most cases, no.

Out of 45 states that participate in the Powerball, more than 80% collect some form of taxes back from winners.

Someone in New York, for example, might end up owing 9.64% to the Empire State.

If they live in New York City, they might fork over another 3.87% in local taxes, too.

That’s as much as 13.51% of the money gone right off the bat.

This is ridiculous, and it highlights just how greedy state and local governments really are.

After all, New York is actually the No. 1 state in terms of profits generated by lottery operations.

Last year, it walked away with a profit of $3.8 billion on roughly $10.8 billion in total sales.

Of course, the real highway robbery is yet to come.

You think Uncle Sam is cool with someone winning a jackpot tax-free?

Ha! Lottery winnings are taxed like regular income.

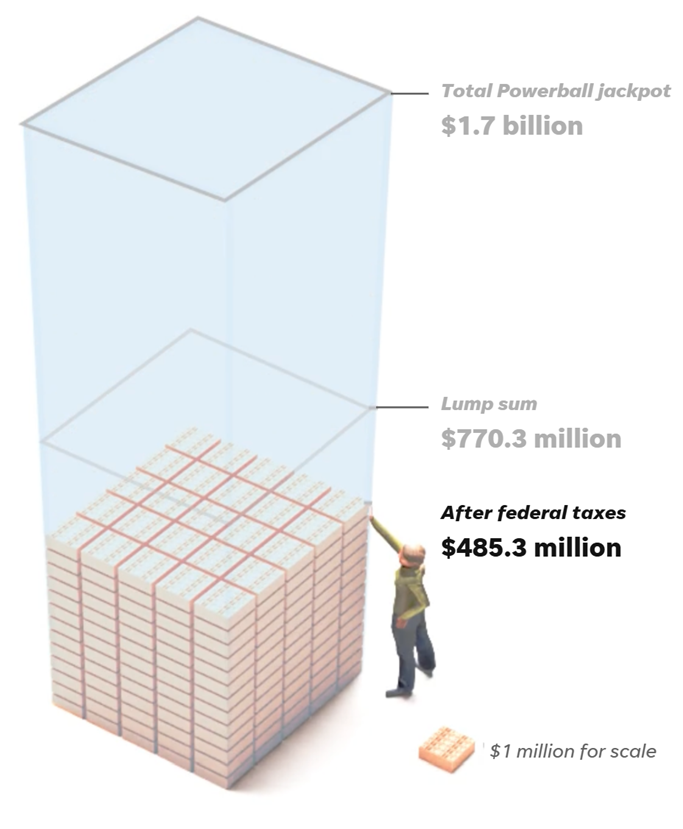

That means winners can kiss another 37% of the money goodbye before they even get to purchase their first Lamborghini.

Oh, and since the Federal withholding rate on lottery earnings is only 24%, they’ll get to savor paying that massive bill more than once.

Bottom line?

All lottery participants pay their money in.

Far fewer collect the same money back out.

And even the “lucky” people who win come to a sad realization …

The amount promised on all the posters has suddenly been cut in half as various government entities claw back the money before it even hits their hands.

You know what that sounds like to me?

Social Security!

It’s not exactly something they print on annual statements or advertise on billboards.

But as I explained in this article from March, Social Security benefits can be subjected to both state AND federal taxation, too.

Neat trick, huh?

It’s actually worse than the lottery because this is all money that was contributed through INVOLUNTARY taxation.

I can’t tell you how many people are still caught off guard by the fact that this happens.

So let me just give you a rough idea …

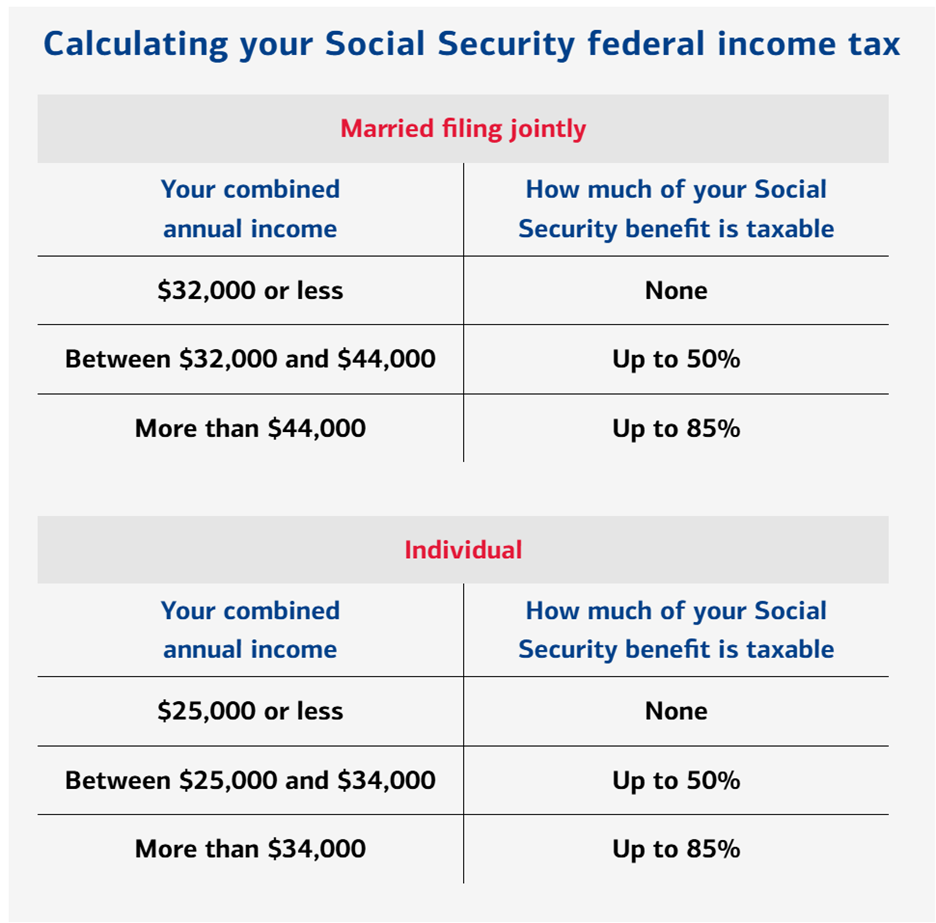

First off, if your personal income is less than $25,000 and you’re single or file head of household, Washington won’t ask for some of your benefit checks back.

If you’re married and file a joint return, you can collectively make as much as $32,000 without owing taxes on your benefit checks.

However, if you make between $25,000 and $34,000 — or $32,000 and $44,000 for married couples — you’re going to owe taxes on some of your benefits … maybe even as much as half of them.

Make more than those thresholds?

Brace yourself!

It’s likely that 85% of your benefits will be subject to federal income taxes.

Please note that many retired couples — people who were teachers, firefighters, factory workers, bank tellers and other “regular” folks — currently exceed those thresholds from modest pensions or lifetimes spent saving and investing.

All told, 25 million Americans currently pay at least some federal taxes on their Social Security benefits, in fact.

Now, yes, the “Big Beautiful Bill” did provide a modest, temporary form of relief for SOME Social Security recipients … but it hardly solved the issue fully or permanently for anyone.

Here are the specifics:

From 2025 through 2028, Americans 65 and older can take a tax deduction up to $6,000.

Note that this is a deduction and not a credit.

In other words, it only reduces taxable income. It doesn’t hand anyone a full $6,000 back.

What’s more, only single taxpayers with a modified adjusted gross income (MAGI) of $75,000 or less get to take the full deduction.

Married filing jointly gets the full deduction if their MAGI is $150,000 or less.

After those points, the deduction begins to phase out.

So, it’s a three-year benefit … that might amount to a couple thousand dollars in actual annual relief … to some retirees.

Social Security benefits are still getting clawed back in a major way for many people.

And obviously, the little “fix” is a net negative for the system’s overall financial health.

It remains to be seen if lawmakers will ever go bigger and completely eliminate all taxation of Social Security benefits, like we heard on the campaign trail.

A new bill to do so was just introduced in the Senate by Ruben Gallego, a Democrat from Arizona.

However, it also includes a provision to raise the cap on the amount of earnings currently subjected to the Social Security payroll tax …

So, it’s really just another redistribution of new money coming in.

Nine states currently tax at least some residents’ Social Security benefits, too.

Which brings me to the bottom line …

Our entire national retirement system remains unfair and dysfunctional as it currently operates.

Last week — while I was buying that lottery ticket — I gave you my simple proposal to fix Social Security’s ailing finances … but as I said then, I hardly expect it to get implemented.

So, I wish I had better news. But you didn’t win the Powerball.

And you probably won’t get back all the money Social Security is promising you, either.

Best wishes,

Nilus Mattive

P.S. This is precisely why all of us should be saving and investing as much as possible to secure our own financial futures.

And if you’re looking for some new ideas that offer “lottery ticket potential” with far better odds of success than you’ll get from Powerball, watch this video update from Dr. Martin Weiss.