3 Massive Crypto Market Changes Happening Right Now

|

| By Jurica Dujmovic |

The crypto market is constantly evolving.

And as we move into the new year, I see three significant structural shifts happening.

Each on its own could remake the crypto landscape.

Together? They could determine whether crypto becomes core financial infrastructure …

Or whether it remains a speculative sideshow.

I’ll give a small spoiler: The latter outcome is highly unlikely.

Here’s why …

Shift 1: Banks Enter the ETF Market

Based on recent headlines around the CLARITY Act, you may think that banks hate crypto.

But you’d only be partially right.

As my colleague Marija Matić explained on Tuesday, banks are wary of any financial infrastructure that threatens their bottom lines.

But if they can get their piece of the pie, then a lot of that pushback falls away.

We saw this play out recently when Morgan Stanley filed with the SEC to launch spot Bitcoin (BTC, “A-”) and Solana (SOL, “B-”) ETFs.

This is bigger than just another product launch.

For the first time, a major U.S. bank decided it would rather be the house than pay rent to BlackRock and Fidelity.

The filing creates a vertically integrated model where Morgan Stanley can push its own crypto products through thousands of wealth advisors instead of watching competitors collect fees.

The timing makes sense when you look at the revenue potential.

Bitcoin ETFs attracted $58 billion in net inflows since January 2024.

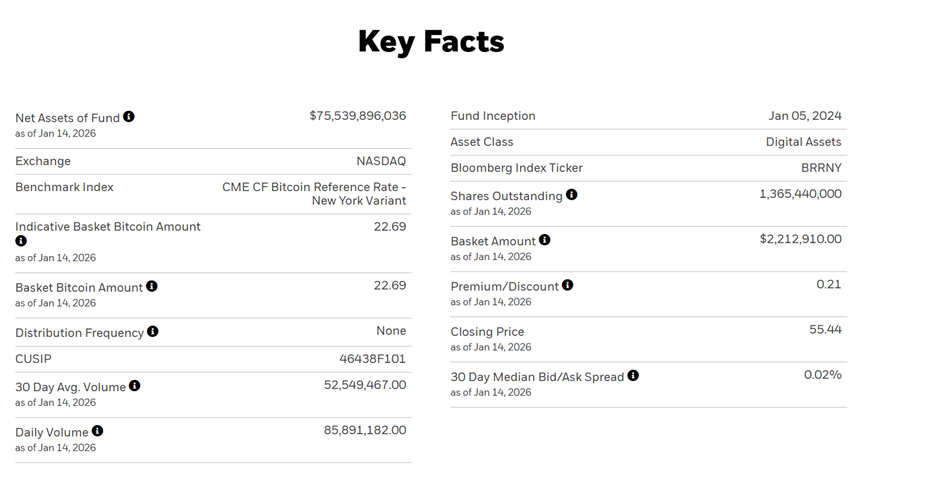

And BlackRock's iShares Bitcoin Trust ETF (IBIT) has become a case study in product-market fit.

In just 21 months, the fund generated $245 million in annual fees — enough to overtake legacy BlackRock funds, like the iShares Russell 1000 Growth (IWF) and iShares MSCI EAFE (EFA).

At $75.5 billion in assets, IBIT sits within a stone’s throw of the $100 billion milestone — a mark no ETF (that I know of) has ever reached this quickly.

For comparison, Vanguard's S&P 500 ETF took over five years to get there.

This is the kind of math that gets executive attention.

And data suggests it’s only going to get more impressive.

Research from TechRepublic indicates that 86% of institutional investors now have digital asset exposure or plan allocations. Of those, 68% invested or are planning to invest in Bitcoin exchange-traded products.

And that includes companies that see BTC as more than just a store-of-value asset.

MicroStrategy (MSTR) has led a wave of corporate treasurers using Bitcoin more strategically when it acquired 257,000 BTC in 2024.

This move established a $2 billion Bitcoin treasury strategy that's no longer treated as an anomaly.

As of right now, this approach is still concentrated among tech-adjacent firms. But institutional survey data suggests broader interest is building.

As companies explore crypto not as a trade, but as a balance-sheet and capital-structure tool, demand will rise.

In short, the adoption pattern has fundamentally shifted.

In past cycles, retail speculation drove price action. That created the wild swings crypto became infamous for.

Now, however, price action is driven more by institutions seeking regulated access through familiar investment vehicles.

Which is exactly as boring — and profitable — as it sounds.

Investor takeaway? Fewer moonshots, but more long-term, steady opportunities.

