Don’t Ignore This All-Time High Millenia in the Making

|

| By Jim Nelson |

With all-time highs in the stock market, Bitcoin’s (BTC, “A”) impressive rally and the rise of AI driving the Magnificent Seven, there’s one asset that isn’t getting the attention it deserves right now.

The idea of investing in gold has been around for as long as civilization has. And despite inflation retreating over the past several months, it, too, found its all-time high recently.

At nearly $2,200 per ounce, gold has added $300 since the start of the Israel-Hamas war. And while some are calling for a correction in the short term, almost everyone agrees that there are a lot of reasons why gold could keep going higher in the longer term.

One of the most important driving forces is the expectation of rate cuts at the Federal Reserve.

Depending on your reading of his comments — which vary wildly depending on who you talk to — Fed Chairman Jerome Powell indicated this week that cuts are indeed coming.

That’s music to goldbugs’ ears, as it makes the non-yielding asset more appealing against other income-producing assets.

But that’s not the only thing driving gold’s rally … and why many expect even larger gains from here.

Take China, for instance.

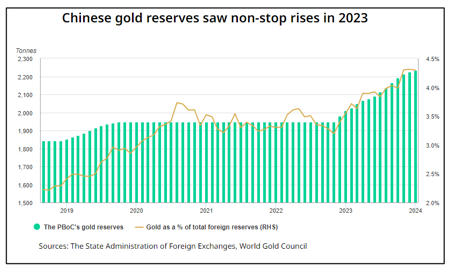

China has long been a heavy buyer of gold. But it took a hiatus when the pandemic began in 2020.

Last year, that changed …

The country is doing this even as its economy has slowed significantly. That’s a second reason why gold is climbing … and could continue.

You see, tons of the private money that was flowing into Chinese investments has stopped … or at least slowed.

The Chinese government is opening up its own firehose of freshly printed capital. But private investors are seeking safety. And that’s gold’s superpower as a safe haven.

A third, yet somewhat related reason for gold’s bright future, is that China isn’t alone in its buying.

In a 2023 study, seven out of 10 central banks believe that gold reserves will increase globally.

According to this survey, the vast majority of developing nations are buying gold. That’s a lot of gold being tied up by central bankers’ hoarding.

Finally, the elephant in the room is ETF outflows.

Gold ETFs have been seeing some of the largest outflows in years recently. Why? Bitcoin.

The recent SEC decision to allow Bitcoin ETFs has opened up the floodgates of money flowing into the crypto sector. A lot of that investment capital is being leeched from gold ETFs.

While this should be dragging on the metal in a huge way, it isn’t. As noted, gold is just off its all-time high.

When that floodgate finally slows a trickle, the final barrier to an even bigger gold rally will be removed.

Of course, gold’s impressive performance and outlook are only one area our experts are looking for gains of their own. Here’s what they have to say …

3 Superb Spring-Cleaning Tools with the Weiss Ratings

Finding the best new stocks to add to your portfolio is important. But so is keeping an eye on them once they are in. Director of Research & Ratings Gavin Magor shares three tools you can use to make sure your portfolio is ready for springtime.

This Buffettism Made Jay-Z Billions Beyond His Music

There’s a common theme in almost all hotshot investors’ strategies. Whether you are considering adding a stock or investing in a startup business, you can apply this bit of wisdom passed on from Warren Buffett to Jay-Z. Chris Graebe has the story of how it’s made the music legend billions.

Your Newest Invitation to the Oil Profit Party

Three weeks ago, Sean Brodrick showed the path to huge oil-patch profits. You’d be up big already if you took it. But even if you passed, he’s back to share why this is another chance to rake in gains from oil in 2024.

How to Invest in What Comes After AI

While we all know just how much AI is driving stocks, the economy and even other innovations, there’s another computing revolution going on … and it will be equally powerful. Tech guru Jon Markman lets us know the four companies leading the charge.

6 Startup ‘Tells’ to Keep You Safe

Investing in startups is a bit different than other types of assets. For one, by rule, they are not typically well-known opportunities. Chris has years of experience identifying what you need to know to keep yourself safe in this space … and he just found one startup that passes every test and more.

Have a great weekend,

Jim Nelson

Managing Editor, Weiss Ratings Daily