2 Strategies to Use When Investing & 5 Promising Projects to Consider

|

| By Jurica Dujmovic |

This week, I'm shaking things up.

Not much has happened in the past week that deserves our full attention. So instead of scouring Twitter (TWTR) for small-time crypto gossip, I've got two important investment strategies you should be aware of as in investor, as well as tools that will help you execute them.

Then I'll point out three projects that members of the Weiss Crypto Team believe to have the most potential in the current market.

The first strategy is one you should be familiar with from our recent Sunday Special: dollar-cost averaging (DCA). This is an irreplaceable method that crypto investors use as the first line of defense during tumultuous volatility.

It's a simple concept, but one that requires discipline and dedication:

By investing a fixed sum at regular intervals, an investor can smooth out the price fluctuations and avoid making impulsive decisions based on short-term price movements.

As can be the case with crypto, however, implementation can get a bit complicated, especially when you're targeting more volatile assets that can only be bought on decentralized exchanges (DEXes). Good thing, then, that our resident DeFi expert, Chris Coney, found a handy tool that automates the process for you.

With Mean.Finance, you can take a set-it-and-forget-it approach to utilizing a DCA strategy in DeFi.

(And if you're interested in learning more tips, tricks and facts about DeFi from Chris, I strongly recommend you check out his DeFi MasterClass.)

Mean.Finance did experience a white-hat hack recently — meaning a well-intentioned hacker attacked their system to find vulnerabilities. And find one they did!

Luckily, Mean.Finance addressed the issue quickly, and use of the platform has been restored. You can review the steps they took in their write-up of the event.

That brings me to my second strategy — research!

Savvy crypto investors don't just pick a crypto asset to invest in because some billionaire tweets about it. And they don't stake their hard-earned assets into any random platform. They make sure the crypto assets they plan on using are solid first.

Areas to look at include how much liquidity a project has, how strong its development team is, what the planned updates are and if it has a white-hat hacker incentive program (like Mean.Finance does), among many other factors.

Usually, this information can be found on a platform or project's website. You can also find and follow its official communication channels (e.g., Twitter, Discord Reddit, etc.).

Another tool to help in your research includes free online code-checkers — like Token Sniffer for the Ethereum (ETH, Tech/Adoption Grade "A") network — which run automated audits of token contracts to check if they contain any malicious code to protect you from scam projects.

OK, now that you know how to invest and how to vet your investments, I want to give you three of our team's favorite projects.

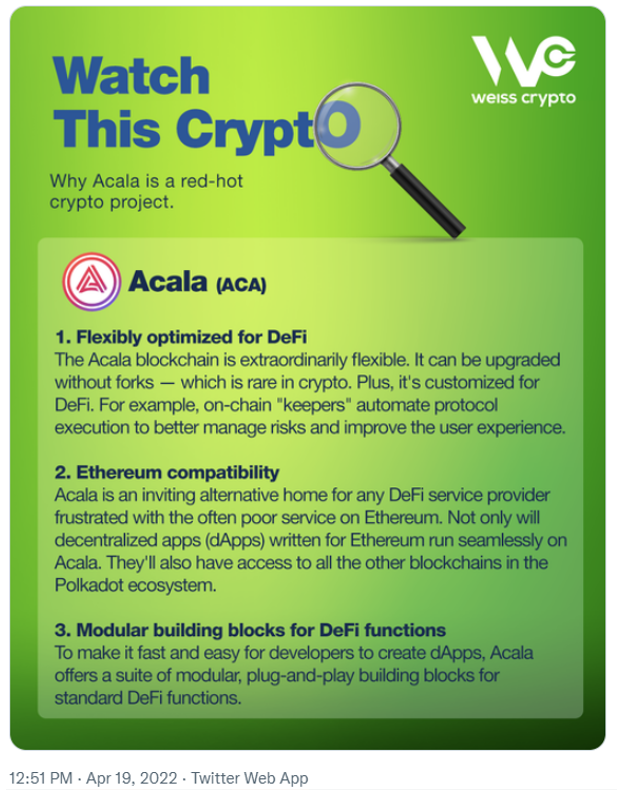

Project 1: Acala

This shout-out to Acala (ACA, Unrated) might've come as a surprise to some of you, as we haven't mentioned in here in our Weiss Crypto Daily issues. But Marija's Undiscovered Cryptos Members should be very familiar with it.

ACA is a Layer-1 smart-contract platform. Its main goal is to power liquidity, economic activity and stablecoin utility for aUSD — the decentralized, multi-collateralized stablecoin backed by cross-chain assets on the Polkadot (DOT, Tech/Adoption Grade "B") network.

You know how I feel about decentralization. So, I have to agree with Marija that an innovative and modular project that supports a decentralized stablecoin is one you should definitely keep your eye on.

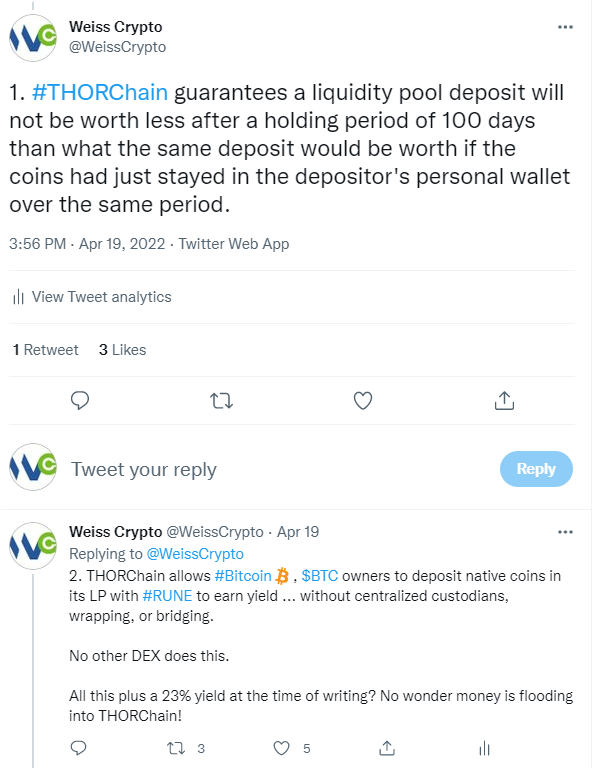

Project 2: THORChain

Next in line is THORChain (RUNE, Tech/Adoption Grade "B-"), a decentralized liquidity protocol. You've heard various members of our team talk about RUNE in the past.

Here's why we absolutely love it:

Interoperability is the future of crypto, as Juan Villaverde and Alex Benfield, editor and contributor to our Weiss Crypto Portfolio, said in an early Sunday Special. Mass adoption of DeFi can't happen until that becomes as easy and user friendly as centralized exchanges.

THORChain is steadily working to make that a reality. And when it does, it'll have the huge benefit of being the first.

I know I said I'd only have two projects for you. But honestly, no list would be complete without these three (click to read the full thread) ...

Needless to say, we've barely scratched the surface in that thread. And I'm definitely not telling you anything you likely didn't know already. After all, we've written about all three of these promising projects in our Weiss Crypto Daily issues.

But we're still just as bullish on all three in the long term, and I know our editors are looking forward to shedding even more light on these fan favorites.

So, stay tuned for that, as well as analyses on new projects, investment tools and strategies in the coming weeks!

Best,

Jurica Dujmović