There’s been an increase of recession chatter from Wall Street to Main Street. And with good reason. The S&P 500 lost 20.6% in the first half of 2022, its worst start to ANY year since 1970 — 52 years ago.

For context, that’s the year the Beatles disbanded, Nixon signed the Clean Air Act and the crew of Apollo 13 aborted their mission to the moon.

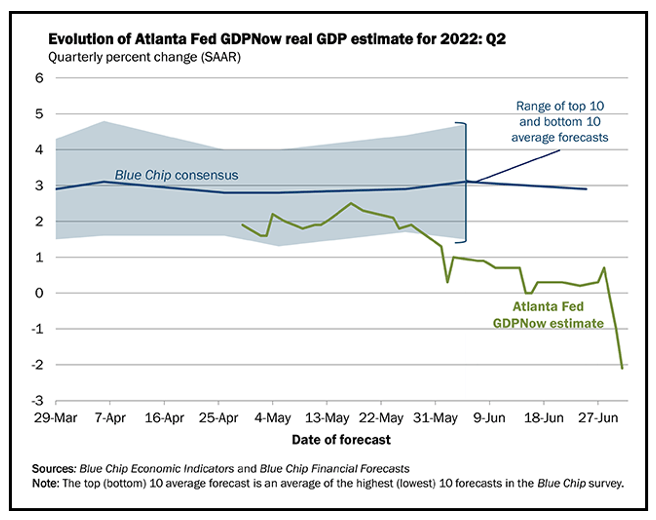

According to the Federal Reserve Bank of Atlanta’s GDPNow — a current measure of gross domestic product — we’re already on pace for a second consecutive quarter of GDP contraction.

Two consecutive quarters of negative growth is widely accepted as the official definition of a recession. Among the drivers are plummeting consumer confidence, increasing jobless claims, a correcting housing market and the highest hikes to the federal funds rate in decades.

Given current market conditions, investors are justifiably hesitant. But our editors and analysts are here to help you protect your wealth amid an increasingly turbulent environment. Here are this week’s top stories from your favorite Weiss Ratings experts.

Is a Recession Coming? Is One Already Here?

Increasingly, Wall Street is whispering nervously about a recession’s already being here, and the writing is on the wall. Income specialist and Senior Analyst Mike Larson explains what the economy is telling us … and what investors can do to protect their portfolios from the slumping markets.

VIDEO: Find Wealth & Wisdom in an Unsettled Market

Even in an unsettled market, setbacks don’t have to stay setbacks for long. In this segment, Financial News Anchor Jessica Borg interviews Analyst Kenny Polcari about stocks on his watch list, how to capitalize in today’s market conditions and his informative new weekly service designed to generate “Wealth & Wisdom” for investors.

Investment Lessons From Dubai: Part 1

The Abu Dhabi National Oil Company owns almost all the oil in the United Arab Emirates, produces over 4 million barrels per day and is the 12th-largest oil company in the world. Globetrotter and Senior Analyst Tony Sagami, who recently visited Dubai, reports on the year-to-date success of the energy sector, and why a handful of exchange-traded funds are poised to continue their climbing.

2 Surprising Upgrades in Tech’s Worst Year

The tech sector’s taken a beating this year, and investors are shunning companies’ share. Rightfully so, too — the Nasdaq is having its worst year EVER. But are there any diamonds in the rough? Editorial Director Dawn Pennington takes her weekly dive into the Weiss Ratings stock screener to see if she can uncover any “Buy”-rated tech stocks in a sector that’s seeing a historic downturn.

VIDEO: Special Market Minute With Kenny Polcari

After a weekend of hot dogs and fireworks, the markets are open again, and it looks like last week’s market bounce was short-lived. The Atlanta Fed’s GDPNow is showing current negative growth for the second consecutive quarter. What’s that mean? Kenny Polcarci, host of Wealth & Wisdom, explains in this week’s Market Minute.

Gas Tax Holidays Won’t Help. This Will.

A gasoline tax holiday is fighting the last war because gasoline prices are already going down. Senior Editor and cycles expert Sean Brodrick discusses why the Biden administration’s gas tax holiday is a wasted effort, and why investors should look to Big Oil amid the current pullback.

Until next week,

The Weiss Ratings Team