|

| By Gavin Magor |

Merry Christmas Eve!

We will soon turn off the lights here at Weiss HQ to spend some quality holiday time with our families.

But the market is open today, at least until 1 p.m. Eastern. And I have a move for you to make …

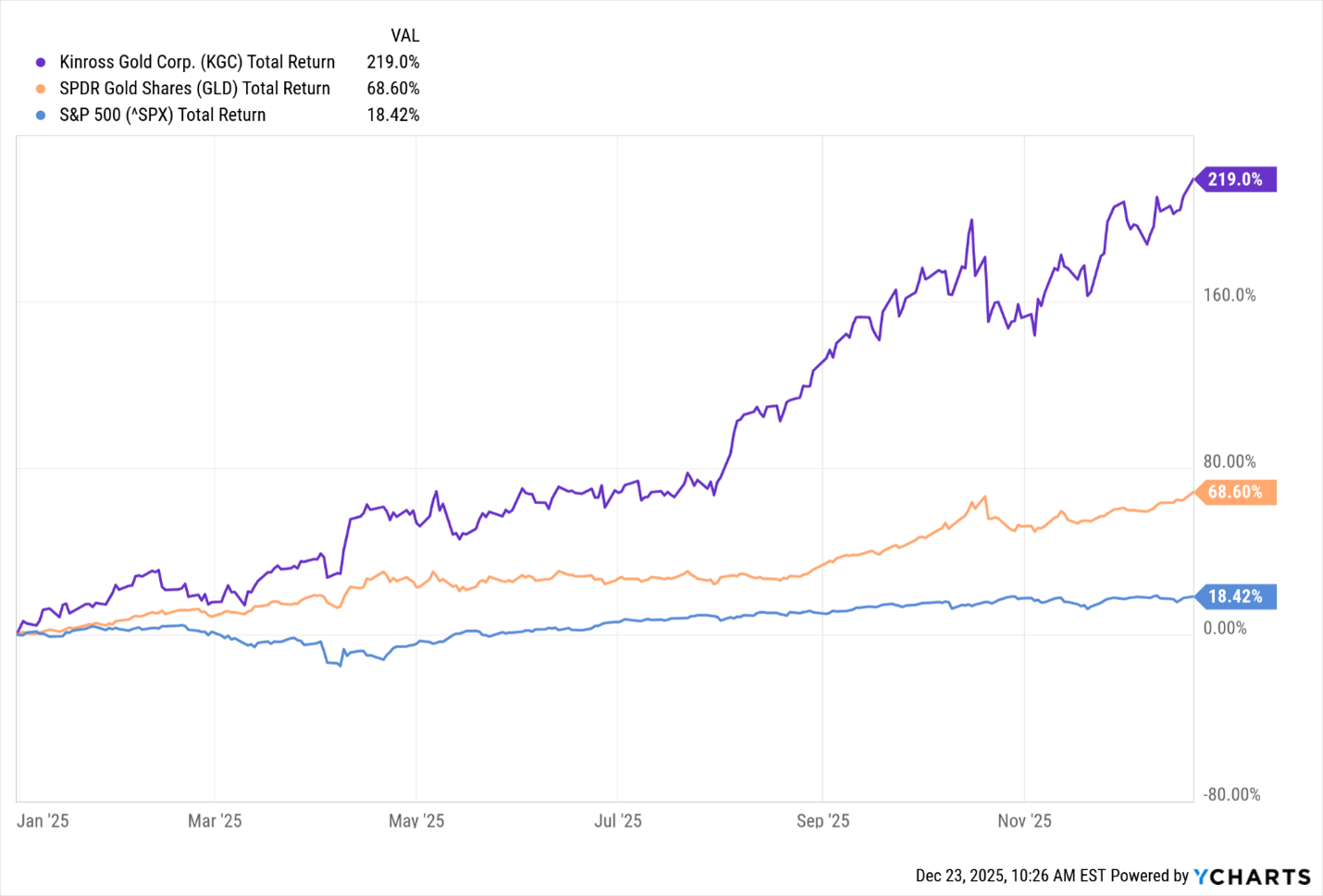

Though if you followed my advice one year ago, you could just hold onto your gains that are up 12x over the S&P 500.

What follows is an updated version of last year’s big prediction.

And it still holds up today. 2026 should be a great year for this “A”-rated rocket ship.

Enjoy, act and have a Happy Christmas!

***

I usually leave the topic of gold to Sean Brodrick, our resident natural-resource expert.

After all, Sean’s a beast at recognizing the best times to invest in precious metals. And, of course, the stocks that stand to fly higher than bullion itself.

Gold is poised to end this year with its best annual performance in more than a decade. The yellow metal gained nearly 69%.

It is clear gold rewarded (and protected) those investors who made it a part of their portfolio this year.

After all, gold offers much more than a way to capitalize on outsized gains. It gives you an added layer of diversity in a portfolio.

That should be especially true in the new year, whose opportunities and challenges have yet to reveal themselves.

Just like stocks and bonds, many variables impact gold’s performance.

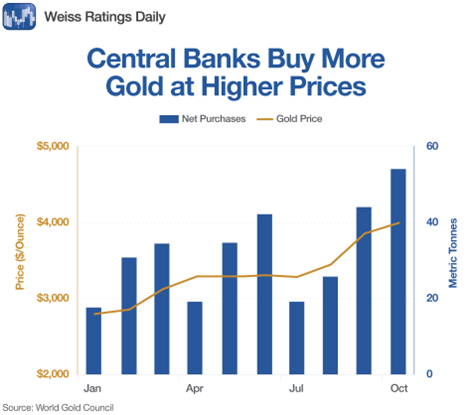

In 2025, buying by central banks and elevated retail interest drove up demand and, therefore, the price of gold.

Here’s a chart courteously provided by Sean:

What’s not so great are the negative factors behind record-setting gold prices.

Things like continued high inflation, the high cost of goods and services and currency depreciation.

All those factors make gold, I believe, more valuable to you today as a hedge in your portfolio.

As a result, I’d consider adding a bit of gold to your portfolio.

Of course, investments in gold mean different things to different folks.

You might picture a physical nugget the size of your fist, or the incredibly popular one-ounce gold bar sold at Costco.

It could be an 18-karat Tiffany bracelet worth thousands of dollars, or gold coins.

However, since we’re experts on stocks, ETFs, mutual funds, insurance and banking, I’ll stick to non-physical avenues to invest in gold.

Let’s consult our Weiss Ratings for the most stellar of the bunch.

I searched gold stocks for those rated above a “C+” with “Buy” recommendations, and here’s how my search populated:

The one I’d like to call your attention to is Kinross Gold (KGC).

One beneficiary of gold reaching a record high of over $4,500 an ounce this year is miners.

This one — with operations spanning North and South America and West Africa — has risen 219%.

The company enters 2026 with record free cash flow and in a strong financial state.

Kinross Gold has built a diversified portfolio of mines over the years through both strategic acquisitions and organic growth, leading it to be one of the top 10 gold mining companies in the world.

Over the years, the company has successfully acquired assets such as the Tasiast mine in Mauritania and the Paracatu mine, both of which are now key assets in its portfolio.

In just 2025, it added ownership positions in Relevant Gold and Eminent Gold.

Other assets in the Americas have resulted in a geographically diverse portfolio that reduces the risk of relying on a single region or jurisdiction.

Now, if you prefer to lower the risk of buying an individual stock even further, consider the SPDR Gold Shares ETF (GLD).

It’s one of the top five rated ETFs, all of which are “B-” in the precious metals/gold sector by Weiss.

They give you the ability to own an asset that reflects the price of gold without having to store the metal.

For even more ways to play gold’s continued rally, I’ll hand it over to Sean.

He is setting down his favorite way to leverage gold’s rise: junior miners.

Here, he’ll tell you which ones he likes for 2026.

Cheers!

Gavin