The Problem With Gold (and Gold-Backed Cryptos)

|

| By Jurica Dujmovic |

As I write this, Russia is starting military operations over Ukraine. Today’s attack, which started before dawn in Europe’s second-largest country by land mass, shook the world and the markets to their core.

If you want a good recap of how we got here and the near-term impact, check out my colleague Marija Matić’s latest column: Should Bitcoin Fall With the Rise of Geopolitical Tensions?

Bitcoin did pull back this week as tensions escalated. It even fell below $35,000 once in the last 24 hours, and the majority of other cryptos followed it lower.

- While all eyes were on Russia and Ukraine, something else unthinkable happened that impacts the crypto crowd.

China took a cue from Canada and barred crypto fundraisers.

You read that right: China wants to jail people who raise funds via crypto. How the tables have turned!

We will keep our eye on that situation and report back.

In the meantime, let’s look at some other recent events that are reverberating through the cryptosphere.

- Last week was a sign of things to come.

We could see the dark clouds amassing on the horizon when gold-backed stablecoins started gaining attention as a safe haven.

Going all-in on gold is a typical pre-war knee-jerk reaction.

- This latest move shows that investors have fallen behind in their understanding of the risks involved in owning assets under custody.

Here we see Canada providing a clear example of why owning assets, such as these centralized stablecoins, may not be the solution many believe it is:

However, if the recent past has taught us anything, it is that all these measures have limited effectiveness.

- Think of crypto like water — it flows above and around the regulation.

So, it can easily find cracks that allow people to rightfully use their hard-earned assets:

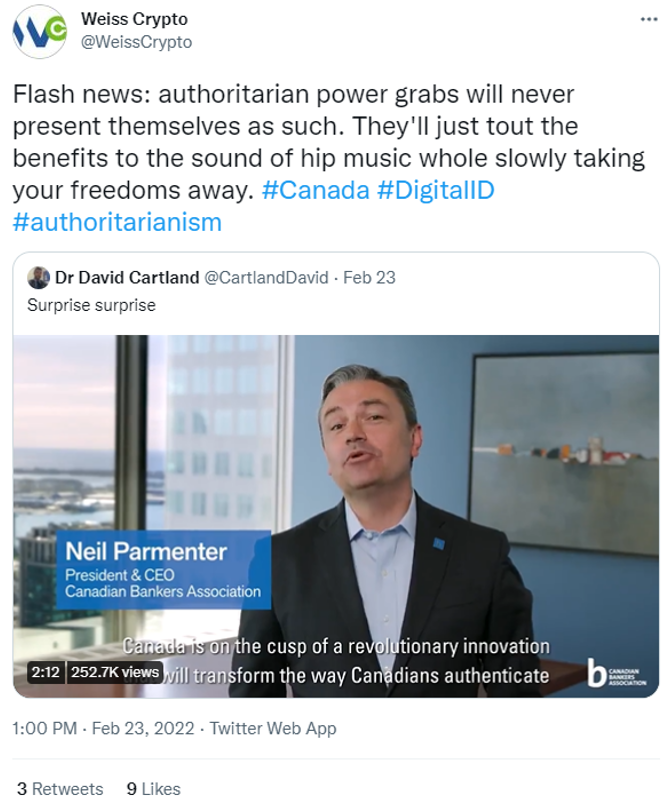

The true value of crypto will be made even more obvious with the global introduction of Digital IDs — the ultimate tool of government surveillance and financial control.

For now, only Canada is audacious enough to introduce them.

There is a glimmer of hope — Sen. Cynthia Lummis (R-Wyo.) is working to pave the way for Bitcoin in her state as well as throughout the United States.

This “Senate Crypto Queen” wants to create a federal self-regulatory body for cryptos as part of a broader digital-asset bill she hopes to get passed this year. That includes consumer protections and minimal regulations, modeled after her home state’s approach.

Although I’m a bit skeptical about her chances, I commend her work and effort.

It’s not just Sen. Lummis who “gets it.” In nearby Mexico, another senator is working on an even bolder bill:

As global tensions escalate, not much has changed for crypto other than a temporary downtick in prices.

- Crypto still fights an uphill battle with a world gone authoritarian.

Of course, like in any good movie, the bad guy fights dirty and claim the hero is actually a villain.

Crypto is dirty, they say.

Drugs, trafficking, illegal weapons — it’s all crypto.

In this war, crypto will facilitate even more abuse, they say.

- So let’s put some things into perspective for all the doubters.

Aside from the Ukrainian crisis, where 57 have been reported dead so far, there are currently four major wars and 18 conflicts going on globally. Those have amassed a death toll around 6 million.

That doesn’t even count 21 minor conflicts with roughly 100 to 1,000 deaths each.

- An overwhelming majority of this suffering has been funded by the illegal use of fiat money.

Nor do those numbers reflect the drug, weapons and sex trafficking that thrive during wartime.

This we know for a fact has been going on since the inception of fiat money.

However, all of this gets ignored to twist the logic and demonize crypto.

In this dark cloud of bad news, it’s hard to find the silver lining. But my colleague Alex Benfield is confident that crypto adoption just inched that much closer.

Bottom line: It’s fun to play the armchair general and to discuss the price action during calamities. But your best move right now is twofold …

First, give the politicians some time to work together toward de-escalating the tensions.

Second, this is a good time make your shopping list of what you want to invest in when it’s clear that cryptos are going higher … and are set to keep going higher.

In other words, if you are holding crypto right now, stay long and stay strong. And if you are eager to get in (or get back in), wait for our signal.

Stay tuned to this space, and stay safe.

Jurica Dujmovic