|

| By Jim Nelson |

If you’ve ever had a financial adviser tell you that timing the market doesn’t work, I hope you moved on.

Now, timing the market IS tough. And to get it exactly right is nearly impossible.

But there are thousands employed by the same financial advisers that are paid to do exactly that.

When you hear someone say that you can’t time the market, they are really saying that it’s riskier.

After all, if you miss, you can lose out on big gains … or stay in just when everything falls apart.

With stocks, there is some value to the saying “TIME IN the market, not TIMING the market.”

One way to stay in, while also adding a little timing to boost gains is by diversifying your portfolio.

But with other assets, timing can play a huge role in success. In fact, it can be much more important.

Take this example …

If you had decided to get into stocks before polls closed on Election Day 2024, you’d have made a good decision.

You may recall the markets lit up for about a month following the results.

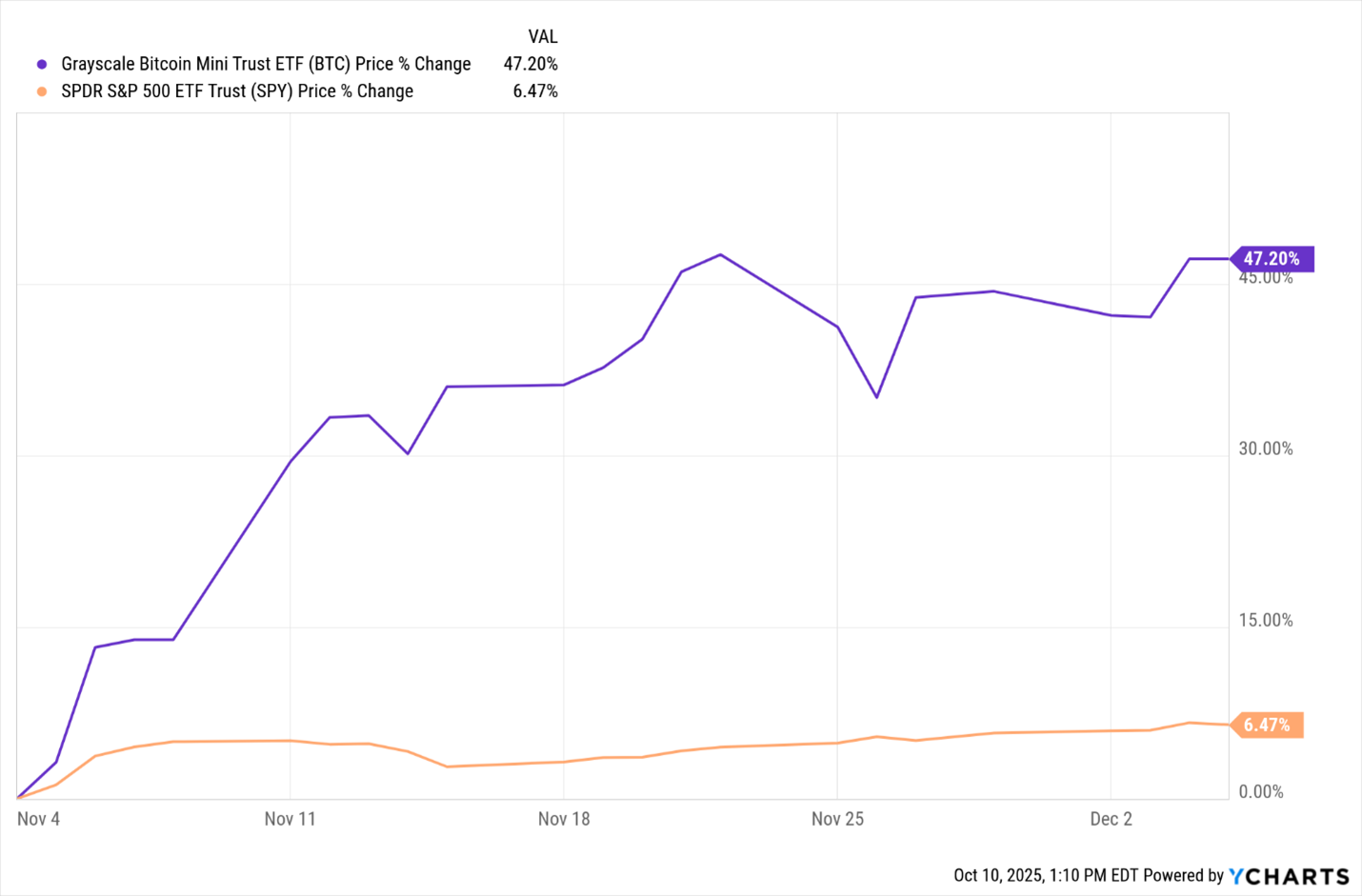

But if you instead decided to get into a simple Bitcoin ETF, here’s how you’d have fared:

Stocks definitely had a solid run after that event. A 6.5% gain in one month is big. But it’s not game-changing.

But if you chose the Grayscale Bitcoin Mini Trust ETF (BTC) instead, you’d have seen your money grow 47% in that same 30-day period.

Ok, so, IF you can time runs like this, crypto is the way to go. But HOW can anyone make that kind of prediction?

That’s what is so remarkable. There is someone who made this exact call … back in Dec. 2023, nearly a year earlier.

We transcribed a clip about it from an interview earlier this week:

Chris Hurt: So, after two years of envisioning and then creating your AI-built 2.0 model … Juan, when did you know you were really onto something here?

Juan Villaverde: Well, it was on Election Day 2024, actually.

I'm sitting at my trading screens, heart pounding.

Bitcoin suddenly skyrockets. Exactly as my new 2.0 model predicted.

But what knocked my socks off was the precision.

Because on Dec. 31, 2023 — almost a year prior — my model flagged Nov. 5 as a major turning point.

Not Nov. 3 …

Not Nov. 10 …

Nov. 5.

And Bitcoin smashed through $70,000 — and skyrocketed to $100,000 a month later.

Chris: Right … So, hold on. You predicted that Election Day would move Bitcoin almost a year in advance?

Juan: Yeah, and that's exactly what happened.

And this wasn't even the first time.

This new 2.0 model nailed three massive Bitcoin moves …

In this interview, he also shares the next date his timing model is flashing … and it’s very soon.

You can watch the full replay, for a very limited time, right here.

Of course, Juan isn’t the only expert with something big to discuss this week. Though, he shows up again on this list.

Here’s what the rest of your experts are looking at …

How I’ll Cash In on the Coming Crash

You don’t have to be a master market timer to see that something isn’t right on Wall Street. Nilus Mattive shares how he’ll cash in when it all comes crashing down.

What the ‘Bitcoin Signal’ Points to Right Now

Juan pinpoints a major divergence going on in global liquidity. And he points out how to play it.

In case you missed it, the market tanked yesterday when President Trump threatened new tariffs following China’s increased rare earth metal bans. Sean shows you how to grab huge profits from it all.

This Month Changes Everything for Crypto

If you do check out Juan’s new model 2.0, you’ll want to see what just changed in crypto … and what’s coming next. Jurica Dujmovic has the story.

Wall Street’s a Year Late to This AI Story

Nvidia just got a little competition. And had you heeded Michael A. Robinson’s advice exactly one year ago, you’d have been on board with the stock that just rocketed higher because of it. Fortunately, you didn’t miss all the gains.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily