|

| By Nilus Mattive |

There are plenty of stocks still worth buying and holding out there … the same types of conservative, dividend-paying companies I’ve specialized in for more than 25 years.

But there are far more groups to hate right now …

Whether you’re talking about tech firms trading at some of the most ridiculous valuations in history …

To the so-called “meme” stocks that ride higher on nothing but internet message board chatter and hype.

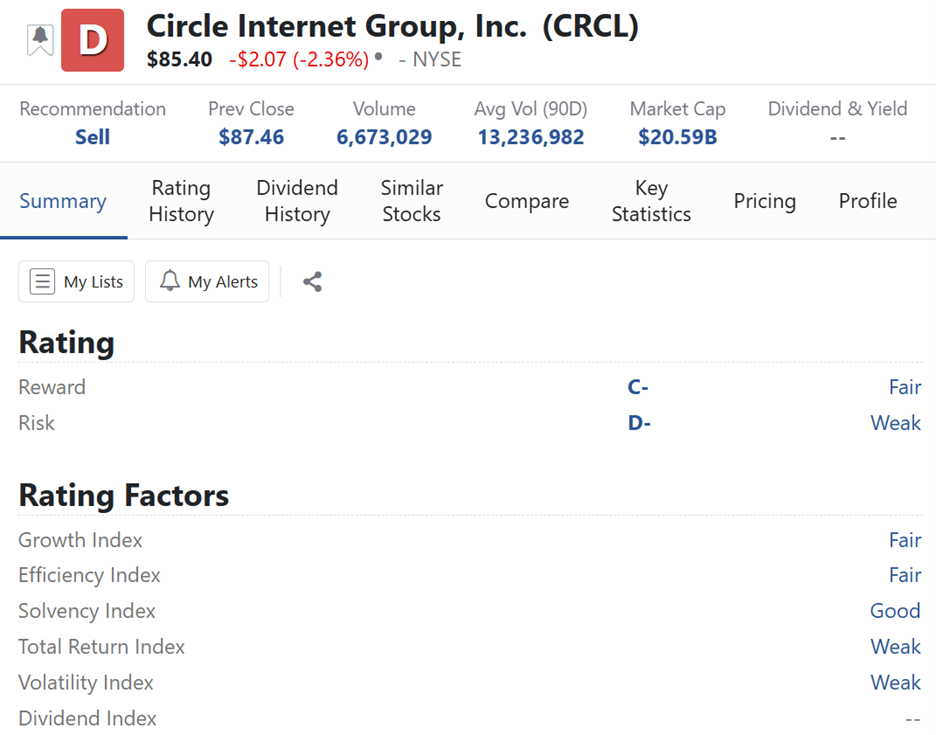

Circle (CRCL) actually embodied both of those things when I first warned you about it this past summer.

Sure, it had big revenue growth and some early signs of profitability.

But it had soared to a valuation that didn’t make sense even under wildly optimistic assumptions about the company itself and the nascent stablecoin market it operates in.

The go-go meme stock crowd just took over and kept bidding the shares higher and higher anyway.

And as I told you in a more recent follow-up, even after a massive slide, the valuation STILL didn’t make sense.

I’m glad to report that Circle continued to implode as predicted …

In fact, the stock dropped another 32% in just nine days after my Nov. 11 update and was down a full 61% since my original piece ran here on June 30.

That’s two-thirds of Circle’s value erased in less than half a year.

The stock ended up trading right back down to the same level it opened at after its red-hot IPO.

I guess you could say it came full circle!

At this point, I’m more agnostic about its prospects going forward.

But there’s another group of crypto-adjacent companies I’ve started to hate in its place … so-called digital asset treasury companies (DATCos).

The Completely Illogical DATCo Craze

Imagine a new publicly traded company called “We Love International Business Machines Corporation Incorporated.”

As its name suggests, the company raises capital by selling debt and equity and then investing the proceeds into shares of IBM.

Sounds stupid, right?

After all, there’s no need for such a company because just about anyone can simply buy shares in IBM themselves anytime they feel like it.

Yet, this is precisely the business model of digital asset treasury companies.

The only difference is that they typically target a single cryptocurrency instead of a publicly traded company like IBM.

Michael Saylor’s Strategy (MSTR) is the oldest and most famous example.

For several decades, when it was still called MicroStrategy, the company actually made various software products that were unrelated to crypto.

Then, around 2020, Saylor got bitten by the Bitcoin bug and decided to start stuffing the cryptocurrency into MicroStrategy’s corporate coffers.

Eventually, the entire company turned into one giant Bitcoin accumulation vehicle — the first DATCo.

There was more logic to the idea back then.

Bitcoin was still relatively hard to buy and sell, especially for larger institutional investors.

And even individual investors were essentially locked out of the game if they wanted to use traditional brokerage accounts or IRAs.

But things have shifted markedly over the last several years.

Most brokerage platforms have launched crypto arms.

Plenty of ETFs covering Bitcoin and Ethereum are readily available.

There are institutional-grade platforms available for buying and storing cryptos, too.

And yet more and more DATCos have been showing up.

Between Jan. 2020 and Oct. 2025, the number of them went from 4 to 142 … with roughly half created just this year alone.

Why?

There are still a lot of big pension funds and other institutional buyers that want to participate in crypto but are prohibited from doing so directly.

