|

| By Chris Coney |

In last week’s issue, I covered the exciting launch of GHO, Aave’s (AAVE, “B-”) new stablecoin.

If you recall, I suggested that the potential investing opportunity here was to become one of the first liquidity providers in a pool where GHO traded against a blue-chip cryptocurrency like Bitcoin (BTC, “A-”) or Ethereum (ETH, “B”).

Today, I have a similar opportunity to share with you … but without the market price risk.

You see, when trading one asset for another, it’s preferable to do it directly to minimize fees and to get the best exchange rate possible.

Put simply, the more steps you need to take for a trade, the more expensive it is.

Now, let’s use a conceptual example to illustrate what I mean.

In the image above, let’s pretend X, Y and Z are all brand-new stablecoins that have just launched.

To start, there are no markets for these stablecoins. In other words, there’s no way to trade them for anything else, so they are disconnected from the rest of the network.

If they want to get in the game, all they have to do is start trading against an asset that’s already part of the network.

Now, let’s pretend stablecoin Y has established a market where it can be traded for stablecoin W. This is indicated by the red line above.

After stablecoin Y is traded for stablecoin W, it can be swapped again and again. That means you can turn it into any other asset within the network.

If you want stablecoin W, then you’re all set after that one transaction, and you can trade it directly now.

But if you wanted stablecoin V, then your money has to complete two hops:

As you can see above, you have to convert your stablecoin Y into stablecoin W before you can turn it into stablecoin V.

Eventually, though, if enough people want to trade Y and V, then someone will create a market directly between them:

Now, the blue line shows Y and V trading directly against each other. So, we don’t have to go through W anymore.

But as you can see, X and Z are still outside the network.

What I have demonstrated here conceptually with the red and blue lines above are the opportunities currently open to liquidity providers.

When the GHO stablecoin first launched, it was just like our friend Y in the diagram — at first, it was all alone and had no one to trade with.

Then, it started to make connections. But it needs more … and now there’s a profit incentive for us to participate.

The 15% Opportunity

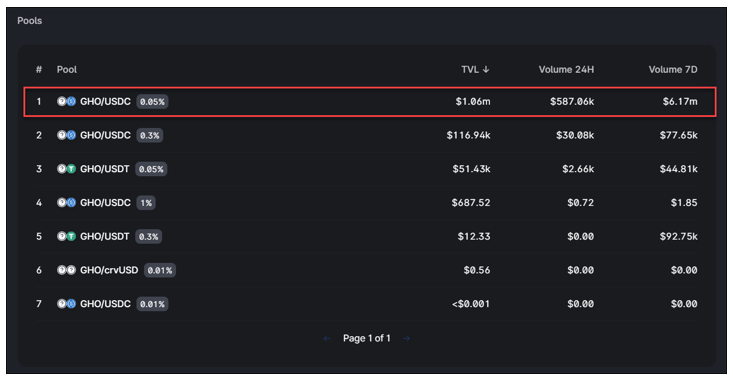

If you go to the Uniswap (UNI, “B”) analytics page right now, you will see all the liquidity pools involving GHO.

Turn your attention to the GHO/USDC pool I have highlighted in red.

That $1.06 million of capital has been turned over 5.8 times in the past seven days.

At a 0.05% fee, that works out to a weekly yield of 0.29%, or an annual percentage yield of 15.08%.

To achieve this yield, all you have to do is complete four simple steps:

- Take some of your dollars.

- Swap half into GHO and half into USD Coin (USDC, Stablecoin).

- Place those assets in the GHO/USDC liquidity pool.

- Earn a 15% annual yield with almost no price risk.

What Are the Risks?

This might sound easy enough, but what’s the catch?

Well, technically, the risks are that either one of the stablecoins loses its peg to the dollar … or the smart contract that runs either of those stablecoins gets hacked.

Although both scenarios are highly unlikely, I would be negligent to not acknowledge them.

However, it’s important to keep in mind that these risks exist across the entire decentralized finance universe.

So, I believe they have to be accepted in order to do anything DeFi-related, because there are bigger risks to worry about, like market volatility.

But that’s the big difference with this opportunity: It all but removes one of the biggest risks to your capital.

By holding all your capital in U.S. dollar-backed stablecoins, the 15% yield from being a liquidity provider can all go straight into your pocket.

So, when you exit your GHO and USDC positions, you should receive your principal back in full plus interest.

Why the Yield Could Be More or Less

Now, it’s important to note that this yield is dynamic, not fixed.

You see, the yield comes from fees paid by the traders who are trading one asset for the other.

So, the more volume that goes through the pair relative to the amount of capital in the pool, the higher the yield.

For example, if $1 million of capital stays in the pool and the volume doubles from there, then the annualized yield would go up to 30%.

Alternatively, if the volume is reduced by half, then the annualized yield would go down to 7.5%.

Either way, this important fact remains: Your capital value shouldn’t change, because it’s in stablecoins.

Even if we end up in the latter case and only make 7.5%, so what? We still made money instead of losing it.

And if we make 30% or better, then we’ll have family offices calling us up asking if we could manage their money for them.

The Step-by-Step Guide

While this opportunity and the concepts I’ve laid out here might be easy enough to understand, sometimes actually executing the steps can be daunting.

But I’m here to help you out. If you’d like to learn what exact buttons to press to take advantage of this opportunity — along with everything you need to know about extracting yields from liquidity pools — I recommend taking my 2023 DeFi Masterclass.

But that’s all I’ve got for you today. Let me know what you think about this 15% stablecoin opportunity by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.