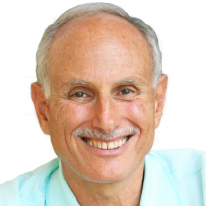

Martin D. Weiss, Ph.D.

| Weiss Ratings Founder

“Mr. Independence” — Forbes

“The only one with no conflicts of interest” — Esquire

“The first to see the dangers” — The New York Times

Dr. Martin D. Weiss is the founder of Weiss Ratings, the nation’s leading provider of 100% independent grades on stocks, mutual funds and financial institutions, as well as the world’s only ratings agency that grades cryptocurrencies.

He founded his company in 1971, and thanks largely to his strict independence, has established a 50-year record of accuracy that’s often the envy of competitors.

For example, the U.S. Government Accountability Office (GAO) reported that the Weiss insurance company ratings outperformed those of the nation’s largest insurance rating agency by a factor of three to one, while beating those of Standard & Poor’s and Moody’s by even wider margins.

The Wall Street Journal reported that investors using the Weiss stock ratings could have made more money than those following the grades issued by Deutsche Bank, Merrill Lynch, J.P. Morgan, Goldman Sachs, Standard & Poor’s and every other firm reviewed.

Barron’s named Weiss “the leader in identifying vulnerable companies,” while Forbes, The New York Times and many others have recognized Weiss for his strict independence and accuracy.

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.

Dr. Weiss began learning finance and economics from his father, J. Irving Weiss in 1959, and received his doctoral degree in cultural anthropology from Columbia University in 1984, specializing in economic anthropology and Japan studies.

In 2017, to better help investors in these volatile times, he returned from semi-retirement to re-assume his role as Weiss Ratings CEO, where he currently leads an international team of researchers, data scientists, stock analysts, and computer programmers.

As a teenager, Martin taught foreign languages at the Berlitz School on Wall Street and in Rockefeller Center, New York. Having lived in Latin America and Asia for nearly two decades, he is fluent in Portuguese, Spanish, Chinese and Japanese, among other European and Asian languages.