|

| By Jurica Dujmovic |

Over the past two weeks, I made the case that the AI bubble has already begun to quietly deflate.

And I showed you the warning signs to watch for in three different tiers of AI investments.

But it’s not the only yellow flag waving in the wind.

Today, I want to dive into the bubble behind the AI bubble: AI datacenters.

The Math Behind AI Infrastructure Doesn’t Add Up

Dozens of modern AI datacenters are sprouting up around Dallas. These centers are the physical infrastructure behind the dazzling “chatbots that think,” “models that code” and “agents that act.”

But behind the hype lies a sobering truth: To stay viable, these massive facilities must generate near-miraculous profits.

And many industry watchers now believe the math doesn’t add up.

Hedge-fund manager Harris Kupperman (Praetorian Capital) laid out one of the clearest warnings.

In an August 2025 essay, he estimated that “AI datacenters to be built in 2025 will suffer $40 billion of annual depreciation, while generating somewhere between $15 and $20 billion of revenue.”

He concluded that the industry would need roughly $320-$480 billion of revenue in 2025 just to break even.

Kupperman argued that, given current cost structures and hardware refresh cycles, the financial model for large-scale AI infrastructure does not yet make economic sense.

This isn’t just speculative talk. Public disclosure from large AI companies confirms it backs it.

Oracle Corporation — a major cloud and AI infrastructure player — reportedly booked around $900 million in GPU-server rentals in a quarter. But it only managed $125 million gross profit — a margin of about 16%.

Oracle may promise 30%—40% margins by the end of the decade. But for now, the numbers tell a humbler story: AI infrastructure is still a low-margin, high-cost business struggling to scale profitably.

But don’t mistake this for just a problem for AI investors. This nascent industry’s struggles are hitting Americans right in the wallet.

Already, average Americans have felt the impact in their utility bills.

These datacenters consumed more than 4% of the U.S.’s electricity in 2023. That’s expected to rise to 12% in just three years. And according to government analysts’ estimates, that will increase to as much as 12 percent in just three years.

Why the Economics Are Brutal

1. Rapid obsolescence.

Kupperman originally assumed a ten-year life for such datacenters. But after speaking with industry insiders, he revised: “Based on my conversations … the physical datacenters last for three to ten years, at most.”

The reason: Technology upgrades come fast. Meaning capital investments are written off quickly.

2. Massive up-front cost and relentless depreciation.

Kupperman estimated $40 billion annual depreciation from 2025’s build-wave, just for the first cohort. Much of that is the GPUs themselves, specialized cooling infrastructure, high-performance interconnects and power systems.

3. High operational costs.

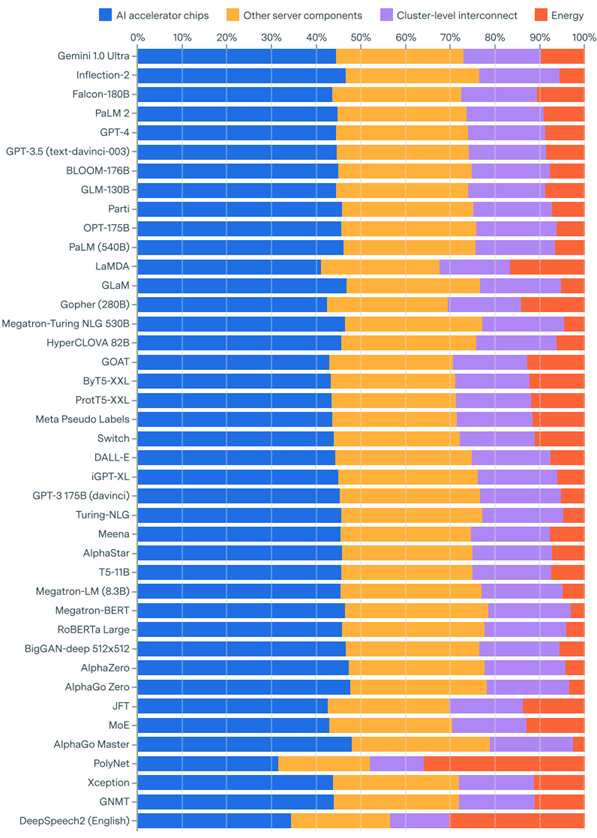

Beyond chips, the power bills and operational overhead are enormous. In one research paper, hardware and server components made up 15%-22% of training costs, interconnect represents 9%-13% and energy 2%-6%.

