|

| By Jim Nelson |

Yesterday, the market finally got what it has wanted.

In his Jackson Hole speech, Fed Chair Jerome Powell said, “The time has come for policy to adjust.”

In other words, rate cuts are coming.

Wednesday’s revision of newly added jobs showing 818,000 fewer than previously thought seems to have done the trick.

But when will the Fed cut? By how much?

The market says soon and a lot.

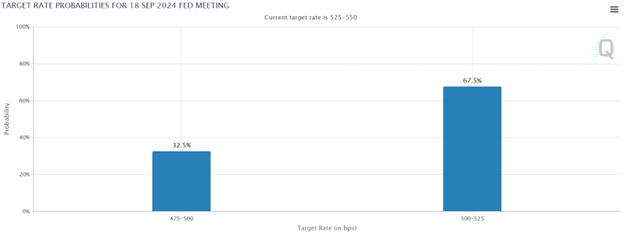

In fact, as soon as Powell gave his speech, the CME FedWatch Tool showed a 100% chance of a rate cut in September:

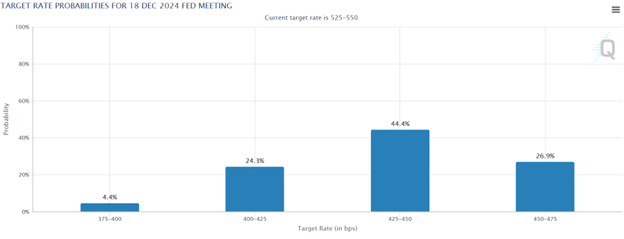

It also showed a more than 73% chance of at least a full percentage point in cuts by the end of this year:

If you wonder what all this means for you, read on …

Target These Big Names for Big Profits

As predicted in Gavin Magor’s article, the market did “twist itself in knots before and after we get a look inside Jerome Powell’s crystal ball.” Of course, Gavin also had the solution, even before we knew what Powell ended up saying.

These Startups Take Aim at SpaceX’s Satellite Empire

A solid way to weather the stock market’s ups and downs over rate cuts is to diversify your portfolio. Specifically, to invest in promising startups that are insulated from markets and Fed governors. Our private equity expert has some ideas for you.

Buy This Other Metal as Gold Takes Off

Precious metals get a lot of attention when the Fed hints about lower rates. Sean Brodrick knows this all too well. He also has the perfect way to play that. Hint: It’s not just buying gold.

Profit on the Move from Venture to Adventure

Chris Graebe tells the amazing tale of a venture-capitalist-turned-gold-medalist. One whose surprise appearance at the Paris Olympics earned two golds for Team USA. Investors can learn a lot from this unusual journey.

Get in on This Unusual Space-Ag Partnership

Space tractors might sound like something you’d read in old science fiction novels for teenagers. But it’s real. And Michael A. Robinson has the angle to take advantage of this odd partnership.

Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily

P.S. Sean is going to be speaking at the MoneyShow event in Orlando in October. This conference is definitely worth attending. You can grab your spot here.