It was more of the same this week, with the Federal Reserve again hiking benchmark interest rates. Inflation continues to take its toll on consumer confidence, and jobless claims — which hit an eight-month high — further stoked fears of a recession.

A mixed bag of corporate earnings resulted in a relatively flat performance for the S&P 500 this week, but there were some positive indicators.

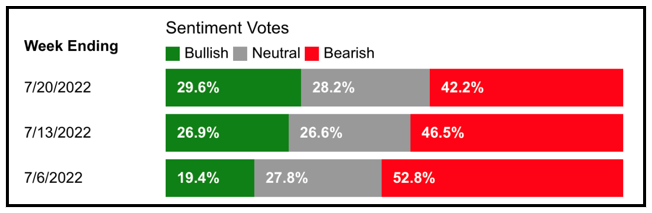

Although remaining predominantly bearish, investor sentiment improved for a third consecutive week.

Plus, big banks like Morgan Stanley (MS) and Bank of America (BAC) reported double-digit loan growth in Q2. According to The Wall Street Journal, that’s because wealthier Americans are tapping into their securities-backed credit lines to purchase heavily discounted assets.

Here are this week’s top stories from your favorite Weiss Ratings experts.

Corporate America’s Buyback Barrage

Companies are on pace to repurchase a record $1 trillion of their own shares by the end of 2022. In just one week in June, four corporations repurchased $41 billion-worth of their own stock. Managing Editor Jordan Chussler explains why they’re doing it, what it means for investors and how to find the information as soon as it becomes available.

The stock market is in a fluid situation and dynamics at play are drawing a deepening gulf between investment winners and losers. In this segment, Financial News Anchor Jessica Borg speaks with Senior Analyst Mike Larson, an income and dividend specialist, about the Fed playing catch-up, recession-resistant stocks and how the rising value of the U.S. dollar is affecting investments across the board.

Use the Weiss Ratings to Protect Your Portfolio

“Markets can stay irrational longer than you can stay solvent.” So said economist John Maynard Keynes. That’s particularly relevant amid an earnings season that’s seen companies that miss have their shares rise, and companies that beat have their shares fall. Editorial Director Dawn Pennington dives into the ratings to make sense of it all in a quest to find “Buy”-rated stocks in an irrational market.

VIDEO: Market Minute With Kenny Polcari

With earnings season in full swing, the Fed’s continuing rate hikes and qualitative tightening and Russia tinkering with the global natural gas supply, Wealth & Wisdom host Kenny Polcari gives viewers his weekly Market Minute.

Pay Attention: Recession Warning Signals Trouble Ahead

We’re in the midst of a second consecutive quarter of contracting GDP, with the Fed hiking interest rates again on Wednesday and a recession seeming to unfold before our eyes. Senior Analyst Mike Larson explains why that’s the case and details the types of investments stockholders can make to prepare their portfolios accordingly.

EVs Aren’t Ready to Replace Gas Cars … Yet

While electric vehicles aren’t ready for the mainstream, an abundance of opportunity exists in the sector. This week, Senior Editor Tony Sagami reports on the numerous reasons why EVs won’t be replacing internal combustion engines yet, and how investors can position themselves for the boom in our electrified future.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily