In a Market Upturn or Downturn, Turn to Weiss Ratings

|

| By Mahdis Marzooghian |

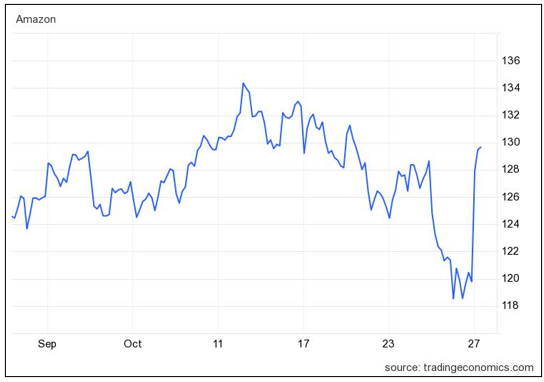

After another disappointingly down week, the markets seemed a bit more stable on Friday, thanks to a reassuring profit report from Amazon.com (AMZN) and some mixed readings on the economy.

Indeed, the S&P 500 was 0.2% higher in morning trading, coming off its ninth loss in 11 days and its lowest level in five months.

Stocks have struggled recently due to several reasons, including a number of Big Tech stocks tanking after releasing their summer profit reports … and rising Treasury yields in the bond market tightening their grip on the market.

However, the market caught a break yesterday after Amazon rose 7.8% following its profit report. Both its summer profit and revenue numbers were better than expected. As seasoned investors know, Amazon’s stock movements carry enormous weight on the S&P 500 and other indexes.

Click here to see full-sized image.

As far as the economy goes, a report showed that the measure of inflation preferred by the Fed remained high last month, but within economists’ expectations. It also showed spending by U.S. consumers was stronger than expected, even though growth in their incomes fell short of forecasts.

All in all, despite what the data shows, the market still expects the Fed to hold rates steady again next week and is prepared for rates to stay higher for longer, as Fed Chair Jerome Powell promised.

But no matter what the market or the Fed does and no matter what the economic data says, one thing is clear — here at Weiss Ratings, our experts have plenty to be optimistic about. That’s because with the help of our Weiss ratings —now with the incorporation of performance boost AI — and our experts’ research, you can find opportunities and gains no matter what.

So, whether there’s a market upturn or a downturn, you should turn to Weiss Ratings — every time. And our experts would certainly agree; in fact, here’s their latest research …

The Most Interesting Ratings in the World

Director of Research & Ratings Gavin Magor makes a bold claim — the Weiss Ratings are some of the most unique ratings in the world, and all investors should use them. Indeed, with our rich 50-plus-year history and plenty of incredible ratings milestones under our belt, we’ve got the data to back up our claim. Find out for yourself!

AI Touts These Two Sectors for the Next 90 Days

Bank earnings reports and their falling deposit numbers are warning about a severe economic downturn. That’s exactly why we’ve incorporated performance boost AI into one of our trading strategies, to bring you some of the sectors that look bullish over the next 90 days.

Algorithms used in high-frequency trading have been a major part of trading for decades. Now, it’s merging with powerful AI technology for the very first time. Senior Investment Writer Karen Riccio breaks down why investors should pay attention.

Line Up This 66% Gain Despite High Interest Rates

Interest rates are rising, and corporate leaders in the automotive industry are worried about shrinking consumer demand. But the data consistently shows that some things in the space are not just a fad, but a lasting trend. Jon D. Markman shows you how to profit from the mistake of those underestimating the undisputed leader in this lasting trend.

How to Deal with Huge Gains and Creeping Greed

While it’s been another down week in the stock market, our friends in crypto have had a wild ride. We have DeFi & Crypto Educator Chris Coney to discuss what such a rapid rally can do to an investor’s mind. And this lesson applies to everything, not just cryptocurrencies.

Until next time,

Mahdis Marzooghian

Managing Editor

Weiss Ratings Daily