|

| By Jurica Dujmovic |

June 2025 has delivered enough unexpected developments to keep even seasoned crypto veterans guessing.

For retail investors who've been riding this wild rocket ship, June offered a masterclass in what "mainstream adoption" actually looks like.

And it’s less moon-shot euphoria and a lot more spreadsheet-wielding institutions treating your favorite altcoin like just another line item in their risk management models.

So, let’s dive into the biggest curveballs the final month of Q2 threw our way.

Development 1: The Great Regulatory Thaw

The biggest story of June wasn't a price pump or a celebrity endorsement.

It was the way the U.S. Securities and Exchange Commission transformed from crypto's biggest villain … into something approaching a collaborative partner.

The agency that once treated digital assets like financial contraband officially dropped its high-profile lawsuits against both Binance and Coinbase.

Binance called the decision a "landmark moment" and thanked SEC Chair Paul Atkins for recognizing that innovation can't thrive under regulation by enforcement.

This wasn't just legal housekeeping.

The policy U-turn shows President Trump's campaign promise to be “crypto-friendly” has begun to materialize.

For retail investors who lived through the Gary Gensler era's aggressive enforcement campaigns, the contrast is jarring. And welcome.

But that was just the start.

Congress actually got its act together on crypto legislation.

The CLARITY Act recently cleared a few key House committees. Now, it’s heading to the House floor for a full vote.

Even more significant for everyday users, the Senate passed the GENIUS Act on June 17.

As my colleague Beth Canova explained on Tuesday, this bill establishes the first comprehensive federal framework for stablecoins.

Translation: Your USDC holdings might finally have the regulatory clarity they've desperately needed to interact with the broader TradFi market.

Development 2: Altcoin ETFs and the New Investment Frontier

Along the same vein, the ETF revolution continued its relentless march into increasingly exotic territory.

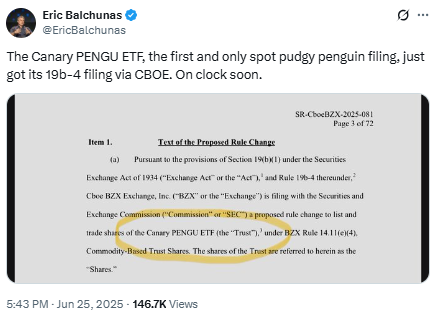

Bloomberg's Eric Balchunas dubbed this the "altcoin ETF Summer."

Sure enough, June delivered on that promise. Over the past month, we saw a regulatory approval frenzy that had asset managers filing applications faster than a DeFi protocol can mint new tokens.

XRP (XRP, “B-”) led the charge with actual results, not just applications.

Volatility Shares' plain-vanilla XRPI cleared $3 million in net assets within 48 hours of launch. After three weeks, it swelled to roughly $13 million.

Also approved was Teucrium's leveraged XXRP product, which ballooned to about $118 million this month.

Both reveal the serious amount of pent-up demand for regulated XRP exposure.

But many expect the belle of this ball to be Solana (SOL, “B”).

It has at least six major ETF applications from heavyweights like Grayscale, VanEck, 21Shares and Bitwise.

And this month, the SEC asked the applicants to include staking provisions and in-kind redemption mechanisms in their filings.

In all but words, that’s the SEC telling fund managers it wants these products to earn yield, not just hold tokens.

But the crown jewel of ETF absurdity had to be Canary Capital's filing for the world's first NFT ETF, centered around one of my favorite NFTs, Pudgy Penguins.

The proposed structure would hold 80-95% PENGU tokens and 5-15% actual Pudgy Penguin NFTs. Essentially, it would create a hybrid crypto fund/digital art gallery.

Whether this represents brilliant innovation or an elaborate publicity stunt remains to be seen. But it certainly captures the "anything goes" spirit of current regulatory sentiment.

Development 3: Big Tech Gains, Hard Tech Lessons

June's technological developments painted a mixed picture.

On the one hand, we saw an industry racing toward mainstream utility.

On the progress front, Circle launched USDC on the XRP Ledger.

This highlights the expanding multi-chain stablecoin ecosystem, which is already valued at $250 billion.

And, thanks to efforts like the GENUIS act, it’s expected to grow substantially. In fact, my colleague Juan Villaverde has dubbed this “Stablecoin Summer.”

XRP Ledger itself also saw changes. It rolled out protocol upgrades to enable new features like token escrows and improved DEX functionality.

In essence, it modernized its platform to better suit crypto needs in 2025, rather than 2012, when it was built.

We also saw progress in bridging crypto and TradFi this month.

Tron (TRX, “C+”) announced plans to go public on the U.S. stock market via a $210 million reverse merger with NASDAQ-listed SRM Entertainment.

Meanwhile, Coinbase confirmed its plan to gain SEC approval to offer blockchain-based trading of tokenized equities. Essentially, the centralized exchange wants to be the first to allow users to trade tokenized stocks around the clock.

On the other hand, however, we saw continued struggles with fundamental security challenges.

Iran's biggest centralized crypto exchange, Nobitex, was hacked for over $90 million.

The hacktivist group, Gonjeshke Darande — which translates to “predatory sparrow” in English — burned the stolen funds instead of stealing them. And in so doing, it created a stark example of geopolitical cyber-warfare in crypto.

Final Thoughts

Now, let’s cut through the noise.

Despite everything else — from volatile price action due to geopolitical conflicts and security hacks — June 2025 will likely be remembered as the month crypto's institutional transformation became official policy.

This will be the moment future generations will point to when asked when regulatory acceptance finally caught up to the correlation reality that had been building since 2020.

That comes with a few key benefits, like …

- More opportunities

- Easier access for new crypto users

- Increased liquidity in the crypto market

That said, it also means we’ll continue to see a higher correlation between crypto and the TradFi markets.

How this will impact crypto going forward remains to be seen. But we’ll keep you in the know as the next market developments roll out with our Weiss Crypto Daily updates.

Best,

Jurica Dujmovic