Another Decentralized Derivative ‘Option’ for You

|

| By Bruce Ng |

We are headed for incredible volatility in the crypto markets.

Not just in the coming months, but in the coming days.

We have a potential interest-rate cut coming up. The U.S. Federal Open Market Committee is teasing the first rate cut after years of tightening.

And all actions, as we’ll see soon enough, have consequences, no matter how well-intentioned.

We also have the U.S. elections coming up.

My colleague Mark Gough already talked with you about how those can shape crypto’s short-term future. Starting with the fact that Juan Villaverde’s Crypto Timing Model shows an important low is expected on or around Election Day on Tuesday, Nov. 5.

Today I want to talk more about what happens after that.

That’s because, historically, the fourth quarters of Bitcoin (BTC, “A”) halving years are usually the most explosive.

All eyes, of course, will be on Bitcoin. But in this climate, I also expect investors’ interest in derivatives to skyrocket.

In crypto, most decentralized finance derivatives take the form of perpetual futures, aka perps.

Perps are like futures but with the following key features:

- They don’t expire. Instead, a maintenance “funding” rate is paid by traders with open positions.

- They offer leverage. Up to 100x leverage is usually allowed with perps.

- Their price is pegged to the underlying spot asset by means of the funding rate. When the perp price is higher than the spot price, longs pay shorts. And vice versa otherwise. You don’t have to understand this in detail, but the point is, the funding rate is a mechanism that pegs the perp price to the spot price.

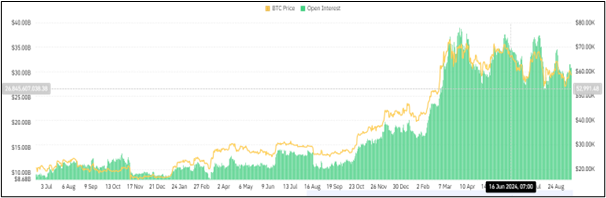

Just like in traditional futures markets, a key metric to watch is open interest.

Open interest is a measure of sentiment. When it goes higher, that means more money is coming into that market.

For example, Bitcoin’s open interest has risen dramatically since mid-2022. Just two years ago, it was at $10 billion. Bitcoin open interest is at $30 billion today.

I also find that open interest tends to peak in times of increased volatility.

Now, a plethora of decentralized perp protocols have emerged in DeFi since the last cycle of 2020.

Perp protocols allow you to trade these derivatives on large leverage in a decentralized way.

They are the derivatives version of their tamer cousins, the decentralized spot exchanges (DEXes), e.g. Uniswap, Sushiswap, etc.

The good (or bad) thing about perp protocols is that they are somewhat like gambling casinos.

Liquidations of leveraged positions always occur in high-volatility periods. And these liquidation proceeds go to the market-makers.

If you are on the correct side of the house, you stand to profit.

This makes perp protocols a highly viable investment irrespective of whether the market rallies or dumps.

As long as traders are losing money, these perp protocols will make money.

Today’s Most Profitable Perp Protocols

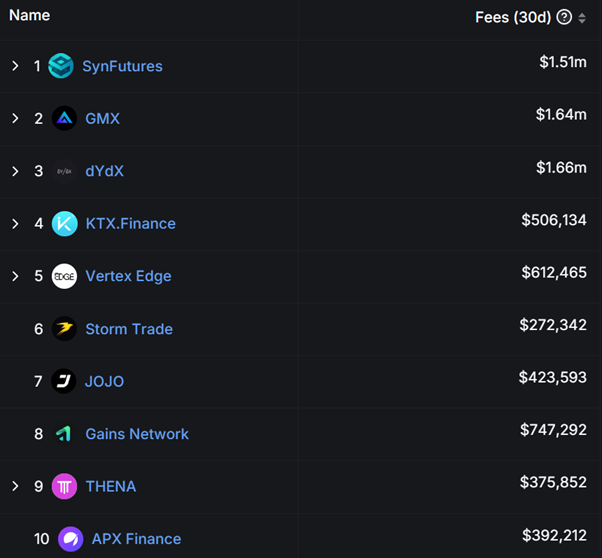

Here, we take a look at the top 10 perp protocols by fees generated.

Figure 2 shows the top 10 perp protocols in 30-day fees.

Also, it’s important to note that fees and revenue are different things:

- Fees: What users pay.

- Revenue: The portion of fees that go to the protocol treasury, tokenholders and liquidity providers (i.e., the house).

No need to worry about revenue now unless they distribute it to tokenholders. Unfortunately, most projects do not.

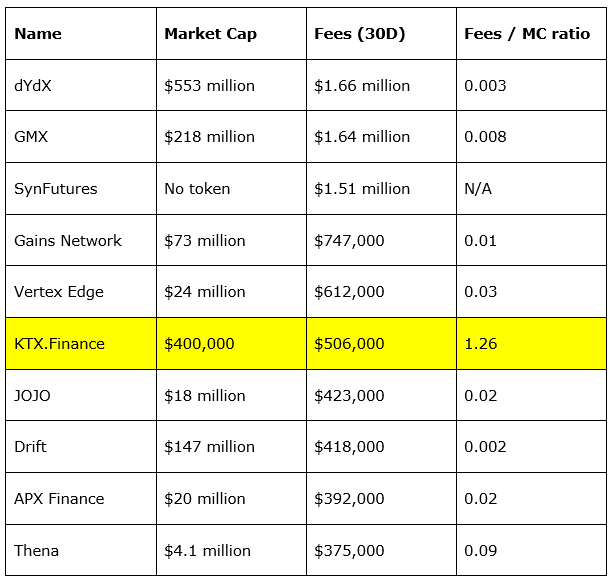

Now, let’s measure fees gained, divided by the market cap of the protocol.

It’s a measure of how much the protocol punches above its own weight.

After all the number-crunching above, one perp DEX stands out like a sore thumb, KTX.Finance.

It beats the rest of the perp DEXes by a factor of 100 or more.

While that is incredible, it also is a call for more research to vet if this is an opportunity that’s too good to be true.

If you’re interested on learning more about KTX.Finance, tag @WeissCrypto on X.com — formerly Twitter — and let me know. I may take an in-depth look for a future Weiss Crypto Daily update.

Meanwhile, take a look at Drift (DRIFT, Not Yet Rated).

My colleague Mark laid out the case for you last week why we’re about to see a “Binance moment” for DeFi derivatives … and why he believes Drift could capture 10% of this new but exploding marketplace.

In our New Crypto Wonders publication, Juan Villaverde and I do a more thorough analysis on protocols like these.

When considering the DeFi sector for example, we will split it into the following categories:

- Derivatives (as we covered here)

- DEXes

- Lending

- Collateralized Debt Positions

- Liquid Staking

- Liquid Restaking

And much more. Then for each category, we identify the strongest projects using metrics like total value locked, price/earnings ratios, etc.

Then for projects with the best metrics, we do a deeper dive into them, considering factors such as …

- Is the team anonymous or public?

- What are the security audits that the project has been approved for?

- What is the ratio of the current market cap to fully diluted value?

- What are the tokenomics like? Who owns how much? How fast do the tokens inflate etc.

To really separate projects with strong promise from the protocols that will fade with the next bear market, investors should be able to sort through data like this.

It may even be useful to keep a list of questions to answer when vetting your next potential crypto investment.

Or you can learn more about our New Crypto Wonders publication.

We consider all these factors and then some before adding anything to our model portfolio. And we utilize Juan’s Crypto Timing Model to help us identify the best times to jump in — and out — of an opportunity.

You can click here to read about how it all works.

Best,

Dr. Bruce Ng