Shift 2: Infrastructure Adoption Scales Beyond Speculation

Last year, while everyone obsessed over Bitcoin price predictions, crypto quietly ingrained itself in TradFi infrastructure.

And it started with stablecoins.

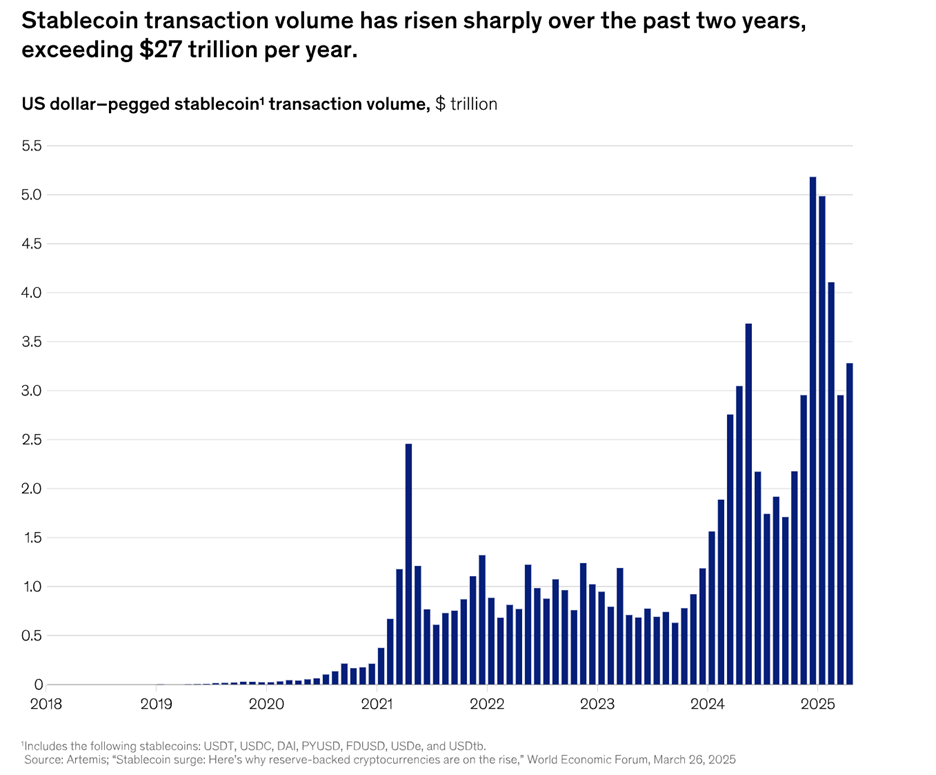

Transaction volumes reached $27 trillion annually, according to McKinsey analysts. And $4 trillion of that was just by July.

According to TRM Labs, that’s an 83% year-over-year increase.

These numbers represent genuine payment flows, not trading volume. That's the difference between infrastructure and speculation.

And it puts stablecoins on the same playing field as payment networks. Think giant transaction processors like Visa (V).

In fact, major payment networks see the writing on the wall. Rather than fight the shift, they’re joining it.

Visa, for example, expanded its U.S. stablecoin settlement program. Now, select issuers and acquirers can settle obligations in stablecoins rather than through traditional banking hours and rails.

Mastercard (MA) joined Paxos' Global Dollar Network, enabling stablecoins — including USDC, PYUSD, USDG and FIUSD — across its network.

When Visa and Mastercard both integrate your technology, you've officially outgrown your “experimental” phase.

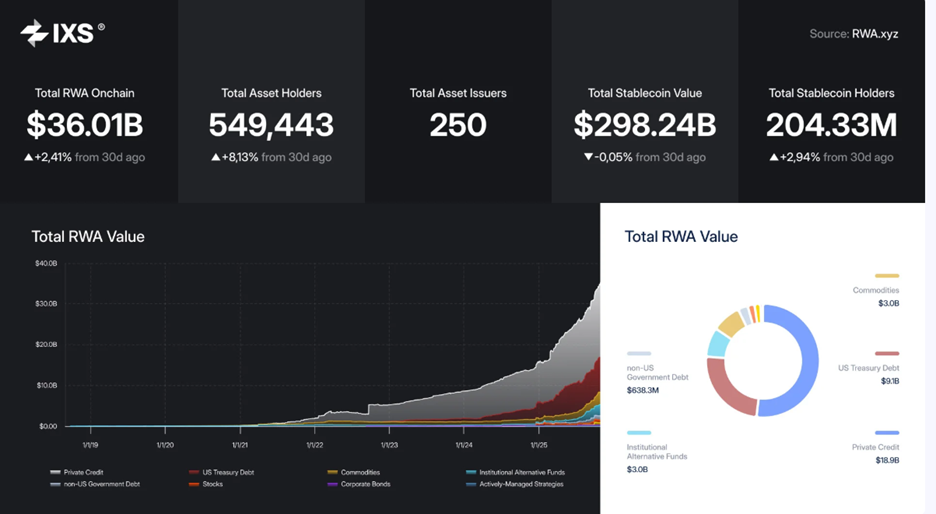

But as I said, stablecoins were just the start. Real-world asset (RWA) tokenization is the next step.

