|

| By Jordan Chussler |

One month ago, analysts and the financial media were shouting from every rooftop in Lower Manhattan about the newly emerging bull market.

There was no shortage of headlines and tidbits hailing the market’s turnaround and instructing investors not to miss the train as tech and AI-leveraged stocks pushed the indices higher:

- On June 8, the Wall Street Journal unequivocally declared the “S&P 500 Starts a New Bull Market as Big Tech Lifts Stocks.”

- On June 12, Seeking Alpha, with unsurprising overconfidence, stated, “Sentiment Speaks: A New Bull Market Has Begun.”

- And on June 14, Mad Money’s Jim Cramer said live on CNBC that “We are definitely in a bull market.”

If there’s ever a trustworthy voice in financial media, it’s Cramer. His track record is impeccable, isn’t it?

Declaring a new bull market was preemptive and careless, especially considering the Federal Reserve’s ongoing plan to continue rate hikes until inflation subsides to its goal of 2%.

That realization caused the markets to sell off again this week, with the major indices all in negative territory over the past five days, with small-caps, as measured by the Russel 2000, leading the way downward with a -3.44% loss at the time of writing.

It’s a cautionary tale I wrote about in late June, when a broad pullback followed the new bull market declaration. And it’s something I discussed two months ago on May 6, when I argued that even if the Fed stops raising rates, numerous other headwinds remain.

This week’s S&P 500 sell-off was just the most recent in a series this year, with each instance putting the bull market assertion on trial:

- From its then-year-to-date high on Feb. 2 to March 1, the index shed 5.65%.

- After bouncing from that low, it sold off again from March 6 to March 13, losing another 4.76%.

- After mustering just a 1% gain in April, the index dropped another 2.56% the first week of May.

- And from June 15 to June 26, it added losses of 2.19%.

Are sell-offs and pullbacks to be expected after strong runs? Yes. But are these recurring sell-offs instilling confidence in most investors? You would hope not.

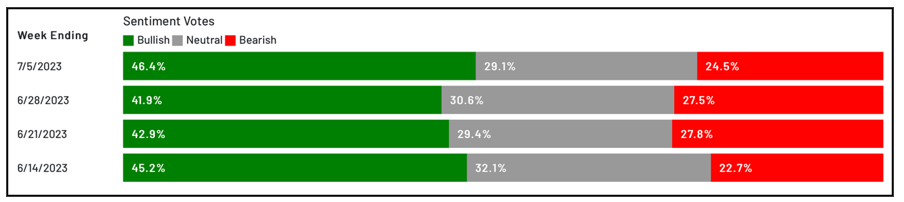

But alas, common knowledge is uncommon. This week marks the fourth in a row that’s seen the AAII Investor Sentiment Survey report over 41.9% bullishness:

My takeaway from that survey: Sentiment is about as practical a gauge of reality as Punxsutawney Phil. If emotions dictated actuality, Jets fans wouldn’t still be waiting for their first Super Bowl win since 1969.

So while the S&P remains precariously above its 200-day moving average — the generally accepted marker for bull and bear markets — it once again finds itself range-bound and above or near “overbought” territory (as measured by the Relative Strength Index) since June 9.

And with the Fed potentially planning another rate hike after its next FOMC meeting from July 25–26, proceeding with caution and safety-rated investments, as our team of editors and analysts has said time and time again, is your best path forward.

Because if this is a new bull market, it’s still a calf being weaned by its mother, and it could buck its riders at a moment’s notice.

Meta’s AI Plan for Ads Will Boost Shares

Buzz about AI during 2023 has been the principal driver of the stock market rally. According to Pulitzer Prize winner Jon Markman, the AI-fueled rally will continue to push tech stocks higher as it moves into ads.

An Investment Summit You Won’t Want to Miss

In a year that’s been proven unpredictable for the markets, the one constant has been how the Weiss team deploys safety-oriented strategies. This year, you can meet them in person to learn more about their methodology and tailored picks.

A Silver Lining in a Solar Storm

Silver consumption in solar power is forecast to account for 161.1 million ounces this year, a 15% increase over 2022 and a massive 189% increase over 2014. As solar adoption continues to rise, demand for this precious metal is similarly growing. Senior Analyst Sean Brodrick explains how investors can take advantage.

The State of the Startup Industry

Compared to the venture capital world, equity crowdfunding is holding steady. But as a whole, funding is slightly down. Startup Investing Specialist Chris Graebe reports on why, while also discussing the future of the space.

3 New ‘Buy’-Rated Upgrades in Tech

In 2022, energy was the outperforming sector. So far in 2023, it’s technology. Director of Research and Ratings Gavin Magor surveys three companies recently upgraded to “Buys” by the Weiss Ratings.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily