|

| By Mahdis Marzooghian |

Well, 2024 got off to the kind of start that perhaps most investors weren’t expecting after the stellar way 2023 wrapped up. But what goes up must come down. That is, until it goes back up again. And the markets tend to be biased to the upside over time.

Despite the slow start to the year, stocks rose slightly on Friday — before the three-day MLK weekend — as traders parsed through the first batch of Q4 earnings, all while taking in the closely-watched inflation reports this week.

The Dow Industrials traded 31 points higher, or less than 0.1%. The S&P 500 gained 0.4%, and the Nasdaq Composite advanced 0.5%.

Moreover, investors got some encouraging news on the inflation front Friday, with wholesale prices unexpectedly declining by 0.1% in December.

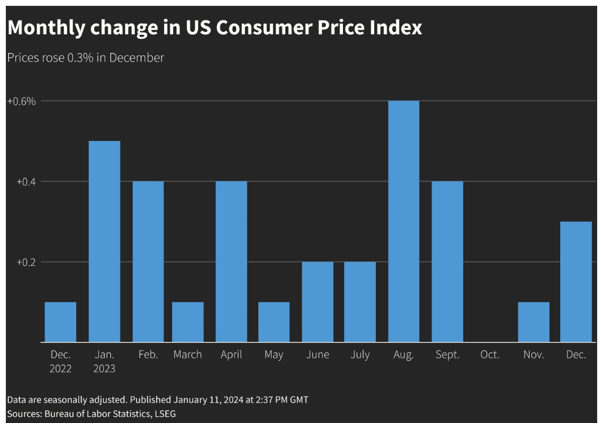

The data follows Thursday’s more widely tracked consumer prices data. The actual numbers came in modestly hotter than forecast, with prices up just 0.3% on the month and 3.4% from a year ago.

According to Bill Adams, chief economist for Comerica Bank, “The path continues to clear for the Fed to begin cutting interest rates in 2024 and to slow the pace at which they shrink their balance sheet.”

Here’s hoping!

In the meantime, our experts here at Weiss Ratings continue to spot opportunities, no matter where the markets are going or what the data says. We’re still in a bull market. And in many cases, the pullbacks we’ve seen since the start of the year are post-holiday gifts for those who have been on the lookout for better entry prices.

Your Weiss Ratings editors are always on the lookout for buying opportunities that offer a healthy balance of profit potential and also potential safety. Here’s what made the cut this week …

'Buy'-Rated Tech Names that Dominated 2023

These high-rated tech stocks dominated 2023, and our Director of Research & Ratings Gavin Magor shows you why you should keep them on your investment radar for 2024.

What Traditional Investors Should Know About Crypto Convergence No. 3

Something big is happening in cryptocurrencies. The good news is, there is still some time to get in on it. That’s why we’re once again asking our crypto expert, Juan Villaverde, to let us know what to watch for and how to play it.

The Robots Aren’t Just Coming … the Robots Are Here!

The marriage between AI and robotics is set to make 2024 a great year for investors — and this is just the beginning. Our supercycles and megatrends analyst, Sean Brodrick, is going to show you exactly how to play this sizzling-hot trend in robotics.

The Robots Are Here. And the Markets Like That!

Duolingo’s AI-based job cuts sent the stock higher. And now, tech expert Jon D. Markman is revealing another stock that’s set to follow in Duolingo’s footsteps.

How to Profitably Play Startups in 2024

Startup Investing Specialist Chris Graebe is going to show you why 2024 holds so much promise for the revival of private equity and venture capital. But the important thing to keep in mind is that the power balance is shifting, with equity crowdfunding gaining strength. Here’s how to be on the correct side of that shift.

Have a great weekend,

Mahdis Marzooghian

Managing Editor

Weiss Ratings Daily