Crypto’s Crazy End to August Paves Our Path Forward

|

| By Beth Canova |

The Wild West days of crypto may be fading into history.

But the market’s infamous volatility is still alive and well.

Last week, Federal Reserve Chair Jerome Powell’s Jackson Hole speech sparked a nice rally when he alluded to coming rate cuts.

But almost immediately after, Bitcoin (BTC, “A-”) corrected hard. And it brought much of the crypto market with it.

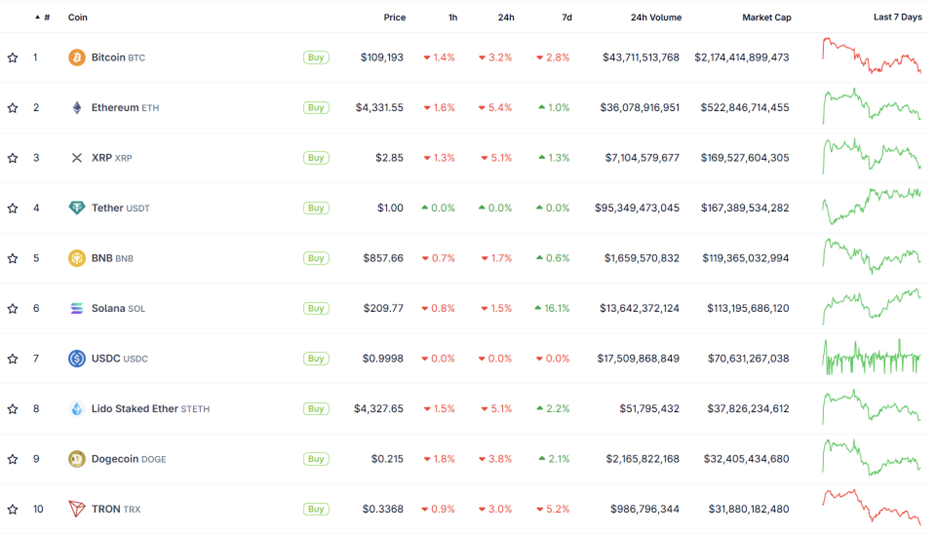

While Bitcoin remains sluggish, however, most of the other top cryptos by market cap are up over the week.

DeFi expert Marija Matic reviewed the on-chain metrics. And she found 4 Realities Revealed in This Weekend’s Market Madness.

All together, they set the stage for altcoins — that is, crypto other than Bitcoin — to run. According to her, flushes like this shake out leverage, clear the decks and often mark the start of cleaner moves ahead.

Still, investors should exercise caution. As tech expert Jurica Dujmovic points out in his latest update, the threat of centralization could greatly impact how the market moves forward.

He says It’s What Happens When Companies Become Bitcoin Banks.

More companies are taking a page out of Strategy’s (MSTR) book. They’re loading up their treasuries with Bitcoin and select altcoins.

In a bull market when things are trending up? This institutional interest can accelerate rallies in a way never before seen in crypto.

But it also means more coins are consolidated in the hands of a few participants. Which means more volatility in uncertain times.

That’s not to say Bitcoin’s best days are behind.

In fact, cycles expert Juan Villaverde Says Bitcoin’s Pullback Is Temporary.

In his latest update, he breaks down what his Crypto Timing Model sees coming over the next few weeks. And he dives into the fundamentals behind this correction … and why his outlook of a bullish Q3-Q4 remains intact.

Zooming out, there’s another bullish catalyst at work: A Megatrend So Intense, It Can Fuel BTC Growth for Decades.

Megatrends like this one have contributed to some of the greatest profit opportunities in history. And this one isn’t a theory. Time will prove it an inevitability.

Which is why Bob gives you two ways you can play the coming run: by loading up on BTC … or targeting quality altcoins likely to outperform.

But knowing what assets to target is only half the battle. Knowing when to deploy your capital is the key to maximizing your success … and minimizing downside volatility.

That’s why Bob Czeschin broke down the historical data and on-chain metrics to help you Find the Best Time to Buy and Sell Crypto.

Not every hour of the 24-7 market is equal when it comes to optimizing your trades. Fortunately, Bob’s latest update can help you target the best day, month and even hour to act based on your strategy and goals.

But that’s all for this week. Be sure to check your inbox tomorrow for our next Weiss Crypto Daily update.

Best,

Beth Canova

Crypto Managing Editor