Buying a publicly traded proxy company that holds copious crypto on its balance sheet gets them around that technical hurdle.

At the same time, many of these companies are simply trying to recast otherwise failing businesses …

Relying on hype to generate valuations above and beyond their actual crypto holdings …

Aiming to manipulate the crypto markets …

And/or serving as backdoor conduits for hedge funds and other players to offload positions onto less-sophisticated parties.

At a bare minimum, many DATCos are just inefficient “trust me, bro” investments actively trading a given crypto … often poorly.

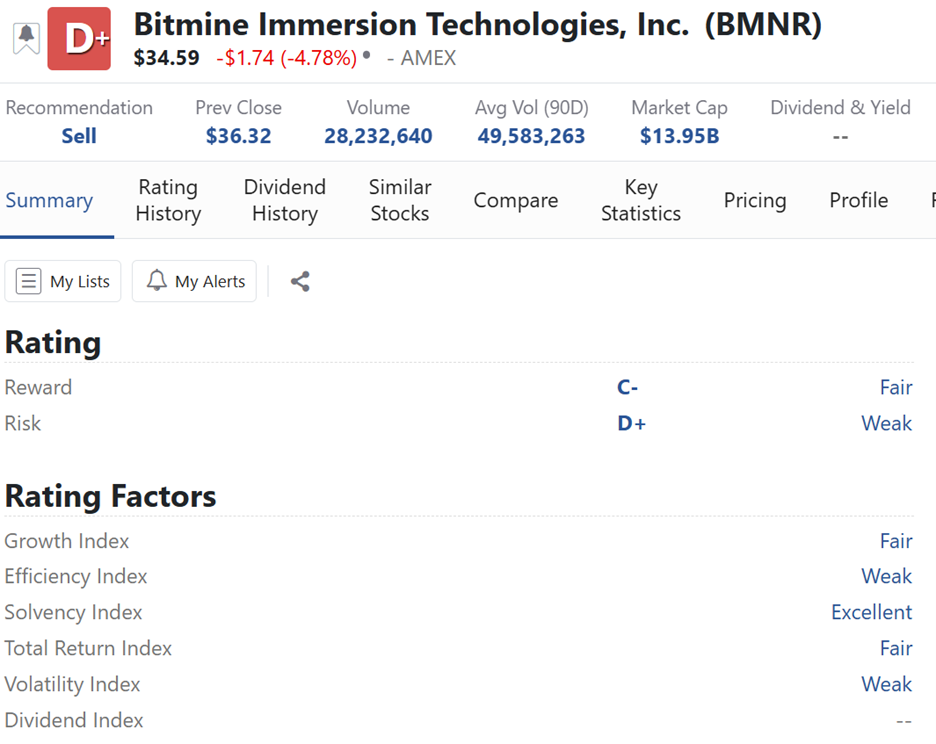

Take BitMine Immersion Technologies (BMNR), currently the second largest DATCo behind Strategy.

The company originally started as a Bitcoin mining company using a novel form of liquid cooling to run its rigs.

That wasn’t quite providing explosive profits.

So, BMNR said it was going to switch its focus to accumulating Ethereum with the goal of controlling a full 5% of total supply.

Investors sent the stock up more than 3,000% in just ten days after that announcement.

The fact that Fundstrat’s Tom Lee — who also appears regularly on CNBC and loves making big predictions with lofty price targets — is now at the helm of the company, has also really helped BitMine Immersion attract lots of investor interest.

Based on a Dec. 1 update, BitMine was aggressively buying more Ethereum during recent weakness and now holds 3,726,499 ETH worth $10.1 billion and 192 Bitcoin worth nearly $16 million at prices on that day.

The company also had unencumbered cash worth $882 million and a $36 million stake in crypto treasury Eightco Holdings (ORBS).

Its average purchase price for the ETH is now supposedly around the $3,000 mark, which means its overall position could be mildly positive at this point.

But based on all the assets I just listed, the company’s market cap is currently at a 10% premium to the value of its underlying assets.

That alone raises a warning flag for anyone buying in right now.

We also have to ask how much DATCo buying itself has actually supported crypto prices and fueled the recent rebound in crypto that has recently taken place.

More to the point — is there enough real demand to keep the rally going?

And what happens if, or when, DATCos start selling some of their holdings — either because of financial distress or profit taking?

Even Strategy’s CEO Phong Le recently told investors that the company would consider selling some of its Bitcoin if its market cap ever dipped below the value of its holdings.

Put it all together and the DATCo craze looks like a dangerous house of cards — companies adding an extra layer of complication (and leverage) to an asset class that is already inherently volatile.

Sure, it could all work out just fine.

But I’m betting it won’t … at least in many cases.

In fact, I recently initiated a small position in put options on BMNR — which the Weiss Ratings system has consistently ranked “Sell” — to profit from any further drop in the stock’s price.

I’m not saying you should follow suit. But I am saying you should at least avoid this group of investments for maximum safety.

Best wishes,

Nilus Mattive

P.S. Weiss Ratings has been ahead of the absurdity this new group of stocks is showing. Most are rated solid “Sells.”

As you can see in the screenshots above, they generally rank very poorly on all our rating factors.

Though, to see all this info on others — and just about any stock you want — you’ll need to watch this to the end.