And it has already developed well past vague PowerPoint presentations.

Platforms like Ondo Finance (ONDO, “C+”) and Securitize offer tokenized U.S. bonds and structured products. Meanwhile, Maple Finance and Centrifuge pioneered tokenized credit pools where investors fund real-world loans.

Overall, the on-chain RWA market reached approximately $35 billion in late 2025.

Turns out putting traditional assets on blockchain — giving institutions crypto’s speed and 24/7 access — is popular when you can actually do it properly.

And that’s why this narrative — crypto infrastructure for TradFi firms — is changing the game.

Institutional capital will flow down the path of least resistance.

And with stablecoins and RWA projects building channels for even easier access, it’s not hard to see where the liquidity will pool.

Shift 3: Regulatory Divergence Creates Market Structure

After years of regulators approaching crypto like bomb squads examining suspicious packages, 2025 brought actual legislation.

The key here is that each governing authority is building its own regulatory infrastructure differently.

And those differences will have outsized impacts on what assets you can target and how you can include them in your strategy.

Take the European Union’s Markets in Crypto-Assets Regulation (MiCA), for example. It implemented comprehensive rules governing issuance, trading and custody.

Under MiCA, stablecoin issuers must secure e-money licenses and maintain segregated reserves, with Tether and Circle anticipating approval by Q1 this year.

Europe has essentially decided to treat stablecoins like they’re actual money, which is …kinda obvious to crypto natives.

The U.S. took a different path, choosing to focus on stablecoins first, then deal with a more comprehensive regulatory overhaul.

Last July, the GENIUS Act was passed to create the first comprehensive federal framework for dollar-backed stablecoins.

The CLARITY Act — which is in committee in the Senate as I write — takes things further. If passed, it will provide clear answers on what counts as a digital commodity, which governing agency is responsible for enforcement and how exchanges, brokers and developers should operate.

And its latest delay is all about passive yield on stablecoins. If the banks get their way, U.S. residents won’t be able to hold passive-income yieldcoins.

Related story: Yieldcoins Give More ‘Bang’ for your Buck

On the other side of the world, Hong Kong continues to position itself as the sensible middle ground between mainland China’s outright bans and Europe’s more open acceptance.

It recently enacted its Stablecoin Ordinance in August 2025. Under it, all stablecoin issuers must have a license and maintain specific minimum financial resources.

These divergent approaches create winners and losers. And which side a project finds itself on will depend on which jurisdiction it falls under.

Firms with strong compliance infrastructure gain market share in regulated jurisdictions. For projects willing to navigate multiple frameworks, regulatory arbitrage opportunities emerge.

The legal architecture has become a patchwork where clear rulebooks bring institutional capital by reducing uncertainty.

That is certain to elevate demand over the long term.

But that comes with a caveat: Compliance costs favor larger players who can afford legal teams in multiple time zones.

Gone will be the days when small-cap projects just suddenly make it big and learn as they go.

Instead, growth investors will need to see project launches with the right stuff to go the distance from the outset.

Bottom Line

In past cycles, changes in the macro outlook would fuel small shifts in sentiment. Liquidity would flow to a new sector for a while before rotating to the next hot topic.

But the three changes I outlined are deeper than a passing narrative.

They’re foundational.

And the ramifications are likely here to stay.

For investors, this means a new approach to crypto.

Gone are the days of hype. To make the most out of your crypto portfolio, you can’t just bet on the next narrative shift.

You’ll need to follow the big money.

And find the projects that help it flow the easiest with the greatest rewards.

Next week, I’ll show you how I do just that. And how I see these changes developing as we move deeper into 2026.

In the meantime, you may consider giving my colleague Juan Villaverde’s Weiss Crypto Investor a look.

In it, he uses his Crypto Timing Model to target the optimal entry and exit prices for long-term holds of crypto’s biggest coins.

Best,

Jurica Dujmovic