|

| By Jurica Dujmovic |

If June turned up the heat, July brought the sizzle.

It delivered the kind of action that reminds investors why crypto never fails to surprise.

Between Bitcoin (BTC, “A-”) casually shrugging off a historic $9 billion liquidation like it was pocket change and Congress actually passing helpful crypto legislation — yes, you read that right — this month has given us much more than mere price action to get excited about.

So, let’s dive into my top highlights …

Bitcoin: The Honey Badger Strikes Again

Naturally, we’ll start with the star of the show.

Bitcoin reached fresh heights above $122,000 on July 14.

Right after, it faced what should have been its kryptonite: an 80,000 BTC sell-off from long-dormant wallets.

This was the largest single sale in crypto history, where $9 billion worth of digital gold hit the market all at once.

Such a sell-off could have pushed BTC well off its shiny new high.

Instead, Bitcoin showed incredible resilience. Investors gave a collective shrug and adopted a "buy the dip" mentality that would make Warren Buffett proud.

Bitcoin briefly dipped, then bulls (mostly institutions) stepped in like they were shopping at Costco during a flash sale.

As of writing, BTC sits pretty near $118,500.

For all the skittish new entrants to the crypto community, this move proves once again that in crypto …

- Good news is priced in.

- Bad news is bought.

- And truly catastrophic news? Well, that's just a Tuesday.

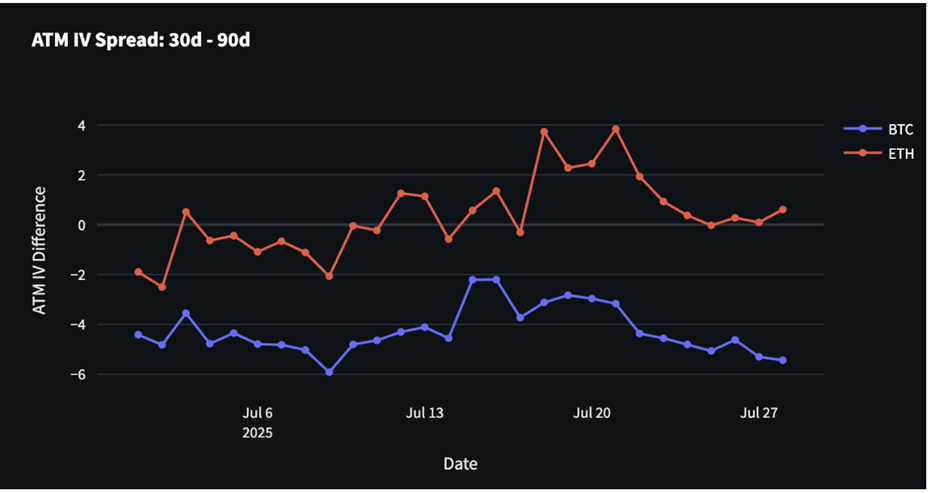

Perhaps more telling was Bitcoin's mature reaction to volatility.

The 30-day volatility fell to around 36%. Those are practically hibernation levels by crypto standards.

For context, this is the same asset that once moved 20% because Elon Musk changed his Twitter bio.

The honey badger is growing up, folks.

Ethereum Finally Gets Its Due Respect

While Bitcoin was busy being Bitcoin, Ethereum (ETH, “A-”) decided July was its time to shine.

ETH strung together 13 green days out of 15, climbing to about $3,900. That’s its highest price since early 2025.

The catalyst? A perfect storm of institutional FOMO and regulatory clarity.

U.S. spot ETH ETFs saw their largest-ever single-day inflow at $3.1 billion. And if that wasn’t enough, 17 consecutive days of inflows followed right after.

Meanwhile, the new SEC Chair Paul Atkins finally put an end to years of speculation by stating what everyone already knew but was afraid to say out loud: "ETH is not a security."

The Great Altcoin Awakening

A strong Ethereum and resilient Bitcoin can only mean one thing: Altcoins can finally shine.

July brought whispers of that magical time every altcoin holder dreams about: "altcoin season."

We’re not in full altcoin season yet. But Bitcoin dominance dropped 5-6% from its peak, clearing the way for the strongest projects to rise above the crowd as traders wasted no time rotating into higher-beta trades.

A chunk of that liquidity landed in Solana (SOL, “B”), which has been a market leader for much of this bull cycle.

It saw an 8% single-day spike. That’s its biggest move in nearly a month.

SOL benefited from …

- Rumors of ETF inclusion,

- The launch of the first U.S.-based SOL ETF with staking,

- Rising DeFi TVL, and

- General market sentiment that maybe, just maybe, there's room for more than one blockchain in this space.

But the real star was Hyperliquid (HYPE, “D”).

This token is not yet available to U.S. residents. But that hasn’t stopped it from conquering a remarkable ascent!

After leading markets with a 24.7% gain in the second week of July, HYPE kept the momentum rolling.

The platform's cumulative trading volume blew past $1.6 trillion. Those are numbers that would make some centralized exchanges jealous!

When Nasdaq-listed companies start buying your governance token for their treasury, you know you've moved beyond "just another DeFi experiment."

SOL and HYPE are the standout projects.

But investors should also keep an eye on which sectors are receiving more love — via liquidity — than others.

That will help us narrow down projects more likely to outperform as we move forward in this bull market.

And the DeFi space is of particular note. It showed remarkable maturity in July.

Trading volumes on decentralized exchanges hit all-time highs. In fact, they captured 27.9% of total crypto spot volume.

But the star of this sector for July? Arbitrum (ARB, “C”).

This Ethereum Layer-2 had a breakout moment with $1.9 billion in net inflows via cross-chain bridges during one week alone.

That's more money than many smaller countries see in foreign investment in a year! And it all flowed into an L2 network that didn't exist four years ago.

More surprising, however, was the comeback that no one saw coming: Non-fungible tokens.

A darling of the last bull market, these crypto curiosities faded into obscurity in this cycle. But just when everyone had written them off, they staged an unlikely return.

NFT’s market cap jumped 94% to $6.6 billion, with weekly trading volumes topping $136 million.

CryptoPunks led the charge with a 53% price increase, culminating in GameSquare's $5.15 million purchase of CryptoPunk #5577 — paid for in company stock.

The sale proved that even in 2025, owning a pixelated character still carries social status.

As one DappRadar analyst put it: "Owning a Punk is about status, and right now that status is trending."

In other words, digital flexing is back!

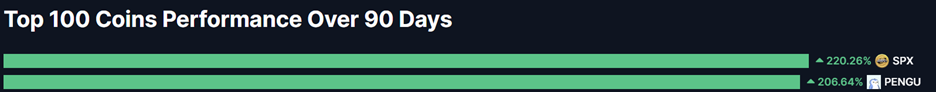

Meanwhile, Pudgy Penguins (PENGU, “D-”) — the NFT project I clocked in 2023 and have written about more recently — is the second largest gainer over the past 90 days.

That’s across all altcoins!

It’s soared over 206% in that time, leaving even coins like HYPE behind.

Regulators: The Plot Twist Nobody Saw Coming

Here's where July got really weird: Regulators started to (almost) make sense.

Congress spent a historic week in July hammering out three major crypto bills. The goal was to regulate stablecoins, clarify which tokens count as commodities and block a U.S. central bank digital currency, or CBDC.

Related story: The 3 Threats of CBDCs and How to Mitigate Them

I already covered the Washington’s whirlwind crypto week. If you haven’t read up on that yet, I suggest you do now.

Because the regulation passed could unleash a new wave of institutional investment and innovation on American soil.

But first, we have to let the politicians have their fun.

This push for clearer regulation wasn’t contained to just the U.S. For example …

- Europe continued to implement MiCA and

- Even traditionally cautious jurisdictions started experimenting with digital assets.

Seems like crypto is finally getting the appreciation and global adoption it wanted.

Whether that’s good or bad (and why) is a story for a different time.

Security: The Price of Innovation

Not everything was rosy. July reminded everyone that crypto's Wild West days aren't entirely behind us.

Crypto exchange BigONE suffered a $27 million hack through a hot wallet exploit. Another exchange, WOO X, lost $14 million to a phishing attack that compromised internal systems.

The silver lining? Both platforms vowed to compensate the affected users and the market barely flinched.

August and Beyond

As we head into August, the question isn't whether crypto has legitimacy.

We’ve seen in July that crypto is now too big and too powerful for governments and TradFi institutions to brush off.

The question now is how fast those entities can adapt to adopt crypto.

With corporate treasuries loading up on Bitcoin and Ethereum, spot ETFs seeing record inflows and regulators actually trying to help, the infrastructure for mainstream adoption is falling into place.

But August brings its own set of catalysts to watch.

The White House crypto policy report from Trump's working group is expected imminently. And it could either accelerate the regulatory momentum … or pump the brakes.

Meanwhile, several Bitcoin ETF proposals have decision deadlines in late August and September. Any early approvals could be major upside catalysts.

July was the month when everything clicked.

Technology matured, regulations clarified, and institutions finally got comfortable.

Now that the foundation is solid, the real question becomes what gets built on top of it. If crypto's track record tells us anything, it's that the answer will surprise everyone.

With that said, August is at our doorstep.

So, buckle up; it's going to be a wild ride.

Best,

Jurica Dujmovic