Weiss Safety Ratings Versus Investment Ratings

|

| By Gavin Magor |

You didn’t think banks would stay out of the limelight forever, did you?

Banking fears have been rekindled this past week after New York Community Bank (NYCB) reported Q4 earnings.

Its stock fell a staggering -42.5% when the opening bell rang last Wednesday. Ouch.

For years, New York Community Bank was touted as a stable commercial real estate lending bank that paid a nice dividend.

And that was mostly true, because before its latest earnings report was released that announced a massive dividend cut, its dividend was yielding a juicy 11.28%.

The bank made other, far more positive, headlines last year when it absorbed some assets, including the assets of Signature Bank, the infamous regional bank that failed last year.

As of Dec. 31, 2023, the bank had $116.3 billion in assets, making it one of the 30 largest banks in the U.S. by total assets. Certainly, a very large and well-known bank.

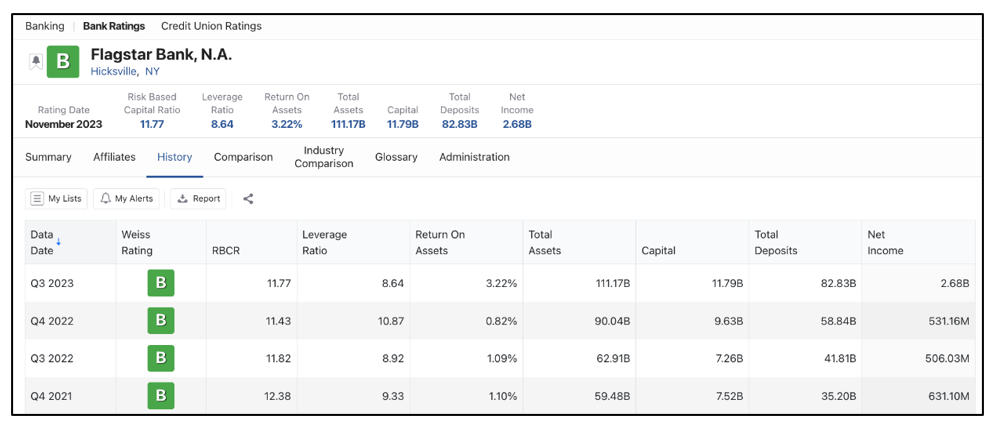

On our Bank Ratings page, the name of the bank is “Flagstar Bank.” New York Community Bank is a division of the bank. Take a look at its assets, which increased greatly over the past year, mainly due to the acquisition of Signature Bank’s assets:

But was it the acquisition of Signature Bank’s assets that caused NYCB’s recent troubles? And are regional banks now in trouble again? Will we see other major banking industry trouble like we saw in 2023?

Currently, the answer to these questions is “no.”

The banking industry appears stable. Capital ratios are actually improving industrywide, interest rates will start to come down at some point this year and most other big banks are quite healthy.

This particular stumble of New York Community Bank was specific to this bank’s financial issues, and it is not an industrywide problem.

In fact, NYCB’s earnings were awful, EPS missed by a whopping –193% and revenue missed by –3.93%. Analysts were expecting EPS of 29 cents per share, only to come in at a 27-cents-per-share LOSS.

NYCB reported huge loan losses. It cut that very attractive juicy dividend and its capital is down massively.

NYCB’s legacy assets hurt them the most in the recent quarter. Remember, NYCB is a major multifamily apartment lender, and New York rent controls were a major issue.

Look, other banks have reported earnings in recent weeks, and they’ve been relatively solid. Strong earnings and healthy balance sheets have been the norm.

This case with NYCB was unexpected … and very surprising. Not many investors could have seen this coming.

I don’t expect this to be a contagion event at all. It’s exclusively NYCB’s issue.

That said, this situation is a perfect example of the differences in Weiss Bank Safety Ratings versus our Investment Ratings.

Weiss Safety Ratings vs. Investment Ratings

We currently rate Flagstar Bank, the operator of New York Community Bank, with a “B” banking safety rating. As of now, the bank is fine. It had a rough quarter, but this issue will mainly impact shareholders, not depositors with the bank.

Could their issues get worse, and could capital ratios decline? Sure, but it doesn’t appear that the bank is in any major trouble.

However, in terms of its stock Investment Rating, which we currently rate as a “C,” things are more uncertain.

It doesn’t take Warren Buffett to realize that when a bank is rapidly cutting its dividend due to major loan loss provisions, there are signs for alarm.

Always consult our investment ratings and bank ratings for your investing and banking needs.

Whilst the banking industry appears to be okay, it’s always important to check on your bank’s rating, at least on a quarterly basis. And as for stocks, I would recommend you check on them far more frequently.

Our Weiss Ratings pages are packed with insightful and easy-to-digest information.

Unlock your best investing potential, and get the best you deserve with the Weiss Ratings at your side.

Cheers!

Gavin Magor

with

PJ Amirata