Last week, the Bureau of Labor Statistics (BLS) released February's consumer price index (CPI) data.

I'm sure you've heard the unfortunate news.

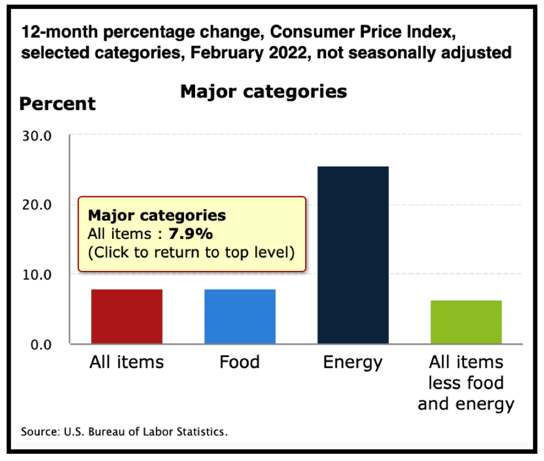

Inflation soared to a 7.9% year-over-year increase. Additionally, the index for all items less food and energy (because who needs those, right?) is at 6.4%.

I think we'll be dealing with heightened inflation readings or the foreseeable future.

And that's having a big effect on investor sentiment, which is looking increasingly bearish.

I wouldn't blame investors for hiding under their desks right now.

But … there's some good news.

A Bright Shining Horizon With a Yellowish Friend

There are plenty of hedges for inflationary environments like the one that investors find themselves in right now.

Commodities like metals, energy and crops are poised to continue profiting in these economic conditions.

- And one metal is looking particularly bright … gold!

In case you missed it, I've written about it here. And here. And here.

Historically, gold performs well against a weak dollar.

Gold tends to go up as the dollar goes down. And guess what? The dollar just hit its lowest point this week as investors gauge inflation and the Federal Reserve's reaction to it by hiking rates for the first time in three years.

But here's the thing: If you didn't hop in when I wrote about gold's promise three times since November 2021, it's just presented another … golden opportunity.

Here's a six-month chart:

That's one heck of a pullback!

- The red trendline indicates that we could see gold bounce from Friday's $1,930 level.

And considering the Fed's posturing lately — and the suggestion that as many as six more rate hikes might occur this year — there very well could be a path for gold to hit $2,200 per ounce … a level it hasn't seen since its all-time high in July 2020.

Does this undermine faith in the U.S. dollar?

Maybe.

But are we going to see inflation continue its ascent?

At least in the intermediate term. Longer term, we could see the U.S. dollar go higher for all sorts of reasons. But for now, it's headed lower.

- If you want to ride that cycle, look into gold-leveraged stocks.

And while we're on the topic of cycles …

One of the most important forecasts in the 50-year history of Weiss Ratings will be released next week.

I'll be sitting down with founder Dr. Martin Weiss to discuss the shocking economic cycles that we're about to enter … but far more important, your next steps to both protect and grow substantial wealth over the next two years.

Registration ends soon. To reserve your place for free, click here now.

Best wishes,

Sean