|

| By Kelly Green |

I’m not really a credit card user anymore.

In my 20s, I ran up some hefty bills that took the first few years of my 30s to pay down. But I do still have a Discover (DFS) card that I will use for online purchases and booking travel.

So earlier this week, I was paying off last month’s purchases and on the bottom of my confirmation, I saw an ad for an investment opportunity …

Now, I remember making out pretty well on some certificates of deposit (CDs) when I was a kid.

And who doesn’t want to watch their savings grow? So, out of curiosity of what rates they were offering, I clicked through.

I found that …

- I had to move the horizontal time marker all the way to five years just to get the offer of 1%!

I’m sure this seems like a good deal to someone ...

But, personally, I can’t imagine watching my money grow at a measly 1% over five years. That’s not even considering how inflation will negate those gains entirely.

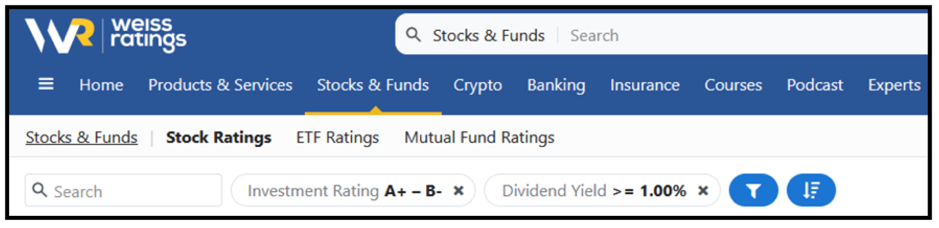

This is especially true since I have the Weiss Ratings screener and …

- It will literally take me five seconds to find better opportunities than a CD.

I simply put in two filters. I wanted all companies with a dividend yield of 1% or more and a “Buy” rating.

The result: 806 opportunities that — right off the bat — look better than Discover’s CD offer.

Before we look at a few of the companies that are touting double-digit yields, you need to hear about Dr. Martin Weiss’ Weekend Windfalls strategy … and your next weekend payout.

His subscribers are making $1,000 in instant payouts nearly every week with a 98% success rate … absolutely blowing CDs out of the water. For more information, click here now.

1. BHP Group Limited (BHP): 13.3% Dividend Yield

BHP is a resource company based in Australia. It operates in the petroleum, copper, iron ore and coal segments in countries across the globe.

Although BHP spent the majority of 2020 and 2021 in the “Hold” range, that might be changing. It spent September and October in the “Buy” range.

And although it slipped into the “Hold” range again, it’s back at a “B-” as of Feb. 23.

The company has been paying a dividend since 1979. But a quick look shows that the payment is variable and there have been times that payments were not quarterly.

Shares are up 18% so far this year but down 10% over the past year. But a quick look at a daily chart of share prices shows that in this current run, it will break through recent highs:

2. Labrador Iron Ore Royalty (LIFZF): 13% Dividend Yield

LIFZF holds a 15.1% equity interest in Iron Ore Company of Canada (IOC). IOC produces and processes iron ore to produce seaborne iron ore pellets and iron ore concentrate.

Over the past eight years, Labrador spent time in the “Sell,” “Hold” and “Buy” ranges.

But in February, the company saw a solid “B” for the first time. Every time the company was upgraded to a “B-,” it fell back to a “Hold” right after.

This time, it might be different. The “B-” upgrade was followed by the upgrade to a “B” just three months later.

Since the company is a royalty corporation, it’s going to be diligent about paying out to its shareholders. It’s there to generate income for investors. But, the payouts can be extremely variable. It’s dependent on the results of IOC.

Shares are up 44% over the past 90 days and 25% over the past year. And a quick look at the daily chart shows that it’s just a few dollars behind the 52-week high:

3. Golden Ocean Group Limited (GOGL): 12.9% Dividend Yield

GOGL is a shipping company based in Bermuda and owns a fleet of 67 dry bulk vessels varying in size.

If you’re unfamiliar with the economy of cargo transports, 90% of global trade is conducted via the seas. Of that, 29% is tanker transport, 17% is container transport and 54% is dry bulk. That dry bulk category includes bulk commodities like ores, coal, grains and fertilizers, to name a few.

The company spent most of the past eight years in the “Hold” range. And when it wasn’t in that range, it was in the “Sell” range.

It’s first upgrade to a “B-” came just last August. After a brief downgrade to a “C+,” it’s back up to a “B-.”

Golden Ocean has been paying dividends to its shareholders since 1997. But the amount is variable, and there are times that it skipped a payment.

Shares are up 25% in the last 90 days and 114% over the past year. In fact, share prices are the highest they’ve been since 2015.

Again, these are just a few examples of investments that are paying a double-digit yield right now.

Among my results were also many dividend stalwarts that — even though they pay lower yields — are more predictable and solid. And even those companies pay out way more than a CD right now.

Best,

Kelly Green