This Semi Star Keeps Chipping Away at Massive Gains

|

Currently, the Weiss stock ratings cover 12,053 stocks.

We rate those anywhere from “A” and “B” (a “Buy” rating) all the way down to “E” (or, “Sell”).

Those simple letters have a rigorous testing screen behind them. One that happens every day, behind the scenes.

We award those that score high marks for upside and safety a “Buy” rating. Right now, 938 stocks have that top rating.

In other words …

Only about 7.8% of the stocks we rate are worth considering for your own portfolio!

We have one of the largest financial datasets in the world, with some 10 terabytes of data.

One of the best sources for fresh data … and lots of it … is earnings season.

Not only have Q3 earnings reports started coming in this month, but the data is already starting to show up in our ratings.

As more data becomes available for stocks, their ratings can change. So it’s important to check back every day.

An easy way to do that is with Weiss Ratings Plus. There, you can set alerts to let you know when a stock is upgraded or downgraded … if a stock price moves up or down by a certain percent or price … and those are just two of the tools that can help you put all those 10 terabytes data to work in your own portfolio. Click here to learn more.

With the AI bubble showing signs of deflating, a lot of people are eager for the semiconductor sector’s earnings to start in earnest on Oct. 27.

One semi already reported last week. Whether it’s a bellwether for its fellow chip stocks remains to be seen.

I’m talking about Taiwan Semiconductor (TSM).

Last Thursday, Oct. 16, the company reported record earnings. Revenue for the previous quarter came in at $33 billion. And earnings per share came in at $2.92.

Both are up significantly YoY. A major contribution to this was massive AI-related demand.

These are all numbers that get factored into our ratings. So does the price action. Which, in TSM’s case, has gone higher since its earnings announcement.

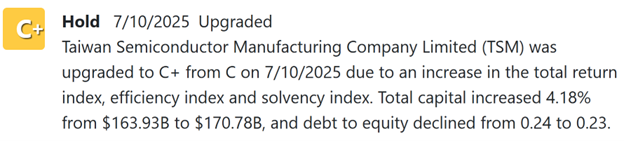

So, why does TSM only earn a “C+,” or “Hold,” rating in the Weiss universe?

Our ratings system upgraded TSM to “C+” on July 10 after its last earnings release. The reasons included higher total returns, more capital on hand and a decline in its debt-to-equity ratio.

Now, a “Hold” grade is nothing to sniff at.

But given how rapidly semis and other AI-leveraged stocks have surged in price this year …

If I were looking to add a stock that’s chipping away at that massive opportunity, I’d rather add one that the data is telling me is a “Buy” today.

Fortunately, we have one of those right now!

A Semi ‘Buy’ on the Fly

The Weiss Ratings system currently rates another chip stock as a buy … and it’s been on a major tear as of late.

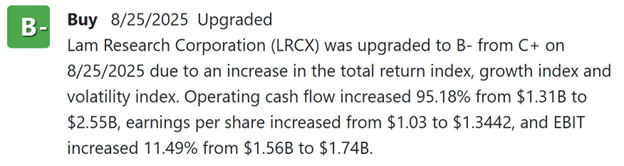

That stock is “B-”-rated Lam Research (LRCX).

Year to date, LRCX is up 96%.

It was recently upgraded to “B-” thanks to an increase in operating cash flow, earnings per share, total return and more.

Together, all these positives could signal massive upside ahead.

Now, that’s based on all the data that our system has amassed on LRCX so far. And if you like to read charts, you can find visual evidence of this uptrend.

That sure looks like a breakout to me.

And when it comes to volatile tech plays, technical levels can become even more important than with stocks in other industries.

LCRX recently used its 200-day moving average as a level of support. That’s a bullish technical signal.

Now, considering that both TSM and LCRX had recent upgrades, why would we consider LCRX as a better “Buy”?

Three reasons:

- One, Lam Research makes the equipment that is used to build the semiconductor chips. In fact, TSM is one of Lam’s biggest customers!

- Two, semi manufacturing should only become more and more complex as the AI revolution ramps up. Its position as a supplier to leading chipmakers like TSM stands to widen an already wide moat.

- Three, Lam appears to be in a very ideal position to keep capturing that market. That’s because it’s doing very well financially … all factors that went into its recent rating upgrade.

Lam Research reports earnings this coming Wednesday, Oct. 22, after the market closes.

Wall Street expects earnings per share of $1.22 on revenue of $5.23 billion. Whether it hits those numbers, or comes in slightly higher or lower, there’s no telling what will happen to the stock immediately, as the markets will be closed.

But if the data has come in as strong as it has over the past several quarters, we could see the ratings reaffirm that “Buy” rating … especially if the uptrend in the stock price continues.

Click here now to see even more stocks that are set to get a second wind from AI.

Cheers!

Gavin Magor & PJ Amirata