|

| By Jim Nelson |

The past three weeks haven’t been kind to investors. So far, the market’s decline in April has already wiped out all gains made in March and part of February, too.

Of course, we can get into all the reasons for this — including hot inflation, cooling anticipation of rate cuts and the increased tension in the Middle East.

But rather than the causes, let’s look at one effect of the recent correction in stock prices — volatility.

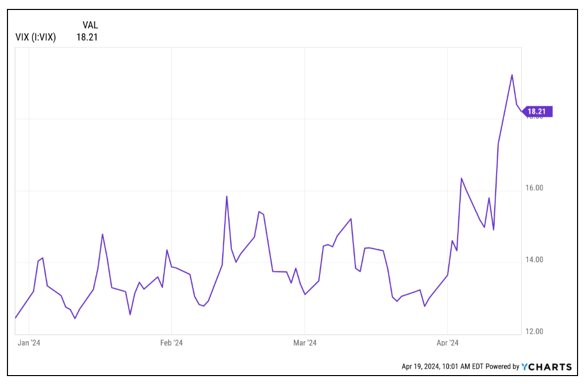

Here’s the year-to-date chart of the CBOE Volatility Index, or VIX:

That’s what happens when the major indexes break their trends … volatility spikes.

Now, the VIX at 18 isn’t wild. It nearly hit 22 just six months ago, and 25 early last year. Historically, anything over 30 is when things get really bad.

It peaked above that threshold several times in 2022. And you probably remember how painful that year was for performance.

Still, volatility does often go hand in hand with opportunity. You just need to know where to look.

Thankfully, our team of experts are always on the hunt for opportunities … and they DO know where to look. Here’s what they are finding …

Turbocharge Your Dividend Income

No matter when the Fed decides it’s time to start cutting rates, investors will soon be in need of alternative income streams. Thankfully, the Weiss Ratings has you covered with its dividend filters. Research & Ratings Director Gavin Magor shows you the way.

Grab Your Slice of These 387% Sports Gains

It’s no secret that professional sports have become big business. Startup specialist Chris Graebe shows how the sizes of audiences for NFL, NBA and other pro sports leagues have translated into direct investment opportunities.

Why Stocks Are Stepping on Rakes Right Now

Sean Brodrick presents one of the most telling charts you’ll see all year. A key ratio is now bottoming out at 20-year lows. Of course, as always, Sean has the perfect way to play it.

AI Is About to Shift Gears Again

Forget about ChatGPT. Forget about the hype around large language models. Our tech guru Jon Markman introduces where AI is headed next. He also reveals which company is set to take advantage of this AI shift.

How Readers Could Have Gotten a Free Crypto Portfolio

Nilus Mattive has been pounding the table about how strategic investments into cryptocurrencies can increase the safety of a portfolio. Now, he shows you exactly how he gave his readers the opportunity to get a FREE crypto portfolio.

Have a great weekend,

Jim Nelson

Managing Editor, Weiss Ratings Daily