Debt Ceiling Watch: The Countdown to $31.4 Trillion

|

| By Jordan Chussler |

A standoff in Congress is propelling the U.S. toward a breach of its debt ceiling.

At $31.4 trillion, the limit could be reached as soon as June.

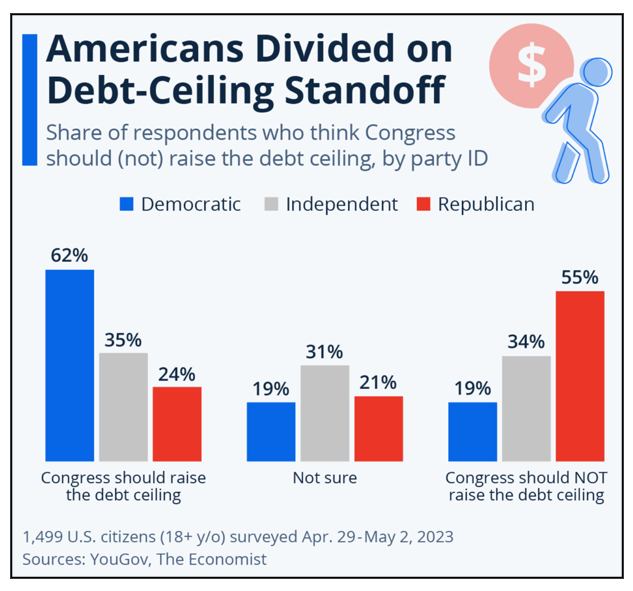

And like most issues in America, there is a stark partisan divide.

Some 55% of Republicans contend Congress should not raise the debt ceiling.

That contrasts with 62% of Democrats who believe Congress should raise it.

However, much of this is posturing for the 2024 election as both parties are signaling to their electorates.

But raising the limit, in fact, is nothing new to either party.

The debt ceiling has been raised by both parties 78 times before: 49 under Republican presidents and 29 under Democrat presidents.

Click here to see full-sized image.

But while both sides of the aisle nitpick, Senior Analyst Sean Brodrick explains in his column this week that the country could:

• Go into default.

• The government could shut down.

• And the roughly 2.85 million Americans who depend on federal paychecks could go without.

Why You Should Fear the Debt Ceiling Crisis

As America struggles with tightening credit and the resulting banking crisis, it’s careening toward another crisis: the battle over the federal government’s debt ceiling. Sean explains one asset that can help investors protect themselves from the looming fallout.

Warren Buffett Is Wrong About AI

The most acclaimed investor in a generation spent last Saturday dispensing words of wisdom, but according to Pulitzer Prize winner Jon Markman, investors should ignore Buffett’s advice on AI.

Learn Our Strategies … from the Sources Themselves

In a year that’s proven unpredictable for the markets, the one constant has been how Weiss analysts and editors deploy safety-oriented strategies, as well as opportunities to hedge with alternative assets. This year, you can meet them in person to learn more about their methodology and tailored picks.

Can Your Insurer Afford to Pay Your Claims?

The subject of insurance is about as exciting as watching paint dry. But right now, the industry is going through some extremely noteworthy changes, which Director of Research and Ratings Gavin Magor details.

Why Investors Turned the Page on Pot Stocks

It wasn’t too long ago when cannabis stocks were hailed as “green gold” and the next hot investment trend. Instead, cannabis stocks fell by a whopping 70% in 2022. And with a rapidly approaching debt ceiling default, Assistant Managing Editor Mahdis Marzooghian points to this asset as a safe haven for investors who might’ve been burned by pot stocks’ shortcomings.

6 Investing Lessons from My Father’s Farm

Senior Editor Tony Sagami’s parents were hardworking vegetable farmers but making ends meet was always a struggle. Farm work is difficult, but according to Tony, those years were the foundation of his success and the source of numerable investment lessons.

The U.S. banking industry could now be facing some of its greatest systemic risks in 90 years since the nationwide closing of all banks declared by President Roosevelt on March 6, 1933. Founder Dr. Martin Weiss discusses the increasing risk of bank failures and the government’s role in the crisis.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily