|

| By Jim Nelson |

While we ate hotdogs and lit fireworks here in the colonies this week, the Brits voted for their own mini revolution.

After being in power for 14 years, the Conservative Party has finally fallen. This was the Tories’ largest defeat in history.

The Labour Party’s win signals that change itself may be more important than the direction of that change.

That’s a theme we’ve seen in the stock markets throughout history. And now, it’s finding its way through the biggest election year in history, with more than 50 countries heading to the polls in 2024.

Though more conservative than previous Labour leaders, Keir Starmer does present a different look for our neighbors across the Pond.

His challenges, however, are the same ones the U.K. has struggled with for the past several years — a stagnant economy, aging population and high debt.

If that sounds familiar, it should. The country also has another thing in common with the U.S. right now … its stock market is going through the roof!

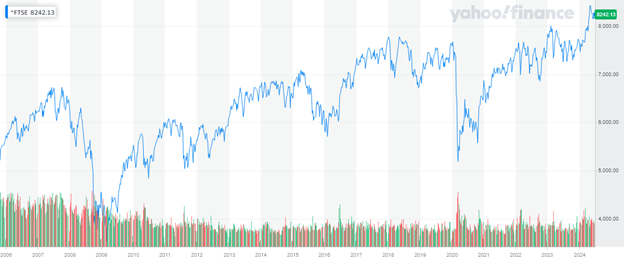

This is the FTSE 100 Index, the U.K. version of the S&P 500. It is comprised of the 100 largest companies listed on the London Stock Exchange.

Despite the economic turmoil of Brexit … the even higher peak inflation in the U.K. … and this week’s giant shift in government control …

U.K. stocks are flying much higher than pre-Covid.

We can only wait and see how Starmer’s new leadership will affect this trend.

But with our own election coming up in just four months, we will watch.

Now, despite our own shortened trading week, your experts have been as busy as ever. Here’s what they are watching …

Our own resident Brit and Research & Ratings Director Gavin Magor took an extreme look at the 12,562 stocks that Weiss Ratings has a grade for. He found three with an “A” rating — two of which deserve a deeper dive.

AI for Good & the 13-Digit Giants

AI has already helped create six trillion-dollar-plus giants. Here’s what Chris Graebe says is the only way for AI startups to join them.

Lock In Your Long, Hot Summer of Profits

Sean Brodrick studies cycles all the time. He found two that are coinciding that signal you need to buy stocks right now. He even has two ways to do that to get the most out of these coalescing cycles.

Revolution Is What’s Truly American

On America’s birthday, our out-of-the-box safe investment expert, Nilus Mattive, has a different take on how to pursue financial, physical and intellectual happiness.

3 Tech Stock Buying Tools for a Top-Heavy Market

With tech stocks reaching the stratosphere, our expert on the subject has three tools you can use to both protect your tech gains and lock in even larger ones.

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily