|

| By Dawn Pennington |

We just wrapped up the first full week of trading in 2026.

It was a crucial one in many ways.

On Jan. 3, the Trump administration captured Venezuelan strongman Nicolas Maduro and his wife in a military raid.

The Maduros have since been indicted in New York on federal drug trafficking charges, among others. Their next court date is March 17.

Not only did crypto react by immediately going up …

But someone made half a million dollars on Polymarket just as quickly.

According to the BBC:

“One account, which joined the platform last month and took four positions, all on Venezuela, made more than $436,000 (£322,000) from a $32,537 bet.

“It remains unclear who placed the bet. The anonymous account had a blockchain identifier of letters and numbers.”

Perhaps in another not-coincidence, you’ll recall the first Trump administration carried out a military operation on Jan. 3, 2020.

That day brought a drone strike that killed Iranian general and second most-powerful person in Baghdad, Qasem Soleimani.

Bitcoin rallied back then, too.

So, it’s not surprising to see Bitcoin once again acting as a safe haven amid geopolitical turmoil.

And it may have another opportunity to do that …

Several opportunities, if Trump makes good on his threats to go after Greenland, Cuba and Colombia next.

In the four-year cycle, 2026 is set to be a bear year for cryptos. But this bull isn’t going down without a fight.

Last year brought all-time highs for Bitcoin (BTC, “A-”), though global inflows into it fell some 35%.

In other words, that money flowed out of Bitcoin.

But that money STAYED in cryptos.

Last year, cryptos attracted some $47.2 billion in flows, nearly matching 2024’s high of $48.7 billion.

Which means select altcoins have benefited.

Altcoins are something we continue to be bullish on. And the analysts behind CoinShares’ 2026 forecast for digital currencies appear to agree with us.

They just declared this is “the year utility wins.”

But first, we see more downside in store.

Already this year, some $1.1 billion left Bitcoin ETFs, though JPMorgan suggests the worst may be over on that front.

Your Weiss Crypto Team continues to look for Bitcoin to bottom and then bounce.

For specifics on that time frame, you need look no further than Juan Villaverde’s Friday note to you.

Why This Weekend Is Crucial for Crypto Investors

Juan’s Crypto Timing Model pinpointed this past Friday and Saturday, Jan. 9-10, as the first important reversal window of 2026.

If crypto turns lower, Juan says we could see a sharp but relatively brief sell-off as month-end approaches.

But if the rally continues into late January, then the ultimate low is more likely to arrive in February.

Whether Bitcoin bottoms in January or February doesn’t change the big picture.

Which is that prices could go higher … perhaps much higher … into April.

Juan’s models currently don’t foresee a new all-time high for Bitcoin in 2026. But anything could happen.

Just look at China for one of the first “anything could happen” stories of the year.

China’s First CBDC Oil Purchase Is a Warning for Crypto

China has bought oil using its yuan since 2023. And now, to kick of 2026, it used its digital yuan to buy crude.

The ramifications of this move will ripple through the blockchain.

Speaking of Ripple …

Wall Street Makes a $40B Bet on XRP

We get more questions about Ripple (XRP) than perhaps any other coin in the cryptoverse.

Unlike memecoins and other fads that rose and flamed out just as quickly, Ripple has quietly built a regulated, enterprise-grade financial infrastructure.

One that now values XRP at some $40 billion.

This week, Mark Gough wrote to you about what that means for the XRP Ledger, the XRP token and the startup itself.

Yieldcoins Give More Bang for your Buck

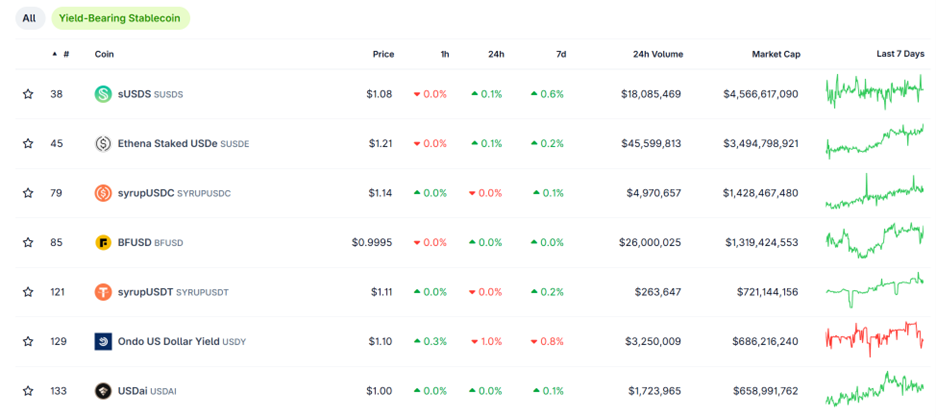

In her Crypto Yield Hunter publication, Marija Matic has her members in delta-neutral strategies.

In other words, no matter whether Bitcoin and its brethren are rising or falling …

She’s showing everyday people how to go for outsized crypto returns in yield-bearing stablecoins like the ones below.

While Bitcoin works to find its bottom, Marija’s yield-hunting strategies are a great way to stay active and in the markets.

Another great way to stay active in the crypto markets?

To read your Weiss Crypto Daily the moment we send it your way!

January is another anniversary around here. A good one!

We launched our Weiss Crypto Ratings eight years ago.

The cryptoverse has come a long way since then. Thank you for being part of this incredible journey with us.

Cheers to all the next steps we’ll take together in 2026 and, as a fellow HODLer, for a long time to come.

To your health and wealth,

Dawn Pennington

Editorial Director