|

| By Mike Larson |

Ask T.S. Eliot what the cruelest month is, and he’d tell you April. Or at least, that’s what he wrote in his 1922 work “The Waste Land.”

But from a market standpoint, August was the real loser this year. Not only did the S&P 500 tank more than 400 points in just a couple of weeks, but so did virtually every major asset class.

Bonds. Precious metals. Commodities. You name it. Bloomberg reported that a “cross-asset” investor — one who tried to diversify away risk by investing in plenty of other things besides stocks — would’ve had the worst monthly performance since 1981!

Blame any of the following:

• The lack of a Powell Pivot.

• Energy market turmoil in Europe.

• The soaring U.S. dollar.

• Or growing recession fears in the U.S.

Whatever the cause(s), the result remains the same. The market is limping into its final few months of the year.

Heck, even an in-line August employment report last Friday couldn’t soothe Wall Street’s troubled soul.

After rallying back above the 4,000 mark on news that the U.S. added a respectable 315,000 jobs last month, the S&P 500 faceplanted and finished down 42 points.

This shouldn’t be incredibly surprising, at least if you’ve been following my work.

I’ve been talking about the negative knock-on effects from Federal Reserve rate hikes for months. I’ve been urging members to avoid garbage stocks that hugely underperform in rough markets like this one.

Most importantly, I’ve been preaching the virtues of dividend-paying, higher-rated, “Safe Money” stocks and sectors. They’re investors’ best bet for minimizing the pain the market can dole out.

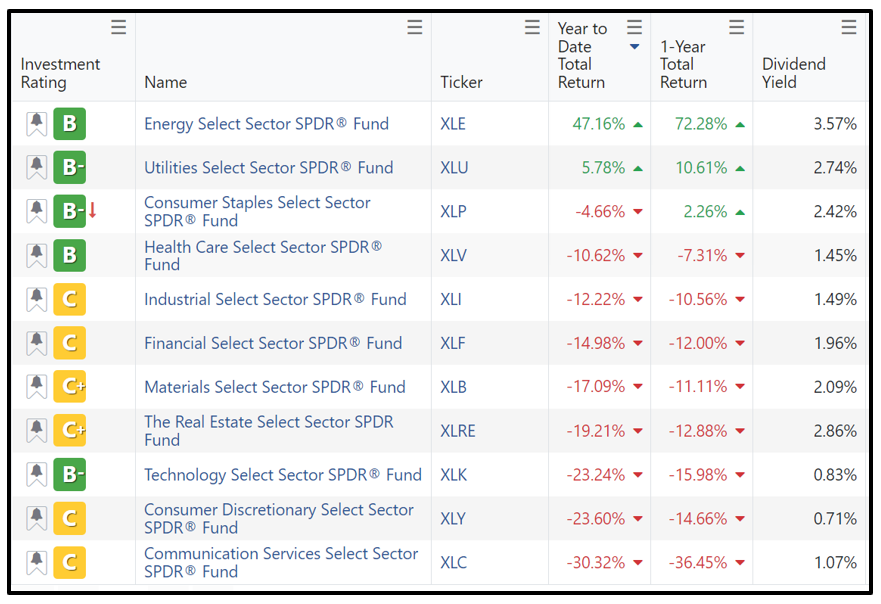

So, how is that plan working out? Well, they continue to lead the 2022 performance race, as you can see in this updated screenshot below, showing gains and losses in sector exchange-traded funds.

The Energy Select Sector SPDR Fund (XLE) is the standout, for obvious reasons. But defensive, yield-oriented sector ETFs like the Utilities Select Sector SPDR Fund (XLU) and the Consumer Staples Select Sector SPDR Fund (XLP) are right behind.

Those ETFs have produced positive — and in XLE's case, exceptional — one-year gains while also spinning off dividends yielding 3.57%, 1.45% and 2.74%, respectively.

Bringing up the rear? You guessed it! Higher-risk, lower-yield ETFs that target communication services, consumer discretionary and technology stocks.

At some point, the market will find its footing again, and it’ll pay to get more aggressive again.

But in the meantime, let me ask you a pair of questions:

1. Would you rather own “exciting” stocks with cool stories that are losing you gobs of money?

2. Or would you rather own “boring” stocks in less flashy sectors that are radically outperforming the market and/or generating profits?

The answers seem pretty obvious to me … and that’s why I keep urging you to stick with Safe Money strategies!

Until next time,

Mike Larson

P.S. If you enjoyed reading this article, check out, a service designed for turbulent market conditions like this one.