Here's How I Told My Mom to Sell Her Gold & Silver

|

| By Nilus Mattive |

One of the great benefits of studying financial markets every single day is using that knowledge to help the most important people in my life — especially my parents.

In one instance, I showed them how to use various loopholes to get extra money out of the Social Security system.

In another, I taught my dad how to sell options to generate extra income from his retirement account.

Most recently, my mom asked me how she could potentially cash in some of the random bits of gold and silver she has lying around the house — things like necklaces or silverware.

And since it’s such a hot topic right now, I wanted to tell you all the same things I told her.

Let’s start with the biggest question — SHOULD you consider selling any gold or silver you currently own?

It’s obviously a personal choice.

Both precious metals have had spectacular run-ups and still trade near all-time highs even after Friday’s sell-off.

I think there could still be more upside ahead and I’ve explained why in past articles.

That said, the recent pullback could extend for some time.

Or you might simply need some extra cash to cover expenses or do something fun for yourself.

In my mom’s case, I told her to wait a little longer and see how she feels.

There’s no wrong answer because she doesn’t desperately need the money. But she also isn’t much of an investor.

What I do care about is getting top dollar for any metal she does decide to sell.

Yet, what I’m hearing is that it’s the wild west out there right now.

For example, just as a starting point, she decided to stop into a local “we buy gold” place in her town.

She brought a necklace for them to evaluate.

What they gave her in return was a simple dollar amount.

My mom thought the number sounded pretty good.

But she didn’t really have the proper information she needed to assess just how good it actually was.

After I asked her some more questions, it turned out to be a rather lowball offer.

So how can you avoid getting fleeced?

For starters, you need to know exactly how much precious metal is in your item.

If it’s pure bullion — something like a 99.9% coin or bar — then that determination is pretty straightforward.

But what if it’s a necklace like the one my mom had?

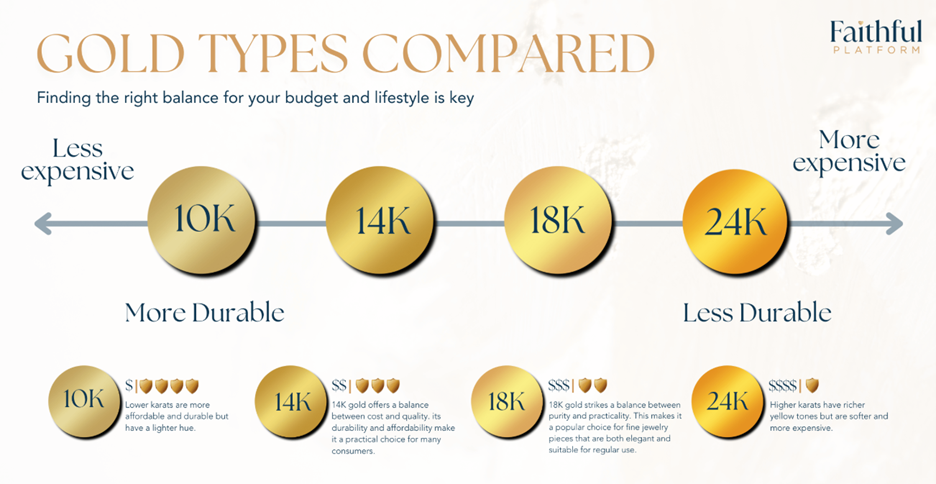

First, you need to know whether it’s 14k, 18k, 24k or something else. This will typically be stamped somewhere on the clasp.

In some cases — like my mother-in-law’s antique Indian jewelry — it might not say anything at all.

In such cases, a (hopefully trustworthy) professional will have to evaluate the piece and tell you.

It’s the same deal with a lot of coins, too.

Take 1907-1933 St. Gaudens Double Eagle coins.

They contain 0.9675 troy-ounce of gold … slightly less than modern one-ounce U.S. gold eagles. (Though they might also carry additional numismatic value that more than makes up the difference.)

Many of the same concepts apply to silver items, too.

For example, silverware is often a solid alloy of 92.5% silver and 7.5% copper typically stamped "925" or "STERLING."

But it could also be a lower-quality mix or silver plated and thus worth far less.

Once you have the percentage of the precious metal content, you have to multiply that percentage by the total weight of the item to get the full picture of just how much gold or silver you’re holding — the so-called “melt value.”

At the very least, the buyer should be willing to provide this number to you.

In my mom’s case, they didn’t.

Nor did they provide the spot price of the metal they were using to determine their offer.

Prices are constantly changing, of course, but you can easily get a current number from any major financial outlet.

So, here’s the ideal step-by-step way to become an informed seller of physical gold and silver …

Step #1. Determine how much precious metal you have if possible.

To do this, weigh each piece using something like a digital kitchen scale. Then multiply that by the percentage of the metal content.

Example: If you have an 18k gold necklace that weighs 10 ounces, you’re looking at 7.5 ounces of gold because 18k gold is 75% pure. (Just so you know, 24k is 99.9% pure and 14k is 58.3% pure.)

Step #2. Get a current spot price for the metal and multiply it by the amount.

To continue with our example …

Assuming gold at $5,000, you’d multiply 7.5 by 5,000 and arrive at a fair value of $37,500 for your necklace.

Then, and only then, move on to …

Step #3. Start shopping your item around to get a fair deal. Don’t expect to get the full value, just aim for a reasonable spread going to the buyer.

Sure, you might be able to get full value selling something like a 1-ounce American gold eagle to a private buyer.

Sometimes, during rapidly rising prices and strong demand for physical metals like we have right now, you might even be able to get over spot in rare instances.

Same goes with numismatic items or intricate jewelry.

But overall, if we’re talking about selling to a dealer, you have to assume they need some spread to keep their business viable.

That’s especially true in cases where the precious metal content will need to be separated out.

So, what’s a reasonable spread?

I can almost guarantee you will find huge differences among local options like pawn shops, jewelry stores and coin shops … some of which will be complete rip-offs.

Stories abound of buyers offering as little as 60% of the true value of the precious metals!

Personally, I’d aim to accept a very low single-digit percentage difference on standard items like coins, bars and bricks … somewhere around 10% for sterling silver … and maybe anywhere from 15% to 20% on other items.

If you can’t find offers like that in your local area, you can certainly get them from highly-rated online dealers like JM Bullion, Apmex or Midwest Refineries.

Best wishes,

Nilus Mattive

P.S. Of course, I still recommend you ADD to your gold hoard right now.

The best way to do that is to listen to what Sean Brodrick has to say about his way to boost your golden gains without buying a single ounce.