But those numbers scale quickly when you build entire datacenters.

4. Revenue expectations versus realistic pricing.

Kupperman pointed out that if AI datacenters assume a generous 25% gross margin, they would still need $160 billion in 2025 revenue just to cover that $40 billion depreciation.

But with the assumed actual revenue closer to $15-$20 billion today, those datacenters could be off by nearly an order of magnitude.

5. Competitive pressure and price compression.

With many players racing to build capacity — including hyperscalers, cloud providers and colocation firms — prices for GPU hours are under pressure. Margins may improve with scale, but only after large build-waves are operational and utilization is high.

A Race Without a Clear Finish Line

Imagine a facility built in 2025 …

It is capital-intensive, consumes megawatts of power, uses cutting-edge GPUs and has to perform at near-perfect utilization just to break even.

Now scale that across hundreds of such facilities globally, as many expect the AI infrastructure boom to proceed, and you can see the problem.

The revenue to support that scale is far from guaranteed.

Kupperman extended his analysis beyond a single year, noting that when you combine the buildouts of 2024 and 2025, the industry would need roughly $1 trillion in total revenue just to reach breakeven.

And it would need several times more to earn a meaningful return.

The required revenue curves are near-vertical. There is no gradual ramp-up; You either grow very fast or you face a margin death spiral.

Oracle’s internal documents further underscore the peril.

Margins of 14%-16% on AI infrastructure compare poorly with the 70% margins seen in legacy cloud business. That massive delta reflects the nascent economics of AI vs. the maturity of general cloud services.

So, Is It a Bubble?

Harris Kupperman argues that the economics of AI infrastructure simply don’t pencil out: the capital costs are too high, the hardware ages too fast and the revenue base is too thin to sustain trillion-dollar buildouts.

His warning focuses on the balance sheet.

My own take looks further up the stack.

The correction he describes at the datacenter level is already rippling through the broader market. As I wrote recently (here and here), this isn’t a bubble waiting to burst. It’s one deflating in slow motion.

It’s draining excess from overfunded startups even as the hyperscalers keep building.

Other analysts share a similar view.

The Bank for International Settlements notes that today’s tech leaders remain profitable and liquid. S&P Global expects consolidation, not contagion.

In that sense, Kupperman and I are describing two sides of the same phenomenon: One financial, one structural.

But both perspectives suggest an industry whose growth curve is bending under its own weight.

Why This “Insane Profits” Story Matters

For investors, executives, policymakers, and the public, the stakes are large.

If AI datacenters require ten- or hundred-billion-dollar revenue thresholds just to break even, then mistakes in timing, pricing, market adoption or technical change can destroy value at scale.

For tech companies, over-building capacity means prolonged negative returns and risk of asset write-downs.

For governments, subsidizing infrastructure or permitting enormous use of energy may create stranded assets if the revenue side falters.

For the broader economy, if AI infrastructure pledges fail to deliver expected productivity gains or monetization, the risk is not just to one company. The contagion may spread to others quickly.

When the Future Runs on Debt and Electricity

When you hear about “AI is everywhere” and “datacenters will power the next industrial revolution,” I hope you’ll pause for a moment and recognize a humbler reality …

Massive machines are burning through capital, energy and time to race against obsolescence. All the while, the companies footing the bill pray for revenues to catch up.

This isn’t to say AI is dead. Far from it.

The story of the AI era is still being written. However, the build-first, profit-later model many have adopted may be a gamble few can afford.

And that could mean fewer winning opportunities for investors like us.

So be sure to check out the warning signs I laid out last week to evaluate your favorite AI play for yourself.

Because it looks like this industry is in for a bumpy ride.

Best,

Jurica Dujmovic