|

| By Jim Nelson |

With Labor Day almost here — and with it, the unofficial end of summer — we face a problem.

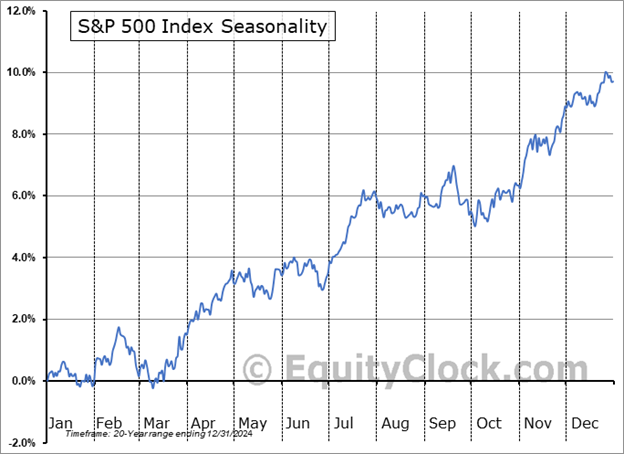

Historically, September is the worst month of the year for stocks.

Over the past 20 years, the average S&P 500 performance during this “back to school” month is a loss of 0.7%.

In fact, the only other month that averages a loss is June. And that’s only a 0.1% decline.

Now, you could write that up as just a coincidence.

Some of the wildest one-off freefalls in recent memory happened in September — the aftermath of 9/11, the escalation of the Great Financial Crisis, the 2022 inflation surge, etc.

But September itself didn’t cause those.

Well, maybe not. But if you go back even further, the story doesn’t get much better.

According to Fisher Investments, the average return for the month was -0.8% dating back to 1926.

That’s 100 years of data that makes September look like a terrible month to start piling into stocks.

So, what do you do if you want to spread your investment capital around for less risk?

Sean Brodrick suggested this week that you should stick to gold.

He writes:

“Inflation is unavoidable, but you don’t have to let it eat away at your wealth.

“A strategic allocation to gold — through bullion, ETFs or miners — can help you stay ahead of the erosion.

“You often hear gold called “insurance.” As the charts show, this insurance is paying off in spades.”

He’s not wrong. Since last week’s Jackson Hole speech, gold shot straight through $3,400 per ounce.

In fact, December futures contracts for the yellow metal surpassed $3,500 yesterday.

But gold isn’t the only “insurance” you can and should have on hand for the upcoming month.

On Tuesday, Dr. Martin Weiss and crypto expert Mark Gough will host an emergency event.

At 2 p.m. Eastern, these two will discuss a particular corner of the crypto market that is expected to blow past Bitcoin and even gold in coming weeks.

We’re talking about gains of 1,204% … 2,324% … and even 17,862%!

It costs you nothing to hear them out. And it might just turn THIS September into your new favorite month. Grab your seat here.

Sean wasn’t the only one to offer his freshest recommendations this week.

Here’s what your stable of experts are focused on …

Here Are My Favorite Personal Finance Hacks

Nilus Mattive steps outside of all investment markets for this one. He returned from his round-the-world tour with ways to squeeze extra benefits out of the money you are already spending.

3 Health Care Plays for This Coming Rally

Gavin Magor uses the Weiss Ratings to share the best ways to play the boomerang bounce back in health care stocks.

Enter This Shelter Before the Debt Bomb Explodes

Bob Czeschin adds his voice to the chorus of dollar doubters. And he points to his favorite way to make its decline pay you.

The Key to AI Strategies Around the World

In tech news, a lot is going on with China’s AI gambit. Michael A. Robinson has the one company that benefits from both the U.S.’ and China’s AI strategy.

Have a great holiday weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily