‘Genius’ New Approach to Crypto Already Paying Off

|

| By Dawn Pennington |

This was a big week for crypto.

Not just on the national stage, as cryptos got rocked after Israel and Iran traded strikes against each other Friday.

Across the world in the U.S., cryptos got a welcome midweek boost. That’s because the “Guiding and Establishing National Innovation for U.S. Stablecoins” Act advanced in the U.S. Senate with bipartisan support.

The “Genius Act” was a big topic at Bitcoin2025, which just concluded in Las Vegas.

That’s why I’m taking over today’s column. I was in the audience to hear from a wide array of political luminaries who shared their support of this and other forthcoming legislation.

And that support comes straight from the top.

Vice President JD Vance addressed a crowd of over 30,000 Bitcoin enthusiasts on May 28 in Vegas.

There, he said the “Genius Act” creates “a clear, pro-growth legal framework for stablecoins in this country.”

He also acknowledged what many in the crypto community have been struggling against for years:

Regulatory uncertainty. Stifled opportunity. And talent that found a home in more welcoming countries.

Vance also addressed a Justice Department’s 2013 initiative to “choke out” payday lenders, banks and other payment networks — like the cryptocurrency industry — considered as having a high risk of fraudulent activity.

“Operation Chokepoint 2.0 is dead and it’s not coming back,” Vance said.

“Let my words serve as its obituary.”

The broad market is already seeing the impact of this shift.

Bloomberg's Eric Balchunas has dubbed this as the Altcoin ETF Summer.

That’s thanks to the impressive number of altcoin spot ETF applications now sitting with the SEC.

As the regulatory quagmire clears, TradFi firms have grown more decisive in their approach to crypto.

But Juan Villaverde believes there’s a more appropriate moniker: Stablecoin Summer.

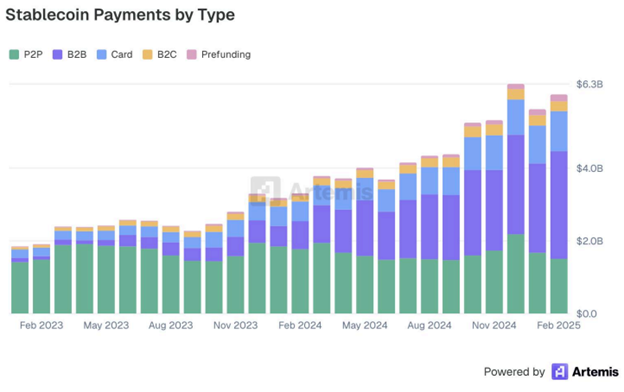

Marija Matić let you know that between January 2023 and February 2025, stablecoin transaction volumes soared to $94 billion.

And much of this surge is thanks to businesses, not retail users.

Business-to-business (B2B) payments jumped to 49% of all stablecoin activity.

And card-linked stablecoin spending more than doubled. Those reached $1.1 billion in February 2025, up from $543 million a year earlier.

This growth marks a transformation:

Stablecoins are no longer just tools for crypto traders.

They’ve begun their evolution into critical infrastructure for real-world finance.

Now, even retailers like Walmart and Amazon are looking into stablecoin payment opportunities.

It’s the dawn of a new era for crypto.

One that boasts a clearer regulatory environment … increased exposure for TradFi institutions … and expanding opportunities for investors like us.

Which is why I want to make sure you saw the gauntlet of great insights and actionable ideas your team of Weiss crypto experts prepared for you this week …

Israel/Iran Conflict Reveals Key Bitcoin Strategy

When a geopolitical crisis hits, investors flock to safe-haven assets.

And while gold has a more extensive history, Bob Czeschin reveals two charts that show Bitcoin may be the better bet.

Travel Tips to Keep Your Crypto Hackproof on the Go

At Bitcoin2025, we set a Guinness World Record on May 28 for the “Most Bitcoin Point-of-Sale Transactions in 8 hours.”

Vendors had all sorts of wares for sale.

Shirts. Art. Hardware wallets. Crocs. Chia Pets. Even the hotel’s cronut shop encouraged Bitcoin purchases.

But was that a good idea using the hotel’s Wi-Fi or 5G? Not according to your Weiss crypto experts.

On Tuesday, Bob shared four tips to help you travel while maintaining peak crypto security.

Be sure to read this before you spend some Satoshis on swanky souvenirs!

Altcoin ETF Summer Is Already Sizzlin’

Bitcoin ETFs demonstrated the pent-up institutional demand for crypto access. If altcoin ETFs follow a similar trajectory, we could see billions flowing into crypto.

Jurica Dujmovic breaks down which funds we’ll likely see approvals for first … and what’s next for this regulatory renaissance.

Ethereum Steals Bitcoin’s Institutional Thunder

BlackRock’s purchase of $500 million in Ethereum (ETH, “B+”) in the past 10 days is a flashing neon sign: ETH’s period of uncertainty may soon be behind us.

That’s not just good news for ETH. As Marija Matić explains, it’s bullish for the broad altcoin market.

Bitcoin Is Flying High; Be Careful Borrowing Against It

Cantor Fitzgerald and countless other companies — including banking giant JPMorgan — have begun to offer BTC-backed loans.

While increased institutional interest in crypto is bullish, using BTC as collateral comes with risk.

To avoid it, Mark Gough recommends you ask yourself these three questions before you leverage your Bitcoin.

But that’s all for this week.

To your health and wealth,

Dawn Pennington

Editorial Director