Editor’s note: Your intrepid resource guru, Sean Brodrick, is in Beaver Creek, Colorado, for a precious metals summit.

This event couldn’t have happened at a better time. That’s because we’re in the middle of a historic week for gold.

Sean’s had some productive meetings with CEOs and founders of junior mining companies. And he has several more lined up.

His mission is singular:

To find the best undiscovered gold companies to play this latest breakout in gold prices.

He’s also gathering their intel on what these CEOs and founders have to say about supply, demand and their own predictions for gold’s next move.

Sean will be back next week to share his findings with his subscribers.

In the meantime, let’s look back at Sean’s own predictions … how high he expects gold to go … and a brand-new chart he sent from the road showing this week’s historic record.

|

| By Jim Nelson |

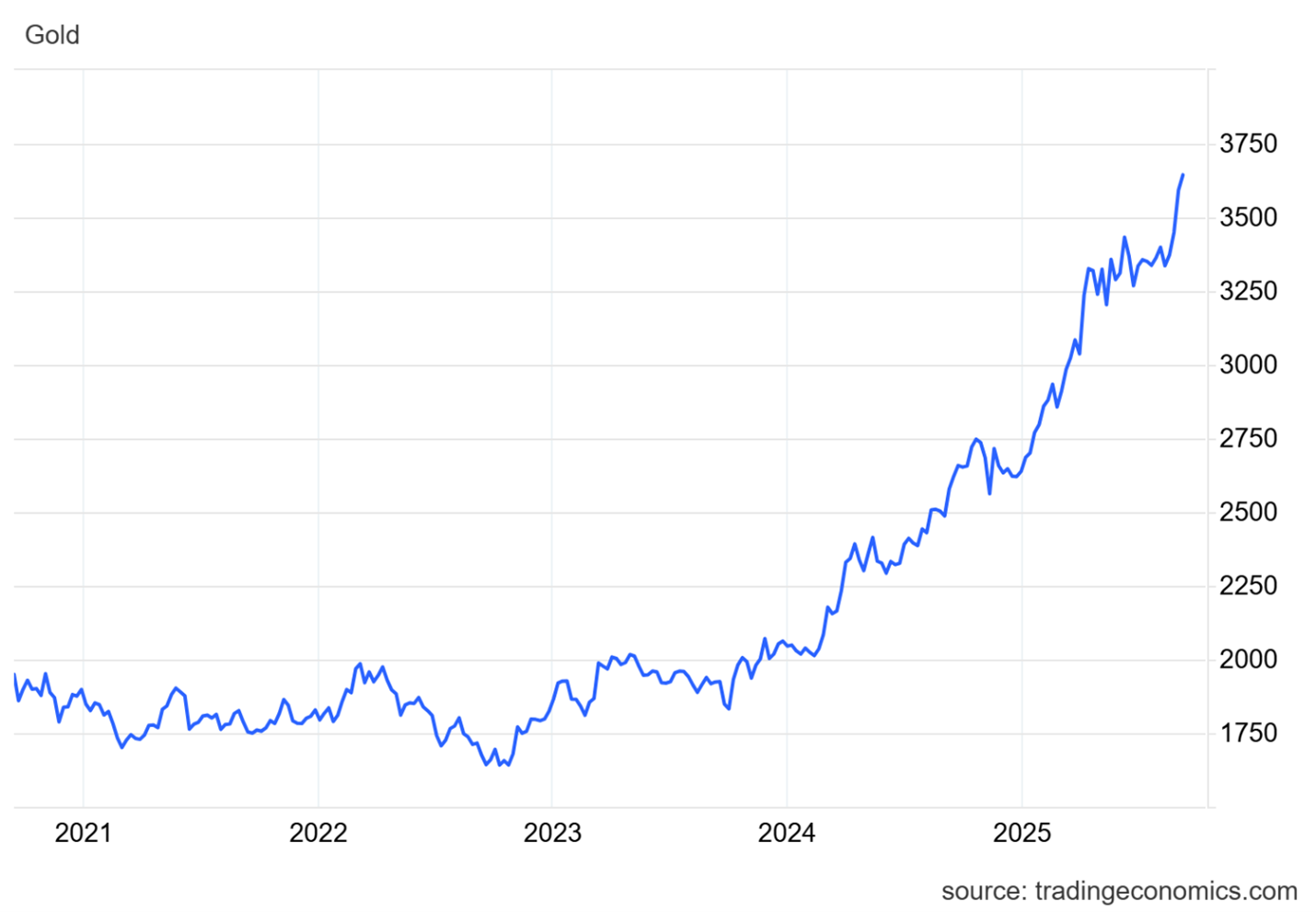

Gold has been on a tear since the start of 2024. That’s when it successfully crested $2,000 per ounce.

And Sean was already calling for it from the start.

On Jan. 31, 2024, he wrote:

“Look at a chart of the SPDR Gold Shares (GLD), an exchange-traded fund that holds physical gold and tracks the price movements in the yellow metal closely.

“You can see that GLD has been coiling up for months. Now, though, it broke the recent downtrend. And this points to a short-term rally in gold of about 16% …

“That’s short term. My long-term target on gold is much higher.”

A few months later, he gave us his targets:

“Gold is making new highs as I write this. It’s on its way to $2,400 in the short term, and more than $2,900 over the course of a year.”

That upper target was breached almost exactly one year later.

He didn’t forget about silver either. In May 2024, he wrote:

“It would not surprise me to see the price of silver QUADRUPLE over the next few years.

“Along with it being the most useful of metals, we’re probably heading to a currency crisis eventually, driven there by a combination of uncontrolled government spending and demographics.”

Of course, he was right about both metals, which had great gains last year.

Earlier this year, he told you to switch gears. Move to gold mining stocks instead of the metal itself.

He wrote:

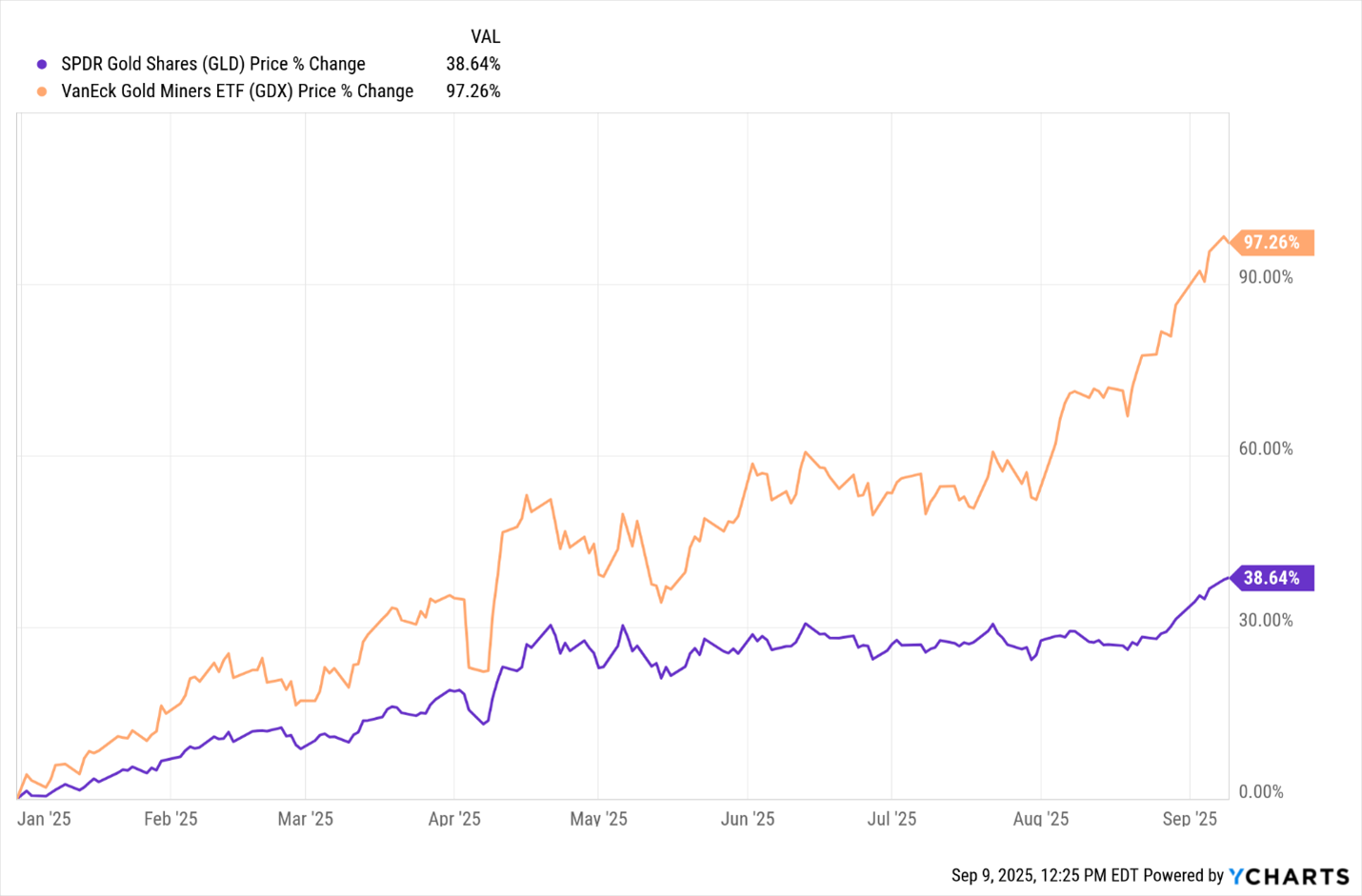

“For years, gold miners were about as popular as a leper in a bikini contest. Even when gold started its big move in 2022, gold miners lagged.

“Fast-forward — gold is up 59.3% in the past three years, while the S&P 500 is up 43.2% and gold miners bring up the rear with a 34.5% gain.

“Look how much of that rally in gold and miners has come in 2025. Gold is sprinting ahead, and gold miners are playing catch-up.”

Again, he was right.

Year to date, gold miners — as represented by the VanEck Gold Miners ETF (GDX) — have nearly tripled the skyrocketing price of gold:

He also opened this year with new price targets:

“A great gold grab is going on right now, and it’s picking up steam.

“It’s not a bunch of bank robbers — I’m talking about the big central banks themselves.

“And it’s another piece of the puzzle that will send gold to my targets of $3,100 by mid-2025 and over $6,900 longer-term.”

We blew through his first target even before mid-year. In fact, this week led to something even bigger …

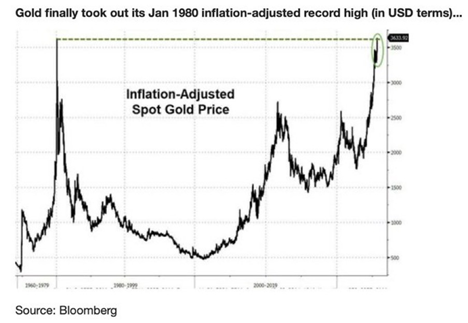

Just before his precious metals summit opened up yesterday morning, Sean sent us his latest chart:

Gold was already hitting all-time highs throughout the past two years.

But now, even adjusted for inflation, it has finally topped its 1980 peak.

Sean says this is just the start. From Colorado, he told us that we have YEARS left of this gold bull cycle.

Remember, his long-term price target for the metal is $6,900.

He still recommends the above ETFs as an easy way to play it.

But for the truly game-changing gains, you’ll want to hear what he comes back with.

We also recommend you watch his latest interview here.

Watch to the end to see how you can get the names of his favorite gold and silver stocks right now.

Cheers!

Jim Nelson

Managing Editor, Weiss Ratings Daily